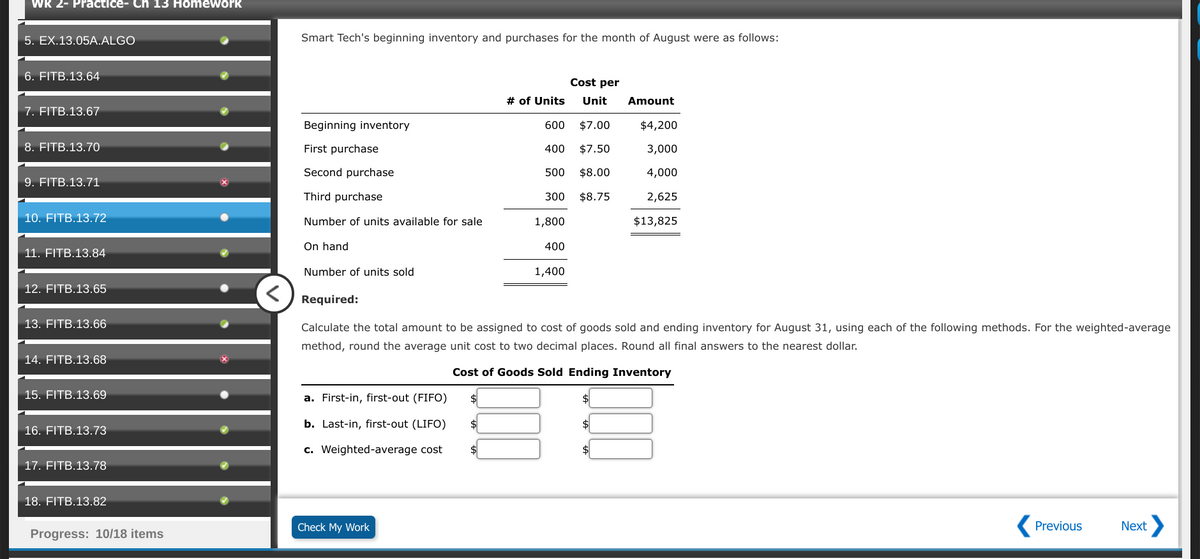

Smart Tech's beginning inventory and purchases for the month of August were as follows: a. First-in, first-out (FIFO) b. Last-in, first-out (LIFO) c. Weighted-average cost # of Units 600 $7.00 400 $7.50 500 $8.00 300 $8.75 Cost per Unit Beginning inventory First purchase Second purchase Third purchase Number of units available for sale On hand Number of units sold Required: Calculate the total amount to be assigned to cost of goods sold and ending inventory for August 31, using each of the following methods. For the weighted-average method, round the average unit cost to two decimal places. Round all final answers to the nearest dollar. Cost of Goods Sold Ending Inventory 1,800 400 1,400 Amount $4,200 3,000 4,000 2,625 $13,825

Smart Tech's beginning inventory and purchases for the month of August were as follows: a. First-in, first-out (FIFO) b. Last-in, first-out (LIFO) c. Weighted-average cost # of Units 600 $7.00 400 $7.50 500 $8.00 300 $8.75 Cost per Unit Beginning inventory First purchase Second purchase Third purchase Number of units available for sale On hand Number of units sold Required: Calculate the total amount to be assigned to cost of goods sold and ending inventory for August 31, using each of the following methods. For the weighted-average method, round the average unit cost to two decimal places. Round all final answers to the nearest dollar. Cost of Goods Sold Ending Inventory 1,800 400 1,400 Amount $4,200 3,000 4,000 2,625 $13,825

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

22nd Edition

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:James A. Heintz, Robert W. Parry

Chapter15: Financial Statements And Year-end Accounting For A Merchandising Business

Section: Chapter Questions

Problem 5CE

Related questions

Topic Video

Question

Transcribed Image Text:Wk 2- Practice- Ch 13 Homework

5. EX.13.05A.ALGO

6. FITB.13.64

7. FITB.13.67

8. FITB.13.70

9. FITB.13.71

10. FITB.13.72

11. FITB.13.84

12. FITB.13.65

13. FITB.13.66

14. FITB.13.68

15. FITB.13.69

16. FITB.13.73

17. FITB.13.78

18. FITB.13.82

Progress: 10/18 items

Smart Tech's beginning inventory and purchases for the month of August were as follows:

Beginning inventory

First purchase

Second purchase

Third purchase

Number of units available for sale

On hand

Number of units sold

a. First-in, first-out (FIFO)

b. Last-in, first-out (LIFO)

c. Weighted-average cost

Check My Work

$

$

# of Units

$

600

400

500

300

1,800

400

1,400

Required:

Calculate the total amount to be assigned to cost of goods sold and ending inventory for August 31, using each of the following methods. For the weighted-average

method, round the average unit cost to two decimal places. Round all final answers to the nearest dollar.

Cost of Goods Sold Ending Inventory

Cost per

Unit

$7.00

$7.50

$8.00

$8.75

$

$

Amount

$

$4,200

3,000

4,000

2,625

$13,825

Previous

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning