stations. Its beginning inventory of chairs was 220 units at $46 per unit. During the year, Cortez made two batch purchases of this chair. The first was a 310-unit purchase at $51 per unit; the second was a 355-unit purchase at $53 per unit. During the period, it sold 570 chairs. Required Determine the amount of product costs that would be allocated to cost of goods sold and ending inventory, assuming that Cortez uses FIFO. LIFO. Weighted average. (Do not round intermediate calculations. Round your final answers to nearest whole dollar amount.)

stations. Its beginning inventory of chairs was 220 units at $46 per unit. During the year, Cortez made two batch purchases of this chair. The first was a 310-unit purchase at $51 per unit; the second was a 355-unit purchase at $53 per unit. During the period, it sold 570 chairs. Required Determine the amount of product costs that would be allocated to cost of goods sold and ending inventory, assuming that Cortez uses FIFO. LIFO. Weighted average. (Do not round intermediate calculations. Round your final answers to nearest whole dollar amount.)

Chapter10: Inventory

Section: Chapter Questions

Problem 11PB: Calculate a) cost of goods sold, b) ending inventory, and c) gross margin for B76 Company,...

Related questions

Question

Cortez Company sells chairs that are used at computer stations. Its beginning inventory of chairs was 220 units at $46 per unit. During the year, Cortez made two batch purchases of this chair. The first was a 310-unit purchase at $51 per unit; the second was a 355-unit purchase at $53 per unit. During the period, it sold 570 chairs.

Required

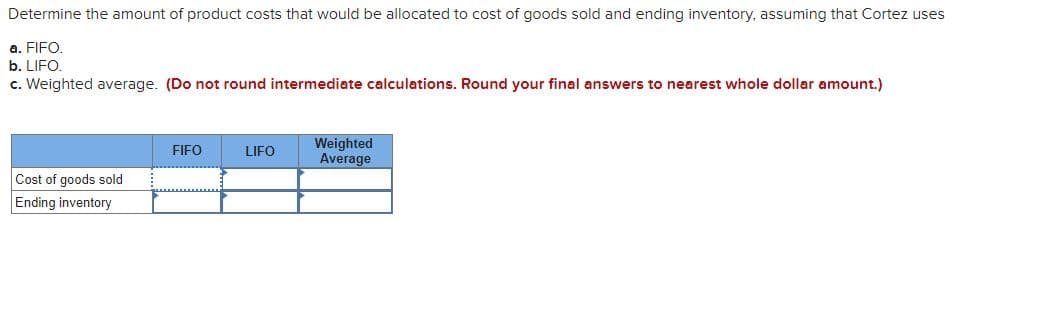

Determine the amount of product costs that would be allocated to cost of goods sold and ending inventory, assuming that Cortez uses

- FIFO.

- LIFO.

- Weighted average. (Do not round intermediate calculations. Round your final answers to nearest whole dollar amount.)

Transcribed Image Text:Determine the amount of product costs that would be allocated to cost of goods sold and ending inventory, assuming that Cortez uses

a. FIFO.

b. LIFO.

c. Weighted average. (Do not round intermediate calculations. Round your final answers to nearest whole dollar amount.)

Cost of goods sold

Ending inventory

FIFO

LIFO

Weighted

Average

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage