Scratch Pad A shareholder has received the following summarised financial results for Scruff Co for the last year: Sm Ordinary shareholders funds 25 Non-current liabilities 6 Operating profit Finance charges 2 Taxation 1 The industry in which Scruff Co operates has the following average financial performance: Return on equity 14% 25% Return on capital employed Which TWO of the following statements are true? Scruff Co's return on capital employed is lower than the industry average Scruff Co's return on equity is higher than the industry average Scruff Co's return on capital employed is higher than the industry average Scruff Co's return on equity is lower than the industry average 7

Scratch Pad A shareholder has received the following summarised financial results for Scruff Co for the last year: Sm Ordinary shareholders funds 25 Non-current liabilities 6 Operating profit Finance charges 2 Taxation 1 The industry in which Scruff Co operates has the following average financial performance: Return on equity 14% 25% Return on capital employed Which TWO of the following statements are true? Scruff Co's return on capital employed is lower than the industry average Scruff Co's return on equity is higher than the industry average Scruff Co's return on capital employed is higher than the industry average Scruff Co's return on equity is lower than the industry average 7

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter15: Capital Investment Analysis

Section: Chapter Questions

Problem 15.3.3MBA

Related questions

Question

Transcribed Image Text:Strikethrough

Calculator

Scratch Pad

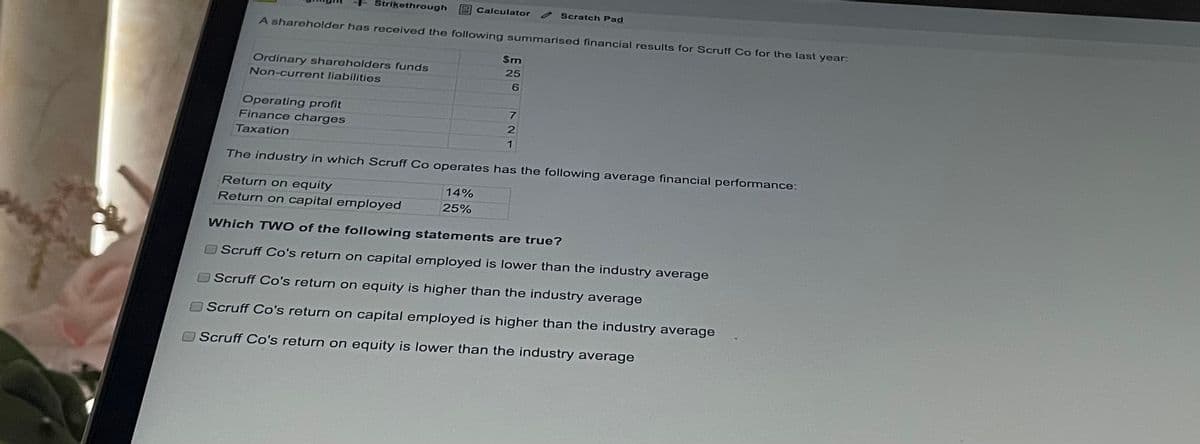

A shareholder has received the following summarised financial results for Scruff Co for the last year:

Sm

Ordinary shareholders funds

25

Non-current liabilities

6

Operating profit

Finance charges

2

Taxation

1

The industry in which Scruff Co operates has the following average financial performance:

Return on equity

14%

25%

Return on capital employed

Which TWO of the following statements are true?

Scruff Co's return on capital employed is lower than the industry average

Scruff Co's return on equity is higher than the industry average

Scruff Co's return on capital employed is higher than the industry average

Scruff Co's return on equity is lower than the industry average

7

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning