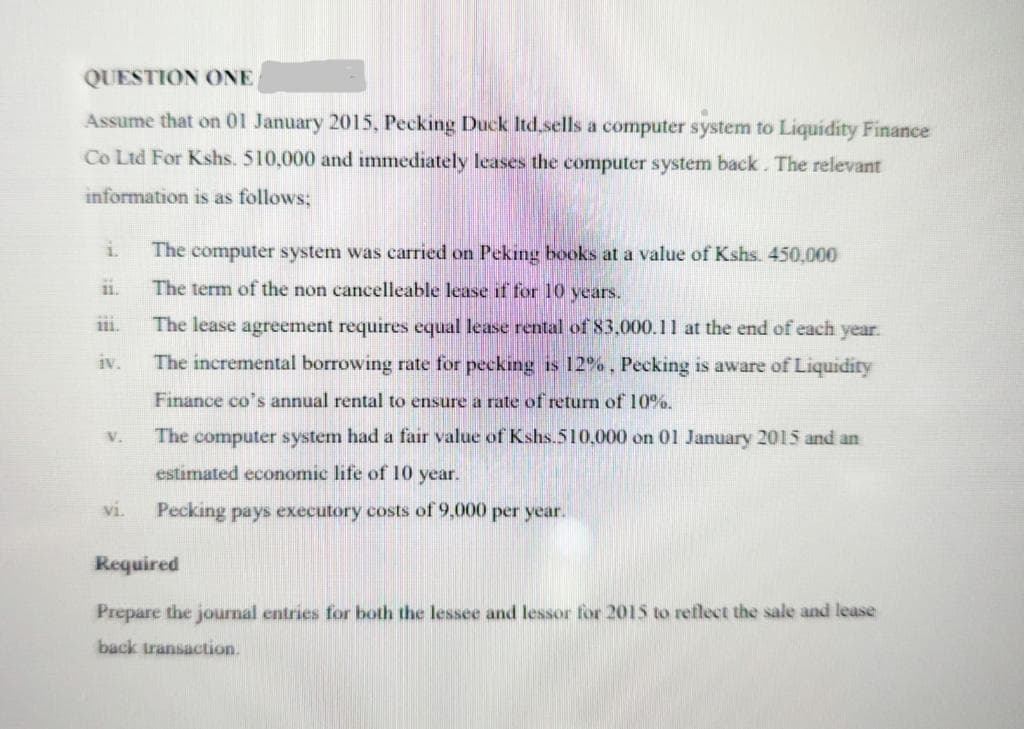

Assume that on 01 January 2015, Pecking Duck ltd sells a computer system to Liquidity Finance Co Ltd For Kshs. 510,000 and immediately leases the computer system back. The relevant information is as follows; 1. 111. iv. V. vi. The computer system was carried on Peking books at a value of Kshs. 450,000 The term of the non cancelleable lease if for 10 years. The lease agreement requires equal lease rental of 83,000.11 at the end of each year. The incremental borrowing rate for pecking is 12%, Pecking is aware of Liquidity Finance co's annual rental to ensure a rate of return of 10%. The computer system had a fair value of Kshs.510,000 on 01 January 2015 and an estimated economic life of 10 year. Pecking pays executory costs of 9,000 per year. Required Prepare the journal entries for both the lessee and lessor for 2015 to reflect the sale and lease back transaction.

Assume that on 01 January 2015, Pecking Duck ltd sells a computer system to Liquidity Finance Co Ltd For Kshs. 510,000 and immediately leases the computer system back. The relevant information is as follows; 1. 111. iv. V. vi. The computer system was carried on Peking books at a value of Kshs. 450,000 The term of the non cancelleable lease if for 10 years. The lease agreement requires equal lease rental of 83,000.11 at the end of each year. The incremental borrowing rate for pecking is 12%, Pecking is aware of Liquidity Finance co's annual rental to ensure a rate of return of 10%. The computer system had a fair value of Kshs.510,000 on 01 January 2015 and an estimated economic life of 10 year. Pecking pays executory costs of 9,000 per year. Required Prepare the journal entries for both the lessee and lessor for 2015 to reflect the sale and lease back transaction.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 1E: Determining Type of Lease and Subsequent Accounting On January 1, 2019, Caswell Company signs a...

Related questions

Question

Do not answer in image Format

Transcribed Image Text:QUESTION ONE

Assume that on 01 January 2015, Pecking Duck ltd.sells a computer system to Liquidity Finance

Co Ltd For Kshs. 510,000 and immediately leases the computer system back. The relevant

information is as follows;

1.

111.

iv.

V.

vi.

The computer system was carried on Peking books at a value of Kshs. 450,000

The term of the non cancelleable lease if for 10 years.

The lease agreement requires equal lease rental of 83,000.11 at the end of each year.

The incremental borrowing rate for pecking is 12%, Pecking is aware of Liquidity

Finance co's annual rental to ensure a rate of return of 10%.

The computer system had a fair value of Kshs.510,000 on 01 January 2015 and an

estimated economic life of 10 year.

Pecking pays executory costs of 9,000 per year.

Required

Prepare the journal entries for both the lessee and lessor for 2015 to reflect the sale and lease

back transaction.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning