specified three annual lease payments of $93,000 each, beginning December 31, 2024, and on each December 31 through 2026. The lessor, HVAC Leasing, calculates lease payments based on an annual interest rate of 8%. Winn also paid a $204,000 advance payment at the beginning of the lease. With permission of the owner, Winn made structural modifications to the building before occupying the space at a cost of $297,000. The useful life of the building and the structural modifications were estimated to be 30 years with no residual value. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: Prepare the appropriate entries for Winn Heat Transfer from the beginning of the lease through the end of 2026. Winn's fiscal year is the calendar year. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to the nearest whole dollar. View transaction list No 1 2 3 View journal entry worksheet Date January 01, 2024 Right-of-use asset Lease payable January 01, 2024 Lease payable Cash January 01, 2024 No Transaction Recorded General Journal Debit 443,670 204,000 Credit 443,670 204,000

specified three annual lease payments of $93,000 each, beginning December 31, 2024, and on each December 31 through 2026. The lessor, HVAC Leasing, calculates lease payments based on an annual interest rate of 8%. Winn also paid a $204,000 advance payment at the beginning of the lease. With permission of the owner, Winn made structural modifications to the building before occupying the space at a cost of $297,000. The useful life of the building and the structural modifications were estimated to be 30 years with no residual value. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: Prepare the appropriate entries for Winn Heat Transfer from the beginning of the lease through the end of 2026. Winn's fiscal year is the calendar year. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to the nearest whole dollar. View transaction list No 1 2 3 View journal entry worksheet Date January 01, 2024 Right-of-use asset Lease payable January 01, 2024 Lease payable Cash January 01, 2024 No Transaction Recorded General Journal Debit 443,670 204,000 Credit 443,670 204,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 1P: Determining Type of Lease and Subsequent Accounting On January 1, 2019, Ballieu Company leases...

Related questions

Question

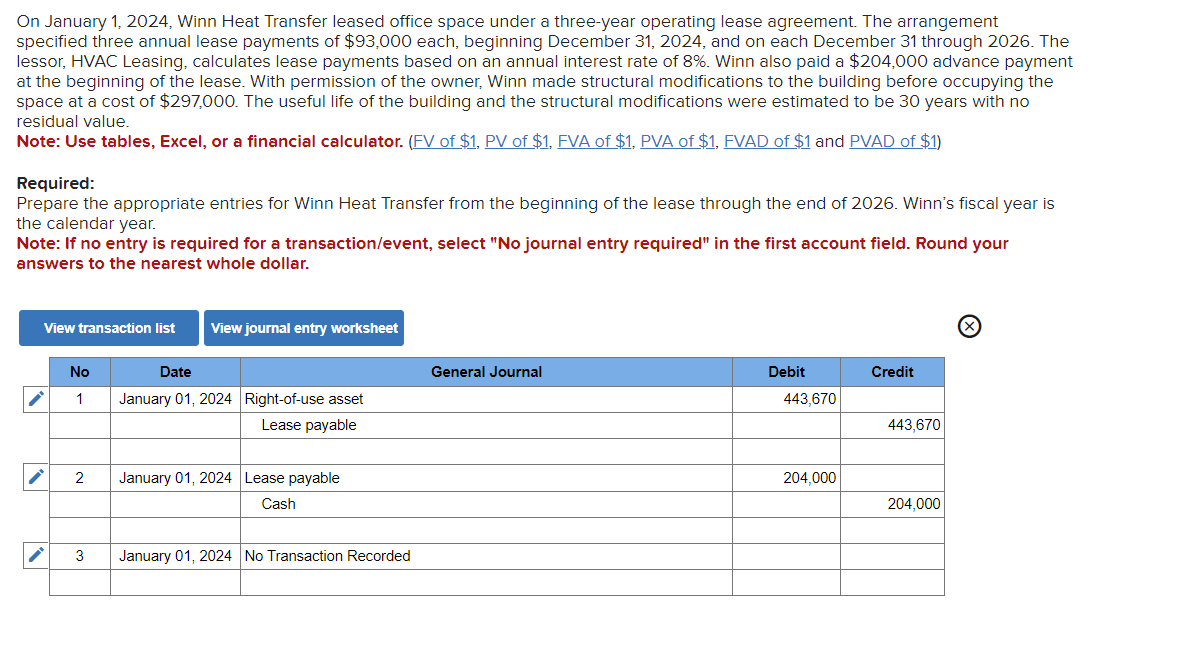

Transcribed Image Text:On January 1, 2024, Winn Heat Transfer leased office space under a three-year operating lease agreement. The arrangement

specified three annual lease payments of $93,000 each, beginning December 31, 2024, and on each December 31 through 2026. The

lessor, HVAC Leasing, calculates lease payments based on an annual interest rate of 8%. Winn also paid a $204,000 advance payment

at the beginning of the lease. With permission of the owner, Winn made structural modifications to the building before occupying the

space at a cost of $297,000. The useful life of the building and the structural modifications were estimated to be 30 years with no

residual value.

Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)

Required:

Prepare the appropriate entries for Winn Heat Transfer from the beginning of the lease through the end of 2026. Winn's fiscal year is

the calendar year.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your

answers to the nearest whole dollar.

View transaction list

No

1

2

3

View journal entry worksheet

Date

January 01, 2024 Right-of-use asset

Lease payable

January 01, 2024 Lease payable

Cash

January 01, 2024 No Transaction Recorded

General Journal

Debit

443,670

204,000

Credit

443,670

204,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning