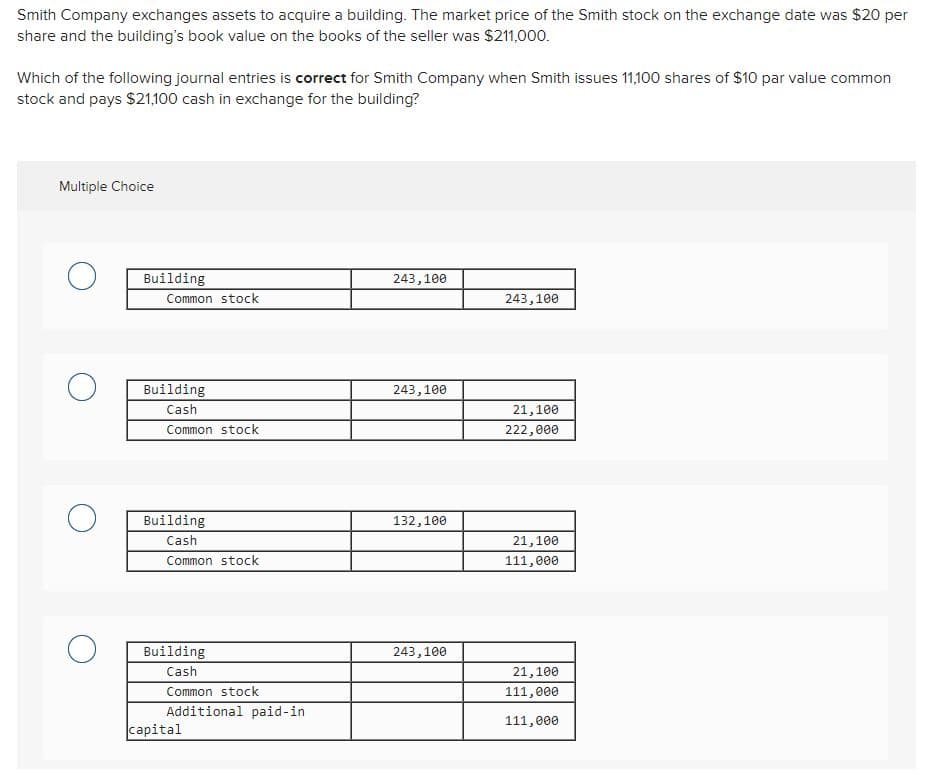

Smith Company exchanges assets to acquire a building. The market price of the Smith stock on the exchange date was $20 per share and the building’s book value on the books of the seller was $211,000. Which of the following journal entries is correct for Smith Company when Smith issues 11,100 shares of $10 par value common stock and pays $21,100 cash in exchange for the building? Please see picture attached

Smith Company exchanges assets to acquire a building. The market price of the Smith stock on the exchange date was $20 per share and the building’s book value on the books of the seller was $211,000. Which of the following journal entries is correct for Smith Company when Smith issues 11,100 shares of $10 par value common stock and pays $21,100 cash in exchange for the building? Please see picture attached

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter14: Statement Of Cash Flows

Section: Chapter Questions

Problem 37E: During 20X1, Craig Company had the following transactions: a. Purchased 300,000 of 10-year bonds...

Related questions

Question

Smith Company exchanges assets to acquire a building. The market price of the Smith stock on the exchange date was $20 per share and the building’s book value on the books of the seller was $211,000.

Which of the following

Please see picture attached.

Transcribed Image Text:Smith Company exchanges assets to acquire a building. The market price of the Smith stock on the exchange date was $20 per

share and the building's book value on the books of the seller was $211,000.

Which of the following journal entries is correct for Smith Company when Smith issues 11,100 shares of $10 par value common

stock and pays $21,100 cash in exchange for the building?

Multiple Choice

Building

Common stock

243,100

243,100

Building

243,100

Cash

21,100

Common stock

222,000

Building

Cash

132,100

21,100

Common stock

111,000

Building

243,100

Cash

21,100

Common stock

111, еее

Additional paid-in

111,e00

capital

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning