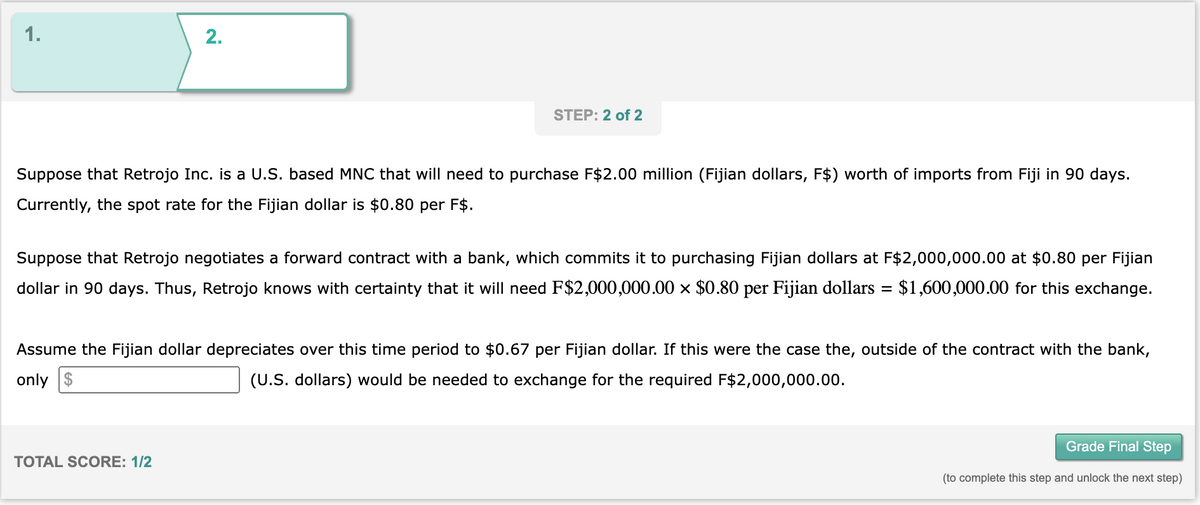

STEP: 2 of 2 Suppose that Retrojo Inc. is a U.S. based MNC that will need to purchase F$2.00 million (Fijian dollars, F$) worth of imports from Fiji in 90 days. Currently, the spot rate for the Fijian dollar is $0.80 per F$. Suppose that Retrojo negotiates a forward contract with a bank, which commits it to purchasing Fijian dollars at F$2,000,000.00 at $0.80 per Fijian dollar in 90 days. Thus, Retrojo knows with certainty that it will need F$2,000,000.00 × $0.80 per Fijian dollars = $1,600,000.00 for this exchange. Assume the Fijian dollar depreciates over this time period to $0.67 per Fijian dollar. If this were the case the, outside of the contract with the bank, only $ (U.S. dollars) would be needed to exchange for the required F$2,000,000.00.

Suppose that Retrojo Inc. is a U.S. based MNC that will need to purchase F$2.00 million (Fijian dollars, F$) worth of imports from Fiji in 90 days. Currently, the spot rate for the Fijian dollar is $0.80 per F$. Suppose that Retrojo negotiates a forward contract with a bank, which commits it to purchasing Fijian dollars at F $2,000,000.00 at $0.80 per Fijian dollar in 90 days. Thus, Retrojo knows with certainty that it will need F$2,000,000.00×$0.80 per Fijian dollars =$1,600,000.00 for this exchange. Assume the Fijian dollar

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images