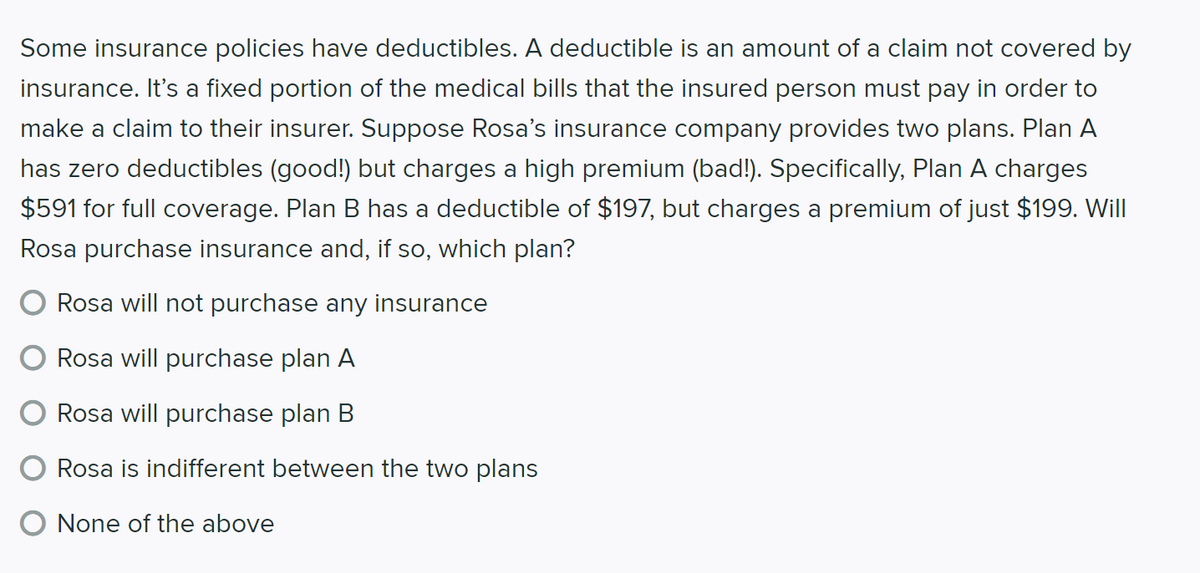

Some insurance policies have deductibles. A deductible is an amount of a claim not covered by nsurance. It's a fixed portion of the medical bills that the insured person must pay in order to make a claim to their insurer. Suppose Rosa's insurance company provides two plans. Plan A has zero deductibles (good!) but charges a high premium (bad!). Specifically, Plan A charges $591 for full coverage. Plan B has a deductible of $197, but charges a premium of just $199. Will Rosa purchase insurance and, if so, which plan?

Some insurance policies have deductibles. A deductible is an amount of a claim not covered by nsurance. It's a fixed portion of the medical bills that the insured person must pay in order to make a claim to their insurer. Suppose Rosa's insurance company provides two plans. Plan A has zero deductibles (good!) but charges a high premium (bad!). Specifically, Plan A charges $591 for full coverage. Plan B has a deductible of $197, but charges a premium of just $199. Will Rosa purchase insurance and, if so, which plan?

Chapter7: Losses—deductions And Limitations

Section: Chapter Questions

Problem 47P

Related questions

Question

Transcribed Image Text:Some insurance policies have deductibles. A deductible is an amount of a claim not covered by

insurance. It's a fixed portion of the medical bills that the insured person must pay in order to

make a claim to their insurer. Suppose Rosa's insurance company provides two plans. Plan A

has zero deductibles (good!) but charges a high premium (bad!). Specifically, Plan A charges

$591 for full coverage. Plan B has a deductible of $197, but charges a premium of just $199. Will

Rosa purchase insurance and, if so, which plan?

Rosa will not purchase any insurance

Rosa will purchase plan A

Rosa will purchase plan B

Rosa is indifferent between the two plans

O None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT