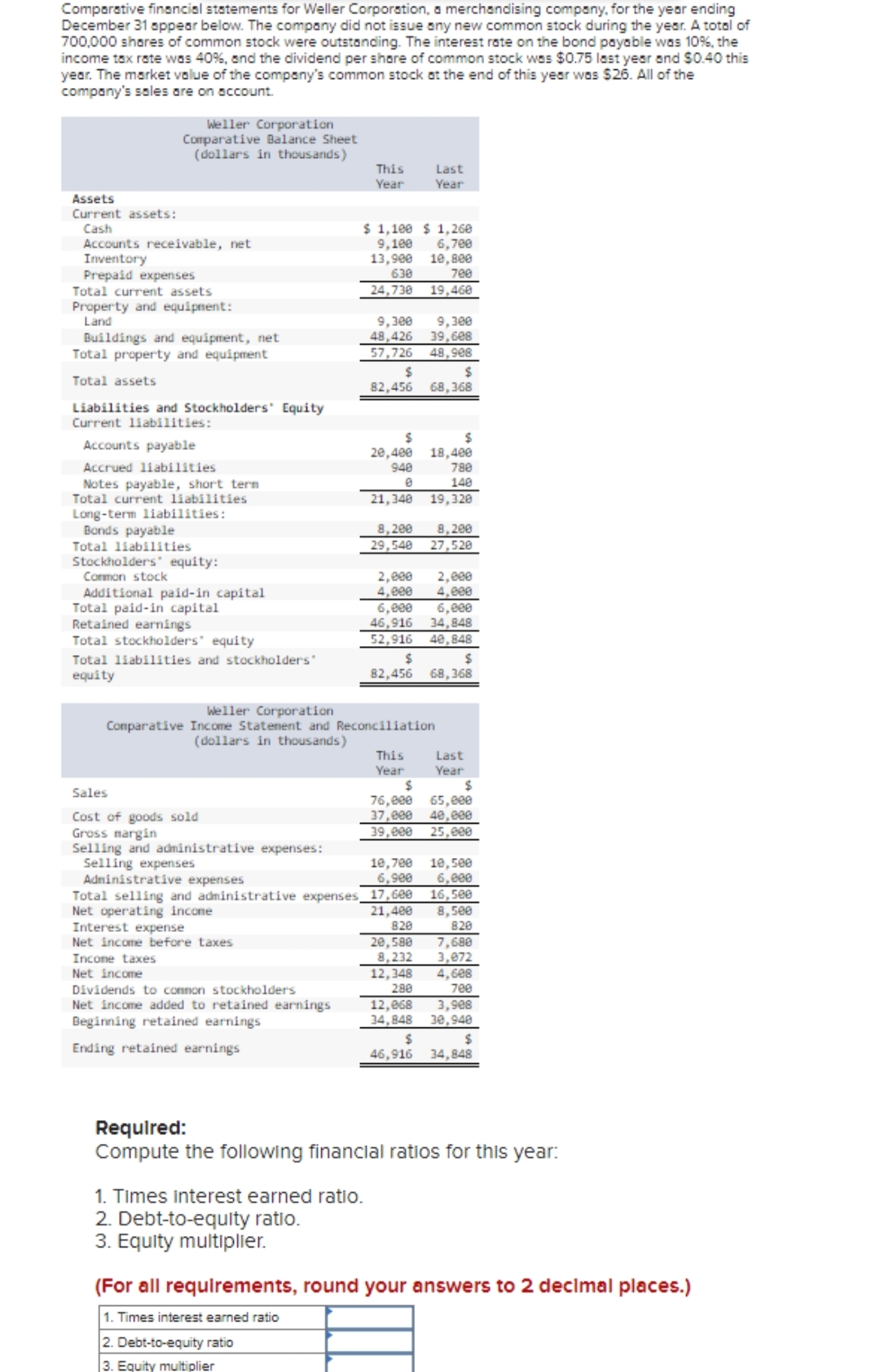

Comparative financial statements for Weller Corporation, a merchandising company, for the year ending December 31 appear below. The company did not issue any new common stock during the year. A total of 700,000 shares of common stock were outstanding. The interest rate on the bond payable was 10%, the income tax rate was 40%, and the dividend per share of common stock was $0.75 last year and $0.40 this year. The market value of the company's common stock at the end of this year was $26. All of the company's sales are on account. Assets Current assets: Cash Weller Corporation Comparative Balance Sheet (dollars in thousands) Accounts receivable, net Inventory Prepaid expenses Total current assets Property and equipment: Land Buildings and equipment, net Total property and equipment Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Accrued liabilities Notes payable, short term Total current liabilities Long-term liabilities: Bonds payable Total liabilities Stockholders equity: Common stock Additional paid-in capital Total paid-in capital Retained earnings Total stockholders' equity Total liabilities and stockholders" equity Sales Cost of goods sold Gross margin Selling and administrative expenses: Selling expenses This Year Interest expense Net income before taxes Income taxes Net income Dividends to common stockholders Net income added to retained earnings Beginning retained earnings Ending retained earnings $1,100 $1,260 9,100 6,700 13,900 10,800 630 700 24,730 19,460 9,300 9,300 48,426 39,608 57,726 48,908 $ 82,456 $ 20,400 948 0 21,340 2,000 4,000 8,200 8,200 29,548 27,520 Last Year Weller Corporation Comparative Income Statement and Reconciliation (dollars in thousands) This Year 6,000 6,000 46,916 34,848 52,916 40,848 Administrative expenses Total selling and administrative expenses 17,600 Net operating income 21,400 820 $ 68,368 $ $ 82,456 68,368 10,700 6,900 $ 18,400 788 140 19,320 12,068 34,848 2,000 4,000 $ $ 76,000 65,000 37,000 40,000 39,000 25,000 $ 46,916 Last Year 10,500 6,000 20,580 7,680 8,232 3,072 12,348 280 16,500 8,500 820 4,608 700 3,908 30,948 $ 34,848 Required: Compute the following financial ratios for this year: 1. Times interest earned ratio. 2. Debt-to-equity ratio. 3. Equity multiplier. (For all requirements, round your answers to 2 decimal places.)

Comparative financial statements for Weller Corporation, a merchandising company, for the year ending December 31 appear below. The company did not issue any new common stock during the year. A total of 700,000 shares of common stock were outstanding. The interest rate on the bond payable was 10%, the income tax rate was 40%, and the dividend per share of common stock was $0.75 last year and $0.40 this year. The market value of the company's common stock at the end of this year was $26. All of the company's sales are on account. Assets Current assets: Cash Weller Corporation Comparative Balance Sheet (dollars in thousands) Accounts receivable, net Inventory Prepaid expenses Total current assets Property and equipment: Land Buildings and equipment, net Total property and equipment Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Accrued liabilities Notes payable, short term Total current liabilities Long-term liabilities: Bonds payable Total liabilities Stockholders equity: Common stock Additional paid-in capital Total paid-in capital Retained earnings Total stockholders' equity Total liabilities and stockholders" equity Sales Cost of goods sold Gross margin Selling and administrative expenses: Selling expenses This Year Interest expense Net income before taxes Income taxes Net income Dividends to common stockholders Net income added to retained earnings Beginning retained earnings Ending retained earnings $1,100 $1,260 9,100 6,700 13,900 10,800 630 700 24,730 19,460 9,300 9,300 48,426 39,608 57,726 48,908 $ 82,456 $ 20,400 948 0 21,340 2,000 4,000 8,200 8,200 29,548 27,520 Last Year Weller Corporation Comparative Income Statement and Reconciliation (dollars in thousands) This Year 6,000 6,000 46,916 34,848 52,916 40,848 Administrative expenses Total selling and administrative expenses 17,600 Net operating income 21,400 820 $ 68,368 $ $ 82,456 68,368 10,700 6,900 $ 18,400 788 140 19,320 12,068 34,848 2,000 4,000 $ $ 76,000 65,000 37,000 40,000 39,000 25,000 $ 46,916 Last Year 10,500 6,000 20,580 7,680 8,232 3,072 12,348 280 16,500 8,500 820 4,608 700 3,908 30,948 $ 34,848 Required: Compute the following financial ratios for this year: 1. Times interest earned ratio. 2. Debt-to-equity ratio. 3. Equity multiplier. (For all requirements, round your answers to 2 decimal places.)

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter17: Financial Statement Analysis

Section: Chapter Questions

Problem 20E: Five measures of solvency or profitability The balance sheet for Garcon Inc. at the end of the...

Related questions

Question

Transcribed Image Text:Comparative financial statements for Weller Corporation, a merchandising company, for the year ending

December 31 appear below. The company did not issue any new common stock during the year. A total of

700,000 shares of common stock were outstanding. The interest rate on the bond payable was 10%, the

income tax rate was 40%, and the dividend per share of common stock was $0.75 last year and $0.40 this

year. The market value of the company's common stock at the end of this year was $26. All of the

company's sales are on account.

Assets

Current assets:

Cash

Weller Corporation

Comparative Balance Sheet

(dollars in thousands)

Accounts receivable, net

Inventory

Prepaid expenses

Total current assets.

Property and equipment:

Land

Buildings and equipment, net

Total property and equipment

Total assets

Liabilities and Stockholders' Equity

Current liabilities:

Accounts payable

Accrued liabilities

Notes payable, short term

Total current liabilities

Long-term liabilities:

Bonds payable

Total liabilities

Stockholders equity:

Common stock

Additional paid-in capital

Total paid-in capital

Retained earnings

Total stockholders' equity

Total liabilities and stockholders'

equity

Sales

Cost of goods sold

Gross margin

Selling and administrative expenses:

Selling expenses

Interest expense

Net income before taxes

Income taxes

Net income

This

Year

Dividends to common stockholders

Net income added to retained earnings

Beginning retained earnings

Ending retained earnings

$1,100 $1,260

6,700

10,800

700

19,460

9,100

13,900

630

24,730

1. Times interest earned ratio.

2. Debt-to-equity ratio.

3. Equity multiplier.

9,300

9,300

48,426 39,608

57,726

48,908

$

82,456

$

20,400

948

0

21,340

8,200

29,540

2,000

4,000

6,000

46,916

52,916

$

82,456

Weller Corporation

Comparative Income Statement and Reconciliation

(dollars in thousands)

Administrative expenses

Total selling and administrative expenses 17,600

Net operating income

21,400

820

20,580

8,232

This

Year

10,700

6,900

Last

Year

$

68,368

12,068

34,848

$

18,400

780

140

19,320

$

46,916

8,200

27,520

2,000

4,000

6,000

34,848

40,848

$

$

65,000

76,000

37,000 40,000

39,000

25,000

$

68,368

Last

Year

10,500

6,000

7,680

3,072

12,348 4,608

280

700

16,500

8,500

820

3,908

30,940

$

34,848

Required:

Compute the following financial ratios for this year:

(For all requirements, round your answers to 2 decimal places.)

1. Times interest earned ratio

2. Debt-to-equity ratio

3. Equity multiplier

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning