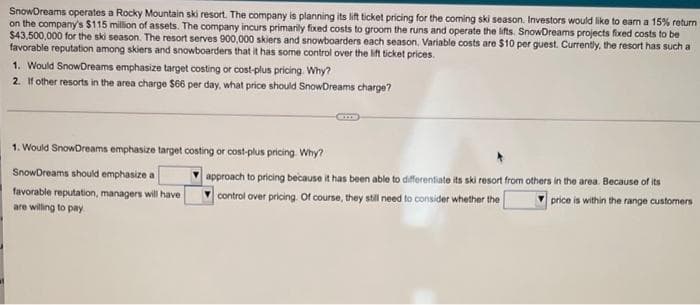

SnowDreams operates a Rocky Mountain ski resort. The company is planning its lift ticket pricing for the coming ski season. Investors would like to eam a 15% return on the company's $115 million of assets. The company incurs primarily fixed costs to groom the runs and operate the lifts. SnowDreams projects fixed costs to be $43,500,000 for the ski season. The resort serves 900,000 skiers and snowboarders each season. Variable costs are $10 per guest. Currently, the resort has such a favorable reputation among skiers and snowboarders that it has some control over the lift ticket prices. 1. Would SnowDreams emphasize target costing or cost-plus pricing. Why? 2. If other resorts in the area charge $66 per day, what price should SnowDreams charge? 1. Would SnowDreams emphasize target costing or cost-plus pricing. Why? SnowDreams should emphasize a favorable reputation, managers will have are willing to pay approach to pricing because it has been able to differentiate its ski resort from others in the area. Because of its control over pricing. Of course, they still need to consider whether the price is within the range customers

SnowDreams operates a Rocky Mountain ski resort. The company is planning its lift ticket pricing for the coming ski season. Investors would like to eam a 15% return on the company's $115 million of assets. The company incurs primarily fixed costs to groom the runs and operate the lifts. SnowDreams projects fixed costs to be $43,500,000 for the ski season. The resort serves 900,000 skiers and snowboarders each season. Variable costs are $10 per guest. Currently, the resort has such a favorable reputation among skiers and snowboarders that it has some control over the lift ticket prices. 1. Would SnowDreams emphasize target costing or cost-plus pricing. Why? 2. If other resorts in the area charge $66 per day, what price should SnowDreams charge? 1. Would SnowDreams emphasize target costing or cost-plus pricing. Why? SnowDreams should emphasize a favorable reputation, managers will have are willing to pay approach to pricing because it has been able to differentiate its ski resort from others in the area. Because of its control over pricing. Of course, they still need to consider whether the price is within the range customers

Chapter3: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 10EB: Keleher Industries manufactures pet doors and sells them directly to the consumer via their web...

Related questions

Question

Transcribed Image Text:SnowDreams operates a Rocky Mountain ski resort. The company is planning its lift ticket pricing for the coming ski season. Investors would like to earn a 15% return

on the company's $115 million of assets. The company incurs primarily fixed costs to groom the runs and operate the lifts. SnowDreams projects fixed costs to be

$43,500,000 for the ski season. The resort serves 900,000 skiers and snowboarders each season. Variable costs are $10 per guest. Currently, the resort has such a

favorable reputation among skiers and snowboarders that it has some control over the lift ticket prices.

1. Would SnowDreams emphasize target costing or cost-plus pricing. Why?

2. If other resorts in the area charge $66 per day, what price should SnowDreams charge?

1. Would SnowDreams emphasize target costing or cost-plus pricing. Why?

SnowDreams should emphasize a

favorable reputation, managers will have

are willing to pay

approach to pricing because it has been able to differentiate its ski resort from others in the area. Because of its

control over pricing. Of course, they still need to consider whether the

price is within the range customers

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT