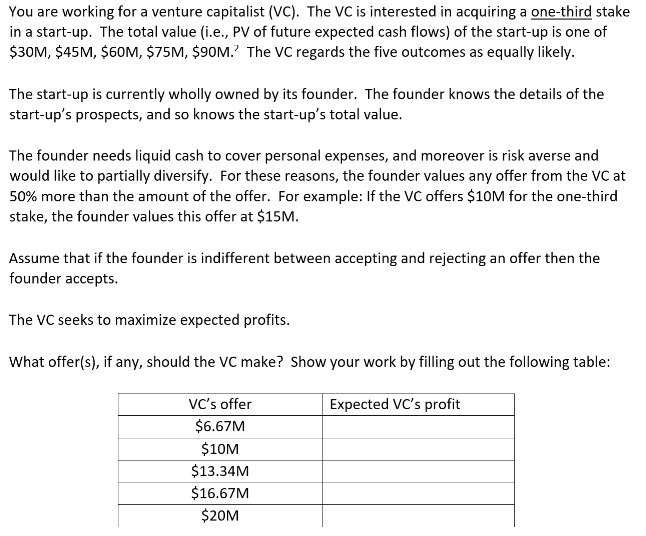

You are working for a venture capitalist (VC). The VC is interested in acquiring a one-third stake in a start-up. The total value (i.e., PV of future expected cash flows) of the start-up is one of $30M, $45M, $60M, $75M, $90M.' The VC regards the five outcomes as equally likely. The start-up is currently wholly owned by its founder. The founder knows the details of the start-up's prospects, and so knows the start-up's total value. The founder needs liquid cash to cover personal expenses, and moreover is risk averse and would like to partially diversify. For these reasons, the founder values any offer from the VC at 50% more than the amount of the offer. For example: If the VC offers $10M for the one-third stake, the founder values this offer at $15M. Assume that if the founder is indifferent between accepting and rejecting an offer then the founder accepts. The VC seeks to maximize expected profits. What offer(s), if any, should the VC make? Show your work by filling out the following table: Expected VC's profit V's offer $6.67M $10M $13.34M $16.67M $20M

You are working for a venture capitalist (VC). The VC is interested in acquiring a one-third stake in a start-up. The total value (i.e., PV of future expected cash flows) of the start-up is one of $30M, $45M, $60M, $75M, $90M.' The VC regards the five outcomes as equally likely. The start-up is currently wholly owned by its founder. The founder knows the details of the start-up's prospects, and so knows the start-up's total value. The founder needs liquid cash to cover personal expenses, and moreover is risk averse and would like to partially diversify. For these reasons, the founder values any offer from the VC at 50% more than the amount of the offer. For example: If the VC offers $10M for the one-third stake, the founder values this offer at $15M. Assume that if the founder is indifferent between accepting and rejecting an offer then the founder accepts. The VC seeks to maximize expected profits. What offer(s), if any, should the VC make? Show your work by filling out the following table: Expected VC's profit V's offer $6.67M $10M $13.34M $16.67M $20M

Chapter11: Venture Capital Valuation Methods

Section: Chapter Questions

Problem 3EP

Related questions

Question

Transcribed Image Text:You are working for a venture capitalist (VC). The VC is interested in acquiring a one-third stake

in a start-up. The total value (i.e., PV of future expected cash flows) of the start-up is one of

$30M, $45M, $60M, $75M, $90M. The VC regards the five outcomes as equally likely.

The start-up is currently wholly owned by its founder. The founder knows the details of the

start-up's prospects, and so knows the start-up's total value.

The founder needs liquid cash to cover personal expenses, and moreover is risk averse and

would like to partially diversify. For these reasons, the founder values any offer from the VC at

50% more than the amount of the offer. For example: If the VC offers $10M for the one-third

stake, the founder values this offer at $15M.

Assume that if the founder is indifferent between accepting and rejecting an offer then the

founder accepts.

The VC seeks to maximize expected profits.

What offer(s), if any, should the VC make? Show your work by filling out the following table:

Vc's offer

Expected VC's profit

$6.67M

$10M

$13.34M

$16.67M

$20M

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College