Starr Company decides to establish a fund that it will use 4 years from now to replace an aging production facility. The company will make a $109,000 initial contribution to the fund and plans to make quarterly contributions of $52.000 beginning in three months. The fund earns 4%, compounded quarterly PV of $3 EV of SS PVA of SS, and EVA of 33 (Use appropriate factor(s) from the tables provided. Round your "Table Factor" to 4 decimal places and final answers to the nearest whole dollar) What will be the value of the fund 4 years from now? Present Value Future Value 1 109.000 S Intal Investment Periodic Investments 52.000 Future Value of Fund 1.1720 127,813

Starr Company decides to establish a fund that it will use 4 years from now to replace an aging production facility. The company will make a $109,000 initial contribution to the fund and plans to make quarterly contributions of $52.000 beginning in three months. The fund earns 4%, compounded quarterly PV of $3 EV of SS PVA of SS, and EVA of 33 (Use appropriate factor(s) from the tables provided. Round your "Table Factor" to 4 decimal places and final answers to the nearest whole dollar) What will be the value of the fund 4 years from now? Present Value Future Value 1 109.000 S Intal Investment Periodic Investments 52.000 Future Value of Fund 1.1720 127,813

Chapter5: The Time Value Of Money

Section: Chapter Questions

Problem 20P

Related questions

Question

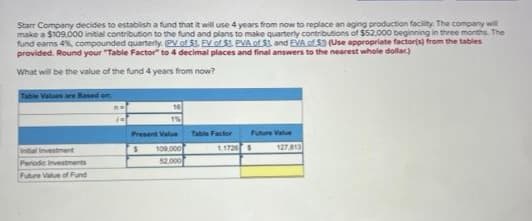

Transcribed Image Text:Starr Company decides to establish a fund that it will use 4 years from now to replace an aging production facility. The company will

make a $109,000 initial contribution to the fund and plans to make quarterly contributions of $52.000 beginning in three months. The

fund earns 4%, compounded quarterly (PV of $1 EV of $1. PVA of S1, and EVA of 5) (Use appropriate factor(s) from the tables

provided. Round your "Table Factor" to 4 decimal places and final answers to the nearest whole dollar)

What will be the value of the fund 4 years from now?

Table Values are Based on

1%

Present Value

Future Value

$

100.000

S

Initial investment

Periodic Investments

52.000

Future Value of Fund

Table Factor

1.1726

127,813

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning