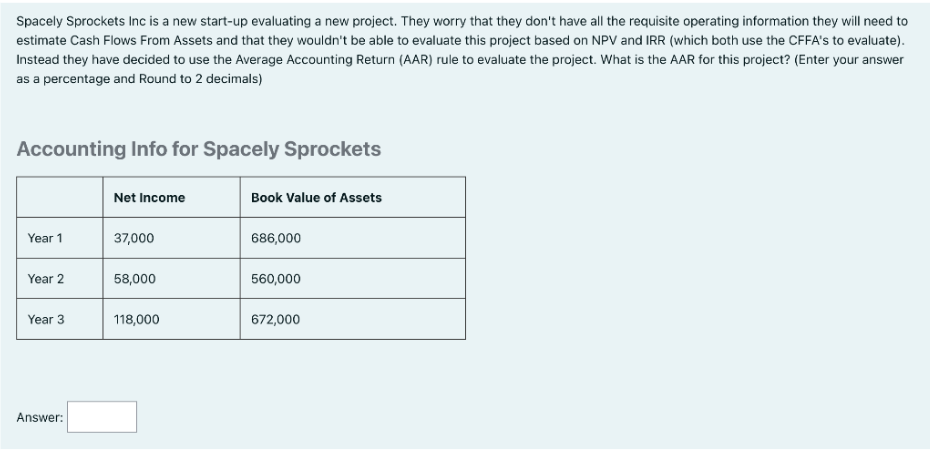

Spacely Sprockets Inc is a new start-up evaluating a new project. They worry that they don't have all the requisite operating information they will need to estimate Cash Flows From Assets and that they wouldn't be able to evaluate this project based on NPV and IRR (which both use the CFFA's to evaluate). Instead they have decided to use the Average Accounting Return (AAR) rule to evaluate the project. What is the AAR for this project? (Enter your answer as a percentage and Round to 2 decimals) Accounting Info for Spacely Sprockets Year 1 Year 2 Year 3 Net Income 37,000 58,000 118,000 Book Value of Assets 686,000 560,000 672,000

Q: Answer the below questions. (a) For a single-name credit default swap, what is the difference…

A: A Credit Default Swap (CDS) is a financial contract between two parties where one party (the buyer…

Q: Rishi Sunak Manufacturing Pte. Ltd. is preparing its budget for next year. The company estimates…

A: Raw materials of December = $240,000 Raw materials of November = $280,000 Raw materials of October…

Q: Scenario: Imagine you have recently inherited $20,000 and you want to save it. You can put it in a…

A: A decision is a choice between two or more alternatives, where the outcome of the choice is not…

Q: Problem #3: Create a table showing the payment of a mortgage of $221,000 month by month. Create…

A: Mortgage payments are the monthly payments of the long-term loan taken from the lender. The borrowed…

Q: A proposed cost-saving device has an installed cost of $700,000. It is in Class 8 (CCA rate = 20%)…

A: Capital Cost Allowance: The capital cost allowance (CCA) is a deduction from an individual's or…

Q: 15. If a project has an initial investment of $20,000, for 9 years a monthly interest rate equal to…

A: The magnitude and timing of cash flows of a project are known. The IRR has to be determined. IRR is…

Q: Suppose a 10-year, $1,000 bond with an 8.9% coupon rate and semi-annual coupons is trading for a…

A: Bonds are debt instruments issued by companies. Bonds pay periodic coupons or interests and in this…

Q: NoGrowth Corporation currently pays a dividend of $0.44 per quarter, and it will continue to pay…

A: Given: Annual dividend = $0.44 Cost of capital = 11.8%

Q: 5. Pathao, a ride sharing company, is interested in estimating its weighted average cost of capital…

A: WACC refers to weighted average cost of capital. WACC shows the after tax cost of capital from…

Q: tim burr wolff believes that builtrite will pay the following dividends over that next 3 years:…

A: Step 1 Yield to maturity (YTM) is the overall rate of return that a bond will have earned once all…

Q: Steven purchased 1000 shares of a certain stock for $25,700 (including commissions). He sold the…

A: Purchase Amount = p = $25,700 Time = t = 2 years Selling Amount = s = $33,400

Q: A municipal bond has face value of $500,000, mature in 8 years and 3 months from now, and the coupon…

A: The coupon rate and the yield to maturity (YTM) are both measures of the return that an investor can…

Q: Your company is considering the purchase of a new ship for $8 million. The forecasted revenues are…

A: Net present value is the technique used in capital budgeting to evaluate the acceptability of the…

Q: A $100,000 mortgage loan at 6.3% compounded semi-annually has a 25-year amortization period.…

A: A mortgage is a covered loan borrowed to purchase a property. The property itself acts as collateral…

Q: A company has completed the operating budget and the cash budget. It is now preparing the budgeted…

A: A budget is a financial plan that outlines an organization's or individual's expected income and…

Q: 3. Consider the CF profile of a project below. Assume a MARR of 9%. Find the discounted payback…

A: The payback period refers to the time that a project’s cash flow takes to recover its initial…

Q: Narendra Modi Pte. Ltd. is preparing its budget for next year. Sales are all on credit. The company…

A: A budget is a financial plan that outlines an organization's projected income and expenses over a…

Q: Imagine you’re renting an apartment with a friend after high school. Your friend wants to get…

A: A person’s credit history is a record of that person’s use of credit over time. This determines a…

Q: Code 71046

A: Given : APC weight = 1.56 Conversion factor CF = $80.79 Wage Index = 0.9445

Q: H1. Optimal Capital Budgeting (Capital Expenditure valuations) Dandy Panda´s Japan affiliated…

A: To determine Dandy Panda's Japan optimal capital budget, we need to calculate the cost of each…

Q: manufactures and sells personal computers is an all- equity firm with 100,000 shares outstanding,…

A: In order to calculate the earning per share you considered the total number of outstanding share in…

Q: 6. David borrowed P^(5),000 from a bank at a rate of 7% per annum compounded annually. Which of the…

A: We need to use compound interest formula below to calculate amount to be paid after certain year. A…

Q: Problem 1: A man deposited ABCDE.00 in a bank of 10% per annum for (A+B+C) months and (D+E) days.…

A: Given: A=1 B=5 C=7 D=6 E=8 Solution : To calculate the ordinary simple interest on a deposit of…

Q: You are asked to analyze The Haus of Us, a local manufacturer of house decor and accessories. Last…

A: In the given case, we have provided the beta , market return and risk free rate . And, the required…

Q: Eric and Susan just purchased their first home, which cost $166,000. They purchased a homeowner’s…

A: given data the cost of home = $166,000 home insurance = $156,000 if anything happens the claim will…

Q: We project unit sales for a new household-use laser-guided cockroach search and destroy system as…

A: Time Value of Money: The time value of money is the widely accepted idea that obtaining a sum of…

Q: A company has completed the operating budget and the cash budget. It is now preparing the budgeted…

A: The answer to the question given below :

Q: Marisa leases a car that has a purchase price of $63,500 with an MSRP of $66,950 and decided to…

A: The lease is the method of acquiring an asset without buying it, that is, the asset is acquired by…

Q: 1. If you invest $1,000 today in a security paying 8 percent compounded quarterly, how much will the…

A: A=P(1+i)n Where A =Amount P=Principal i=periodic interest rate n=number of compounding

Q: How much interest will an account earn if you deposited $665 at the end of every six months for 8…

A: An annuity is a financial product that provides a series of payments at fixed intervals, typically…

Q: Courtney Limited has capital project opportunities each of which would require an initial investment…

A: The process that analyzes and evaluates any project's feasibility and profitability is recognized as…

Q: Which of the following is NOT true about Blockchain application in Accounting? A. Auditors can get…

A: Blockchain technology has many potential applications in the field of accounting, some of which are…

Q: 1. What is the estimated volume sold of the Quick Fresh Car Wash (OFCW) bond? COMPANY (TICKER)…

A: A bond quote shows the coupon rate of the bond, the date of maturity, the last price traded, the…

Q: Which of the following are true about debt and equity interest payments are generally tax deductible…

A: Debt refers to borrowed money that must be repaid over time, typically with interest. In this form…

Q: A credit card has a monthly rate of 1.6% and uses the average daily balance method for calculating…

A: When a credit card holder carries a balance on their credit card, they are charged interest on that…

Q: Trudeau Manufacturing Inc. is producing its cost of sales budget. Direct materials are budgeted to…

A: To calculate the budgeted cost of sales for June 2020, we need to first determine the budgeted sales…

Q: The net present value of a project: Ⓒa. O b. Is an absolute metric of value and ignores the timing…

A: The net present value (NPV) is a measure of relative valuation that takes into account when a…

Q: Note: Round your interest amount answers to 2 decimal places. Enter the current yield answers as a…

A: The current yield is different from the bond's coupon rate, which is the fixed rate of interest that…

Q: YNA is expected to pay a dividend of $1.0 in Year 1 and $1.2 in Year 2. Analysts expect the price of…

A: The magnitude and timing of the future dividends arising from a stock are known. Beta of the stock…

Q: A 15 year $1000 face value coupon bond pays a coupon rate of 3.8% and has a YTM of 4.4%. Coupon…

A:

Q: What does it take to become a personal financial advisor?

A: Personal financial advisor-They provide guidance to individuals on matters relating to personal…

Q: Give typing answer with explanation and conclusion Assume that the risk-free rate is 2.5% and the…

A: Step 1 The financial requirements of an investment, development or significant purchase are outlined…

Q: Required: 1. Estimate the amount of Stanley Mills's annual retirement payments for the 15 retirement…

A: NOTE; Question can answer up to 3 subparts only as per Honor code. Upload again for the remaining…

Q: 1.Applying microeconomics principles, explain why was the real estate market ( properties and homes)…

A: The stock exchange prices of companies like Enron, Lehman, and Satyam computers crumbled in just a…

Q: 2. Find the last sold price of the Bettie's Bags (5) bond COMPANY (TICKER) Bettie's Bage (05)…

A: As per the given information: Coupon rate = 7.749Last price = 114.905Last yield = 3.128Estimated…

Q: You are interested in short selling 200 shares of Queen Company Limited. The initial margin is 55%…

A:

Q: In the article “Incorporating Country Risk in the Valuation of offshore Projects”, Lessard…

A: The viability of offshore projects might be affected by the complexity and numerous hazards they…

Q: MCQ & True/false : International Financial Management: 1. Changes in relative inflation rates can…

A: Inflation- It can be described as the increase in the general price level of goods or services, or…

Q: Ratio Liquidity Ratio Current ratio Activity Ratio Inventory turnover Leverage ratio Debt ratio %…

A: The liquidity ratios of Toyota, as measured by its current ratio, suggest that the company has a…

Q: Firms in Japan often employ both high operating and financial leverage because of the use of modern…

A: The degree of combined leverage shows the effect of operating and financial leverage on the…

Ef 444.

Step by step

Solved in 2 steps

- Porbandar plc is considering the investment in a project that has an initial cash outlay followed by a series of net cash inflows. The business applied the NPV and IRR methods to evaluate the proposal but, after the evaluation had been undertaken, it was found that the correct cost of capital figure was lower than that used in the evaluation. What will be the effect of correcting for this error on the NPV and IRR figures? Effect on NPV Effect on IRR A Decrease Decrease B Decrease No Change C Increase No Change D Increase IncreaseWhich one of the following would NOT result in incremental cash flows and thus should NOT be included in the capital budgeting analysis for a new product? a. It is learned that land the company owns and would use for the new project, if it is accepted, could be sold to another firm. b. The cost of a study relating to the market for the new product that was completed last year. The results of this research were positive, and they led to the tentative decision to go ahead with the new product. The cost of the research was incurred and expensed for tax purposes last year. c. Revenues from an existing product would be lost as a result of customers switching to the new product. d. Shipping and installation costs associated with a machine that would be used to produce the new product. e. Using some of the firm's high-quality factory floor space that is currently unused to produce the proposed new product. This space could be…Why does a company evaluate both the money allocated to a project and the time allocated to the project? What is the next thing a company needs to do after it establishes investment criteria? What is the payback method used to determine? Why do businesses consider the time value of money before making an investment decision? A fellow student studying Financial Accounting says, “The net present value (NPV) weighs early receipts of cash much more heavily than more distant receipts of cash.” Do you agree or disagree? Why?

- Tesar Chemicals is considering Projects S and L, whose cash flows are shown below. These projects are mutuallyexclusive, equally risky, and not repeatable. The CEO believes the IRR is the best selection criterion, while the CFOadvocates the NPV. If the decision is made by choosing the project with the higher IRR rather than the one with thehigher NPV, how much, if any, value will be forgone, i.e., what's the chosen NPV versus the maximum possible NPV?Note that (1) "true value" is measured by NPV, and (2) under some conditions the choice of IRR vs. NPV will have noeffect on the value gained or lost.WACC: 7.50%Year 0 1 2 3 4CFS −$1,100 $550 $600 $100 $100CFL−$2,700 $650 $725 $800 $1,400Market Fresh Foods is evaluating a new project to determine whether it warrants funding consideration. Having just taken over managing the project initiation process for Market Fresh from the previous project controller, Ray Bones is trying to evaluate the project's potential given its projected cash flows. As a first step, Ray developed the table of investment and revenue estimates below that he plans to use to determine the project's net present value. Market Fresh's CFO has indicated that, based on assumptions about risk during the course of the project, Ray should initially use 0.15 as a discount rate, but use 0.14 beginning in year 6. Assume all cash flows occur at the end of the specified year and calculate all values to three decimal places. if the problem has table data, copy the following lines and paste into the appropriate spot in the text section\footnotesize \baselineskip = 12pt\begin{tabular}{c | c}Investment & Revenue \\ \hline12.4 & 0 \\ 15.8 & 0 \\ 17.5…ND Inc. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. The CEO believes the IRR is the best selection criterion, while the CFO advocates other methods. If the decision is made by choosing the project with the higher IRR, how much, if any, value will be forgone, i.e., what's the Profitability index? Discuss your results of these methods and make a recommendation on the projects to the CEO about which one to go for and why?

- ND Inc. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. The CEO believes the IRR is the best selection criterion, while the CFO advocates other methods. If the decision is made by choosing the project with the higher IRR, how much, if any, value will be forgone, i.e., what's the NPV and IRR of the chosen project(s). What is the Payback period and discounted payback period?Yonan Inc. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. If the decision is made by choosing the project with the shorter payback, some value may be forgone. How much value will be lost in this instance? Note that under some conditions choosing projects on the basis of the shorter payback will not cause value to be lost. WACC: 10.25% 0 1 2 3 4 CFS -$800 $650 $350 $0 $0 CFL -$1,900 $550 $600 $600 $840 Please explain and show calculations.For projects with cash outflows up front and cash inflows later on, ignoring the time value of money would lead companies to understate the value of investment projects and therefore decline to make investments that they should in fact pursue. True False

- Dalrymple Inc. is considering production of a new product. In evaluating whether to go ahead with the project, which of the following items should be considered when cash flows are estimated? If the item should not be included, explain why not.A) Since the firm's director of capital budgeting spent some of her time last year to evaluate the new project, a portion of her salary for that year should be charged to the project's initial cost.B) The project will utilize some equipment the company currently owns but is not now using. A used equipment dealer has offered to buy the equipment.C) The company has spent for tax purposes $3 million on research related to the new product. These funds cannot be recovered, but the research may benefit other projects that might be proposed in the future.D) The new product will cut into sales of some of the firm's other products.E) The firm would borrow all the money used to finance the new project, and the interest on this debt would be $1.5 million…Your supervisor is on the company’s capital investment decision team that is to decide on alternatives for the acquisition of a new computer system for the company. The supervisor says, “The book value of the existing computer system for the firm that we are considering replacing is nothing but an accounting amount and as such is irrelevant in the capital expenditure analysis.” Does this reasoning make senseSexton Inc. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. If the decision is made by choosing the project with the higher IRR, how much value will be forgone? Note that under certain conditions choosing projects on the basis of the IRR will not cause any value to be lost because the one with the higher IRR will also have the higher NPV, so no value will be lost if the IRR method is used. WACC: 12.75% 0 1 2 3 4 CFs -$2050 $750 $760 $770 $780 CF L -$4300 $1500 $1518 $1536 $1554 Options: $24.80 $30.25 $22.32 $28.52 $22.57