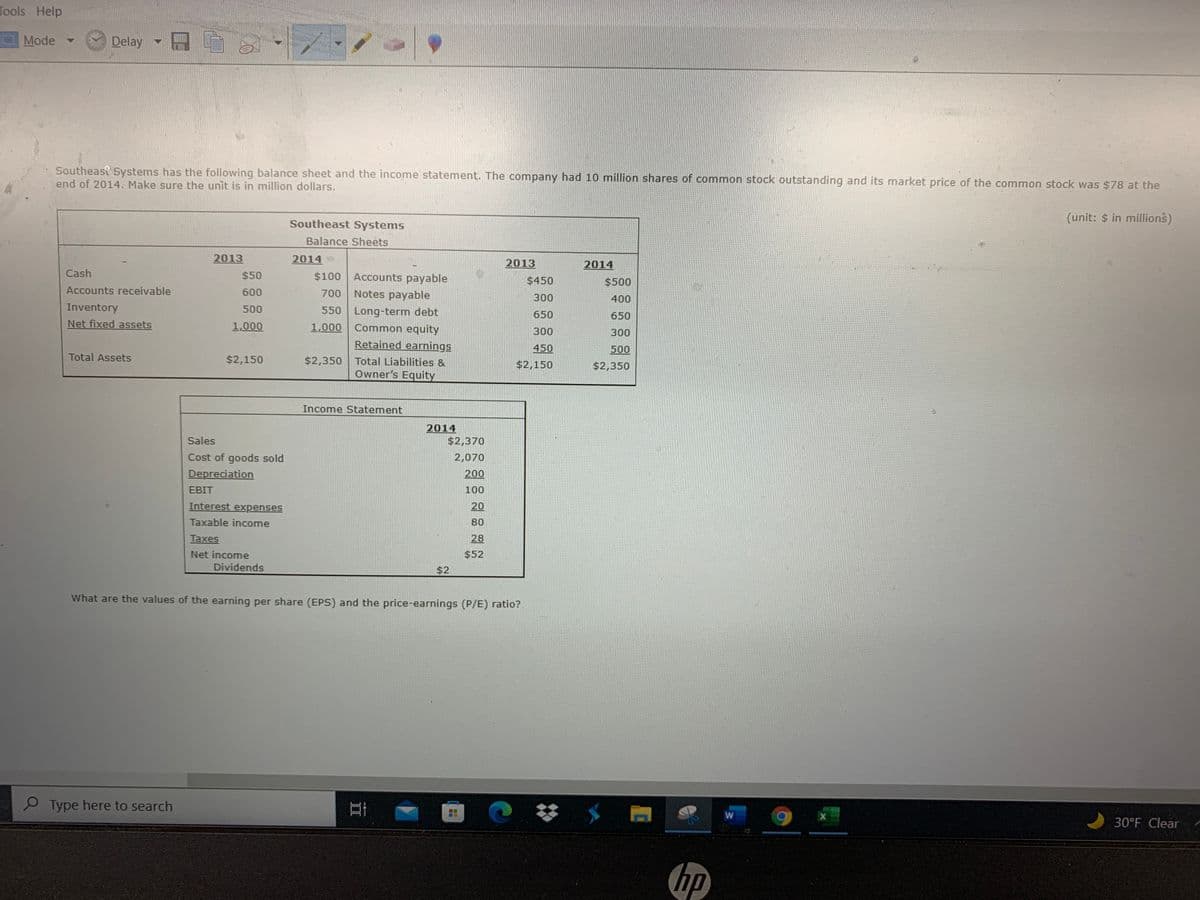

*Southeasi Systems has the following balance sheet and the income statement. The company had 10 million shares of common stock outstanding and its market price of the common stock was $78 at the end of 2014. Make sure the unit is in million dollars. (unit: $ in millio: Southeast Systems Balance Sheets 2013 2014 2013 2014 Cash $50 $100 Accounts payable 700 Notes payable 550 Long-term debt $450 $500 Accounts receivable 600 300 400 Inventory Net fixed assets 500 650 650 1.000 1.000 Common equity Retained earnings $2,350 Total Liabilities & Owner's Equity 300 300 450 500 Total Assets $2,150 $2,150 $2,350 Income Statement 2014 $2,370 Sales Cost of goods sold 2,070 Depreciation 200 EBIT 100 Interest expenses 20 Taxable income 80 Тахes 28 Net income $52 Dividends $2 What are the values of the earning per share (EPS) and the price-earnings (P/E) ratio?

*Southeasi Systems has the following balance sheet and the income statement. The company had 10 million shares of common stock outstanding and its market price of the common stock was $78 at the end of 2014. Make sure the unit is in million dollars. (unit: $ in millio: Southeast Systems Balance Sheets 2013 2014 2013 2014 Cash $50 $100 Accounts payable 700 Notes payable 550 Long-term debt $450 $500 Accounts receivable 600 300 400 Inventory Net fixed assets 500 650 650 1.000 1.000 Common equity Retained earnings $2,350 Total Liabilities & Owner's Equity 300 300 450 500 Total Assets $2,150 $2,150 $2,350 Income Statement 2014 $2,370 Sales Cost of goods sold 2,070 Depreciation 200 EBIT 100 Interest expenses 20 Taxable income 80 Тахes 28 Net income $52 Dividends $2 What are the values of the earning per share (EPS) and the price-earnings (P/E) ratio?

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 99.4C

Related questions

Question

100%

Transcribed Image Text:Tools Help

O Mode

Delay

Southeast Systems has the following balance sheet and the income statement. The company had 10 million shares of common stock outstanding and its market price of the common stock was $78 at the

end of 2014. Make sure the unit is in million dollars.

(unit: $ in millions)

Southeast Systems

Balance Sheets

2013

2014

2013

2014

Cash

$50

$100 Accounts payable

$450

$500

Accounts receivable

600

Notes payable

700

300

400

Inventory

500

550 Long-term debt

1,000 Common equity

650

650

Net fixed assets

1,000

300

300

Retained earnings

450

500

Total Assets

$2,150

$2,350 Total Liabilities &

$2,150

$2,350

Owner's Equity

Income Statement

2014

$2,370

Sales

Cost of goods sold

2,070

Depreciation

200

ЕBIT

100

Interest expenses

20

Taxable income

80

Таxes

28

Net income

$52

Dividends

$2

What are the values of the earning per share (EPS) and the price-earnings (P/E) ratio?

P Type here to search

30°F Clear

hp

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning