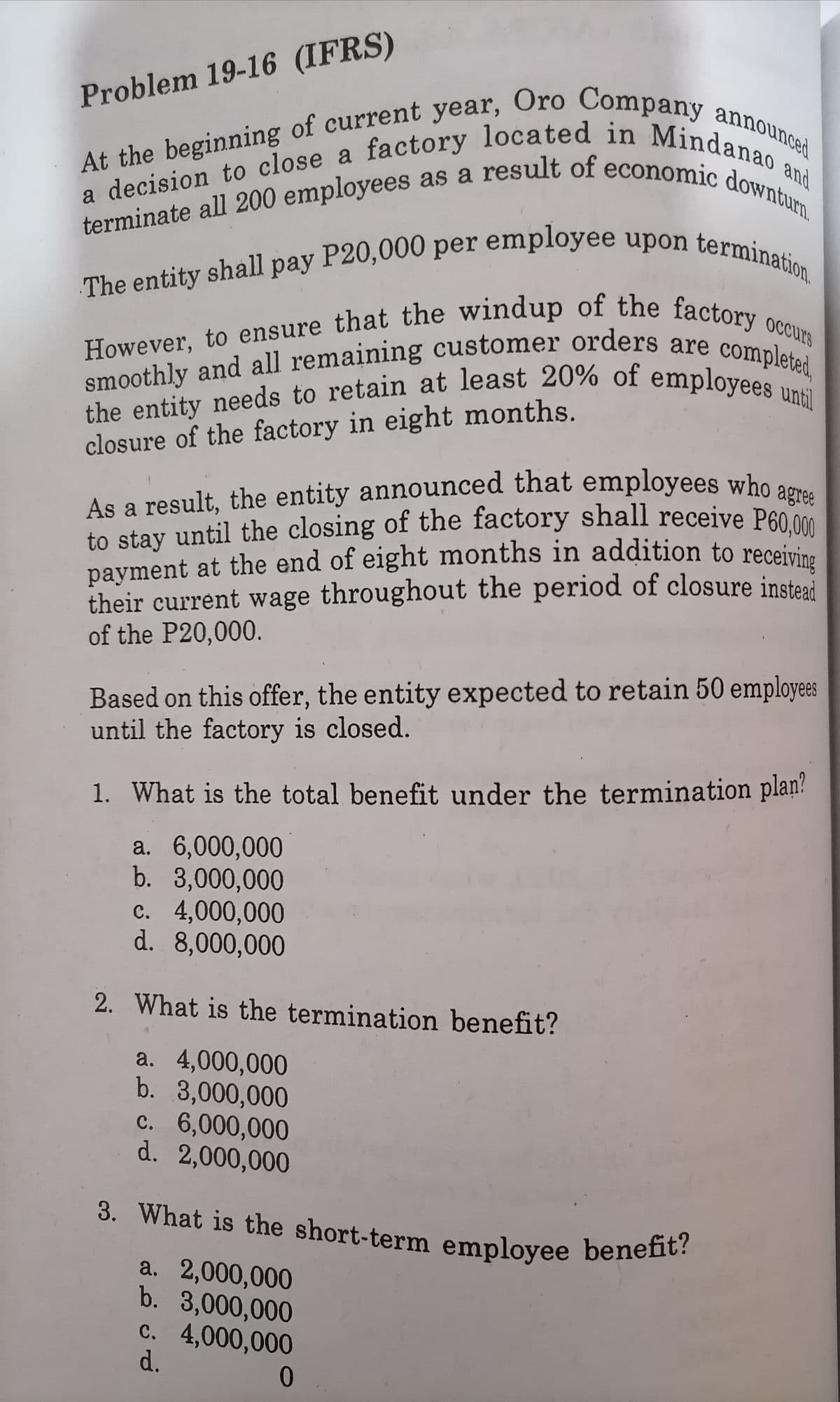

smoothly and all remaining customer orders are completed, terminate all 200 employees as a result of economic downturn. The entity shall pay P20,000 per employee upon termination At the beginning of current year, Oro Company announced a decision to close a factory located in Mindanao and the entity needs to retain at least 20% of employees until However, to ensure that the windup of the factory occurs to stay until the closing of the factory shall receive P60,000 As a result, the entity announced that employees who agree 3. What is the short-term employee benefit? Problem 19-16 (IFRS) and closure of the factory in eight months. to stay until the closing of the factory shall receive P60 00 payment at the end of eight months in addition to receivin their current wage throughout the period of closure instea of the P20,000. Based on this offer, the entity expected to retain 50 employes until the factory is closed. 1. What is the total benefit under the termination plan? a. 6,000,000 b. 3,000,000 c. 4,000,000 d. 8,000,000 2. What is the termination benefit? a. 4,000,000 b. 3,000,000 c. 6,000,000 d. 2,000,000 3. What is the short-term employee benent: a. 2,000,000 b. 3,000,000 c. 4,000,000 d.

smoothly and all remaining customer orders are completed, terminate all 200 employees as a result of economic downturn. The entity shall pay P20,000 per employee upon termination At the beginning of current year, Oro Company announced a decision to close a factory located in Mindanao and the entity needs to retain at least 20% of employees until However, to ensure that the windup of the factory occurs to stay until the closing of the factory shall receive P60,000 As a result, the entity announced that employees who agree 3. What is the short-term employee benefit? Problem 19-16 (IFRS) and closure of the factory in eight months. to stay until the closing of the factory shall receive P60 00 payment at the end of eight months in addition to receivin their current wage throughout the period of closure instea of the P20,000. Based on this offer, the entity expected to retain 50 employes until the factory is closed. 1. What is the total benefit under the termination plan? a. 6,000,000 b. 3,000,000 c. 4,000,000 d. 8,000,000 2. What is the termination benefit? a. 4,000,000 b. 3,000,000 c. 6,000,000 d. 2,000,000 3. What is the short-term employee benent: a. 2,000,000 b. 3,000,000 c. 4,000,000 d.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter17: Advanced Issues In Revenue Recognition

Section: Chapter Questions

Problem 19RE

Related questions

Question

Transcribed Image Text:The entity shall pay P20,000 per employee upon termination.

payment at the end of eight months in addition to receiving

terminate all 200 employees as a result of economic downturn.

the entity needs to retain at least 20% of employees until

to stay until the closing of the factory shall receive P60,000

smoothly and all remaining customer orders are completed,

However, to ensure that the windup of the factory occurs

As a result, the entity announced that employees who agree

3. What is the short-term employee benefit?

Problem 19-16 (IFRS)

and

closure of the factory in eight months.

As a result, the entity announced that employees who o

to stay until the closing of the factory shall receive P6000

payment at the end of eight months in addition to receiri

their current wage throughout the period of closure insteai

of the P20,000.

Based on this offer, the entity expected to retain 50 employees

until the factory is closed.

1. What is the total benefit under the termination plan?

a. 6,000,000

b. 3,000,000

c. 4,000,000

d. 8,000,000

2. What is the termination benefit?

a. 4,000,000

b. 3,000,000

c. 6,000,000

d. 2,000,000

3. What is the short-term emplovee benefit?

a. 2,000,000

b. 3,000,000

c. 4,000,000

d.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT