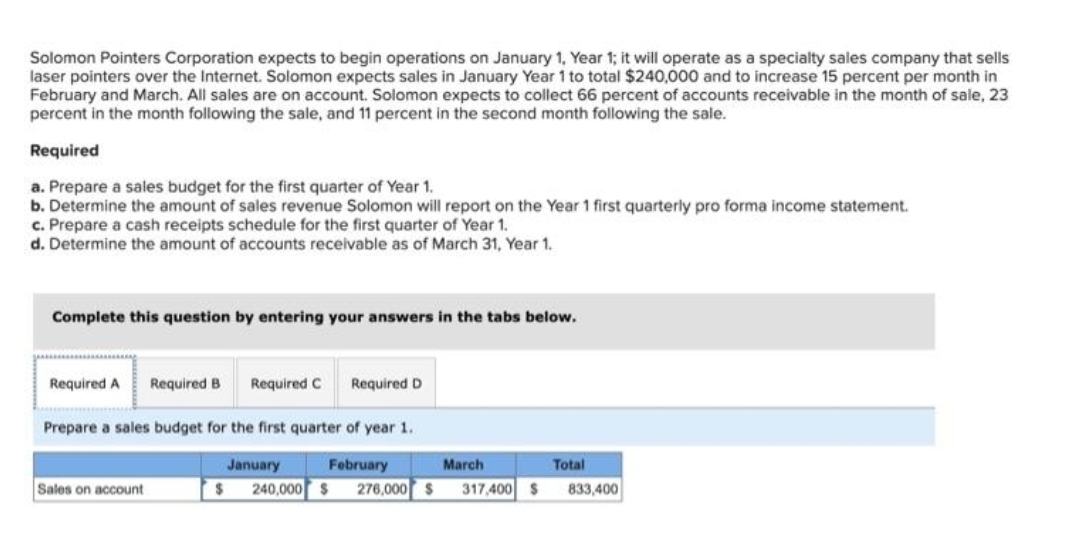

Solomon Pointers Corporation expects to begin operations on January 1, Year 1; it will operate as a specialty sales company that sells laser pointers over the Internet. Solomon expects sales in January Year 1 to total $240,000 and to increase 15 percent per month in February and March. All sales are on account. Solomon expects to collect 66 percent of accounts receivable in the month of sale, 23 percent in the month following the sale, and 11 percent in the second month following the sale. Required a. Prepare a sales budget for the first quarter of Year 1. b. Determine the amount of sales revenue Solomon will report on the Year 1 first quarterly pro forma income statement. c. Prepare a cash receipts schedule for the first quarter of Year 1. d. Determine the amount of accounts receivable as of March 31, Year 1.

Solomon Pointers Corporation expects to begin operations on January 1, Year 1; it will operate as a specialty sales company that sells laser pointers over the Internet. Solomon expects sales in January Year 1 to total $240,000 and to increase 15 percent per month in February and March. All sales are on account. Solomon expects to collect 66 percent of accounts receivable in the month of sale, 23 percent in the month following the sale, and 11 percent in the second month following the sale. Required a. Prepare a sales budget for the first quarter of Year 1. b. Determine the amount of sales revenue Solomon will report on the Year 1 first quarterly pro forma income statement. c. Prepare a cash receipts schedule for the first quarter of Year 1. d. Determine the amount of accounts receivable as of March 31, Year 1.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter8: Budgeting For Planning And Control

Section: Chapter Questions

Problem 24E: Del Spencer is the owner and founder of Del Spencers Mens Clothing Store. Del Spencers has its own...

Related questions

Question

Nn.113.

Subject :- Accounting

Transcribed Image Text:Solomon Pointers Corporation expects to begin operations on January 1, Year 1; it will operate as a specialty sales company that sells

laser pointers over the Internet. Solomon expects sales in January Year 1 to total $240,000 and to increase 15 percent per month in

February and March. All sales are on account. Solomon expects to collect 66 percent of accounts receivable in the month of sale, 23

percent in the month following the sale, and 11 percent in the second month following the sale.

Required

a. Prepare a sales budget for the first quarter of Year 1.

b. Determine the amount of sales revenue Solomon will report on the Year 1 first quarterly pro forma income statement.

c. Prepare a cash receipts schedule for the first quarter of Year 1.

d. Determine the amount of accounts receivable as of March 31, Year 1.

Complete this question by entering your answers in the tabs below.

Required A Required B Required C Required D

Prepare a sales budget for the first quarter of year 1.

January

February

$ 240,000 $ 276,000 $

Sales on account

March

317,400 S

Total

833,400

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub