someone solve Question 3.12 while question 3.11 also given .solve it step by step not by excel

someone solve Question 3.12 while question 3.11 also given .solve it step by step not by excel

Chapter4: Time Value Of Money

Section: Chapter Questions

Problem 5PROB

Related questions

Question

someone solve Question 3.12 while question 3.11 also given .solve it step by step not by excel

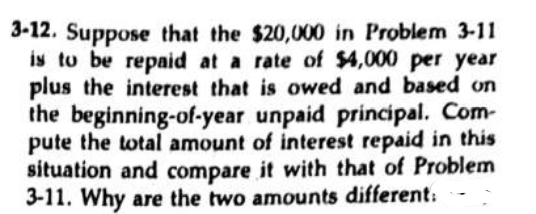

Transcribed Image Text:3-12. Suppose that the $20,000 in Problem 3-11

is to be repaid at a rate of $4,000 per year

plus the interest that is owed and based on

the beginning-of-year unpaid principal. Com-

pute the total amount of interest repaid in this

situation and compare it with that of Problem

3-11. Why are the two amounts different:

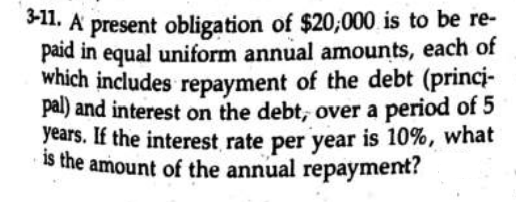

Transcribed Image Text:S11. A present obligation of $20;000 is to be re-

paid in equal uniform annual amounts, each of

which includes repayment of the debt (princi-

pal) and interest on the debt, over a period of 5

years. If the interest rate per year is 10%, what

is the amount of the annual repayment?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning