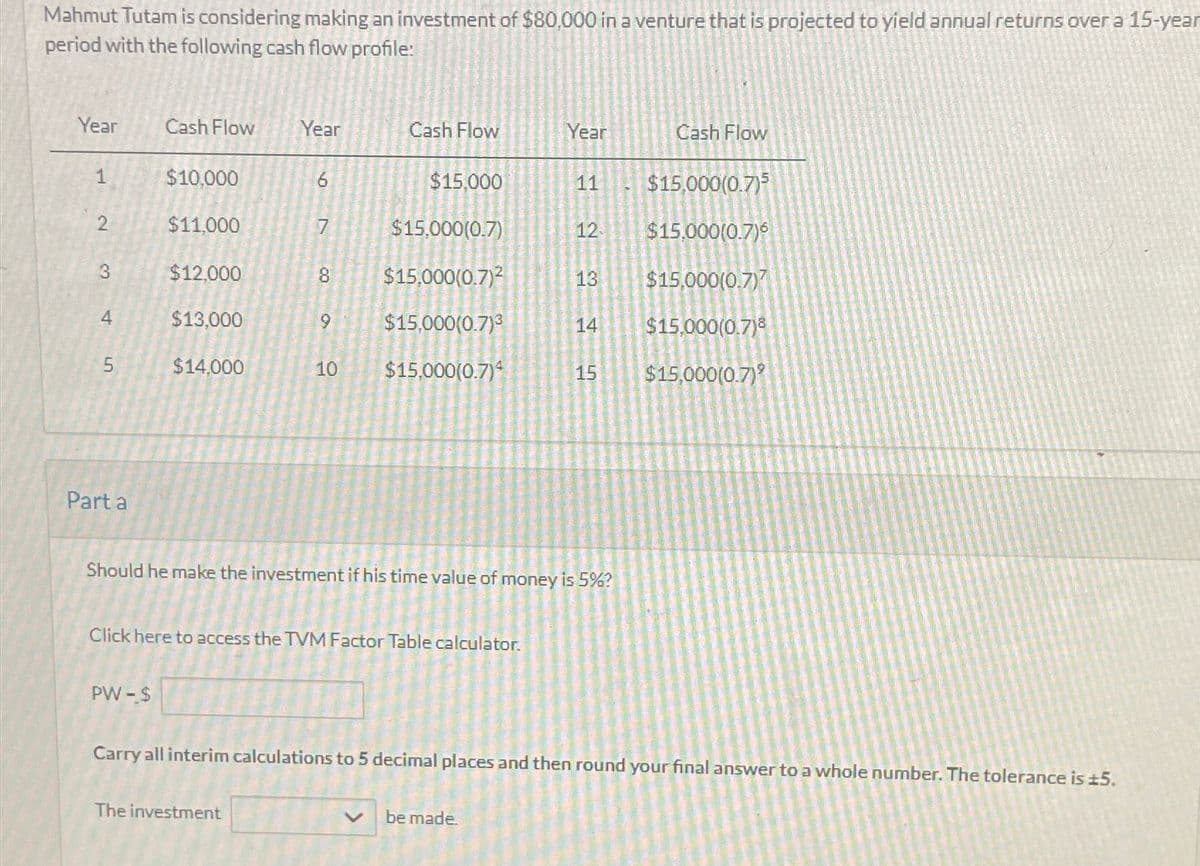

Mahmut Tutam is considering making an investment of $80,000 in a venture that is projected to yield annual returns over a 15-year period with the following cash flow profile: Year Cash Flow Year Cash Flow Year Cash Flow 1 $10,000 6 $15,000 11 $15,000(0.7)5 2 $11,000 7 $15,000(0.7) 12 12 $15,000(0.7)6 3 $12,000 8 $15,000(0.7)² 13 $15,000(0.7)7 4 $13,000 9 $15,000(0.7)³ 14 $15,000(0.7) 5 $14,000 10 10 $15,000(0.7) 15 $15,000(0.7) Part a Should he make the investment if his time value of money is 5%? Click here to access the TVM Factor Table calculator. PW-$ Carry all interim calculations to 5 decimal places and then round your final answer to a whole number. The tolerance is ±5. The investment be made.

Mahmut Tutam is considering making an investment of $80,000 in a venture that is projected to yield annual returns over a 15-year period with the following cash flow profile: Year Cash Flow Year Cash Flow Year Cash Flow 1 $10,000 6 $15,000 11 $15,000(0.7)5 2 $11,000 7 $15,000(0.7) 12 12 $15,000(0.7)6 3 $12,000 8 $15,000(0.7)² 13 $15,000(0.7)7 4 $13,000 9 $15,000(0.7)³ 14 $15,000(0.7) 5 $14,000 10 10 $15,000(0.7) 15 $15,000(0.7) Part a Should he make the investment if his time value of money is 5%? Click here to access the TVM Factor Table calculator. PW-$ Carry all interim calculations to 5 decimal places and then round your final answer to a whole number. The tolerance is ±5. The investment be made.

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 10PB: Bouvier Restaurant is considering an investment in a grill that costs $140,000, and will produce...

Related questions

Question

vvk.2

Transcribed Image Text:Mahmut Tutam is considering making an investment of $80,000 in a venture that is projected to yield annual returns over a 15-year

period with the following cash flow profile:

Year

Cash Flow

Year

Cash Flow

Year

Cash Flow

1

$10,000

6

$15,000

11

$15,000(0.7)5

2

$11,000

7

$15,000(0.7)

12

12

$15,000(0.7)6

3

$12,000

8

$15,000(0.7)²

13 $15,000(0.7)7

4

$13,000

9

$15,000(0.7)³

14 $15,000(0.7)

5

$14,000

10

10

$15,000(0.7)

15

$15,000(0.7)

Part a

Should he make the investment if his time value of money is 5%?

Click here to access the TVM Factor Table calculator.

PW-$

Carry all interim calculations to 5 decimal places and then round your final answer to a whole number. The tolerance is ±5.

The investment

be made.

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning