Sonia and Fred are partners in a CPA firm that was formed as a Limited Liability Partnership (LLP). If Sonia commits malpractic in the preparation of client financial statements, are the partner's personal assets at risk to pay damages caused by Sonia? a. Yes, Sonia's assets are at risk b. No, the LLP shields Sonia's personal assets from malpractice c. No, the LLP shields the personal assets of both partners from malpractice Od. Yes, Sonia and Fred's personal assets are at risk

Sonia and Fred are partners in a CPA firm that was formed as a Limited Liability Partnership (LLP). If Sonia commits malpractic in the preparation of client financial statements, are the partner's personal assets at risk to pay damages caused by Sonia? a. Yes, Sonia's assets are at risk b. No, the LLP shields Sonia's personal assets from malpractice c. No, the LLP shields the personal assets of both partners from malpractice Od. Yes, Sonia and Fred's personal assets are at risk

Chapter8: Trusts

Section: Chapter Questions

Problem 1CTD

Related questions

Question

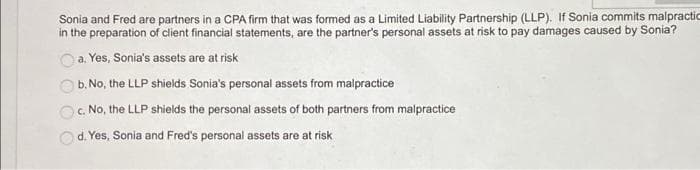

Transcribed Image Text:Sonia and Fred are partners in a CPA firm that was formed as a Limited Liability Partnership (LLP). If Sonia commits malpractic

in the preparation of client financial statements, are the partner's personal assets at risk to pay damages caused by Sonia?

a. Yes, Sonia's assets are at risk

b. No, the LLP shields Sonia's personal assets from malpractice

c. No, the LLP shields the personal assets of both partners from malpractice

d. Yes, Sonia and Fred's personal assets are at risk

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage