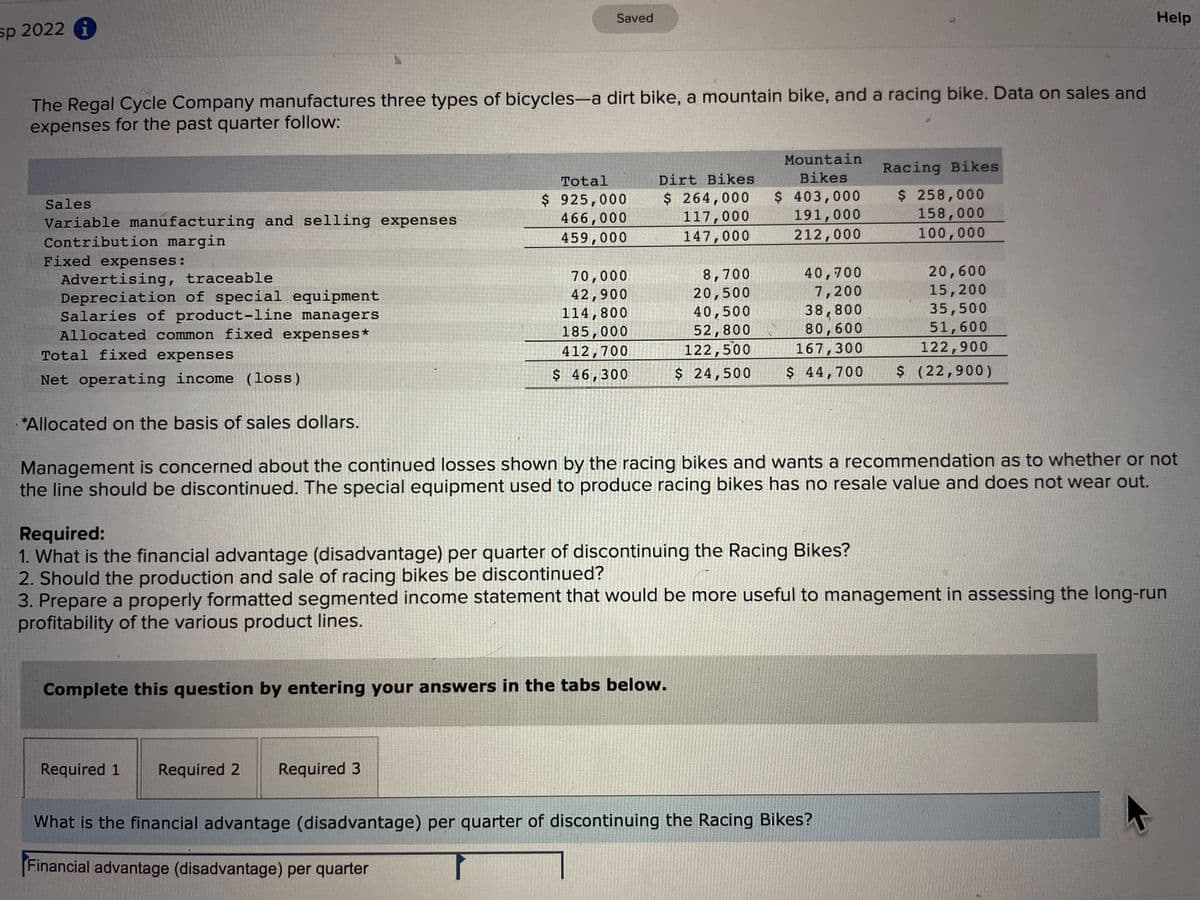

The Regal Cycle Company manufactures three types of bicycles-a dirt bike, a mountain bike, and a racing bike. Data on sales and expenses for the past quarter follow: Mountain Bikes Racing Bikes Dirt Bikes $ 264,000 117,000 147,000 Total $ 925,000 466,000 459,000 $ 403,000 191,000 212,000 $ 258,000 158,000 100,000 Sales Variable manufacturing and selling expenses Contribution margin Fixed expenses: Advertising, traceable Depreciation of special equipment Salaries of product-line managers Allocated common fixed expenses* Total fixed expenses 40,700 7,200 38,800 80,600 20,600 15,200 8,700 70,000 42,900 20,500 40,500 52,800 122,500 $ 24,500 35,500 51,600 122,900 114,800 185,000 412,700 |167,300 $ 46,300 $ 44,700 $ (22,900) Net operating income (loss) *Allocated on the basis of sales dollars. Management is concerned about the continued losses shown by the racing bikes and wants a recommendation as to whether or not the line should be discontinued. The special equipment used to produce racing bikes has no resale value and does not wear out. Required: 1. What is the financial advantage (disadvantage) per quarter of discontinuing the Racing Bikes? 2. Should the production and sale of racing bikes be discontinued? 3. Prepare a properly formatted segmented income statement that would be more useful to management in assessing the long-run profitability of the various product lines.

The Regal Cycle Company manufactures three types of bicycles-a dirt bike, a mountain bike, and a racing bike. Data on sales and expenses for the past quarter follow: Mountain Bikes Racing Bikes Dirt Bikes $ 264,000 117,000 147,000 Total $ 925,000 466,000 459,000 $ 403,000 191,000 212,000 $ 258,000 158,000 100,000 Sales Variable manufacturing and selling expenses Contribution margin Fixed expenses: Advertising, traceable Depreciation of special equipment Salaries of product-line managers Allocated common fixed expenses* Total fixed expenses 40,700 7,200 38,800 80,600 20,600 15,200 8,700 70,000 42,900 20,500 40,500 52,800 122,500 $ 24,500 35,500 51,600 122,900 114,800 185,000 412,700 |167,300 $ 46,300 $ 44,700 $ (22,900) Net operating income (loss) *Allocated on the basis of sales dollars. Management is concerned about the continued losses shown by the racing bikes and wants a recommendation as to whether or not the line should be discontinued. The special equipment used to produce racing bikes has no resale value and does not wear out. Required: 1. What is the financial advantage (disadvantage) per quarter of discontinuing the Racing Bikes? 2. Should the production and sale of racing bikes be discontinued? 3. Prepare a properly formatted segmented income statement that would be more useful to management in assessing the long-run profitability of the various product lines.

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter2: Financial Statements, Cash Flow,and Taxes

Section: Chapter Questions

Problem 20SP: Begin with the partial model in the file Ch02 P20 Build a Model.xlsx on the textbook’s Web...

Related questions

Question

Transcribed Image Text:Saved

Help

sp 2022 G

The Regal Cycle Company manufactures three types of bicycles-a dirt bike, a mountain bike, and a racing bike. Data on sales and

expenses for the past quarter follow:

Mountain

Racing Bikes

Total

Dirt Bikes

Bikes

$ 925,000

466,000

459,000

$ 264,000

117,000

147,000

$ 403,000

191,000

212,000

$ 258,000

158,000

100,000

Sales

Variable manufacturing and selling expenses

Contribution margin

Fixed expenses:

Advertising, traceable

Depreciation of special equipment

Salaries of product-line managers

Allocated common fixed expenses*

Total fixed expenses

70,000

42,900

114,800

185,000

412,700

8,700

20,500

40,500

52,800

122,500

40,700

7,200

38,800

80,600

167,300

20,600

15,200

35,500

51,600

122,900

$ (22,900)

Net operating income (loss)

$ 46,300

$ 24,500

$ 44,700

*Allocated on the basis of sales dollars.

Management is concerned about the continued losses shown by the racing bikes and wants a recommendation as to whether or not

the line should be discontinued. The special equipment used to produce racing bikes has no resale value and does not wear out.

Required:

1. What is the financial advantage (disadvantage) per quarter of discontinuing the Racing Bikes?

2. Should the production and sale of racing bikes be discontinued?

3. Prepare a properly formatted segmented income statement that would be more useful to management in assessing the long-run

profitability of the various product lines.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Required 3

What is the financial advantage (disadvantage) per quarter of discontinuing the Racing Bikes?

Financial advantage (disadvantage) per quarter

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning