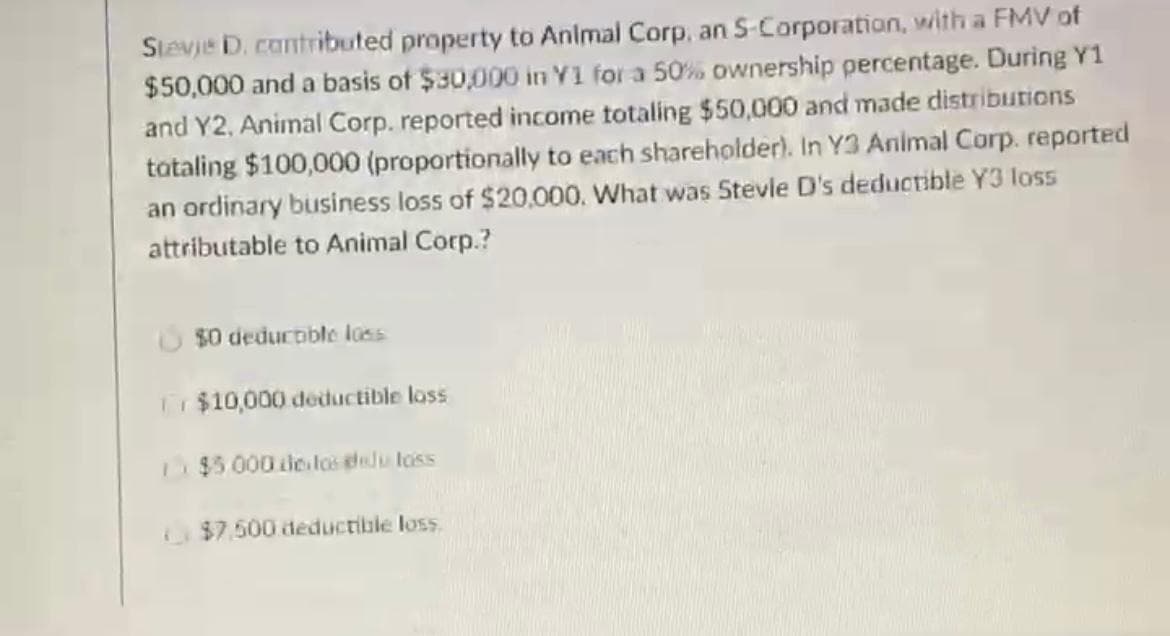

Stevje D. contributed property to Anlmal Corp, an S-Corporation, with a FMV of $50,000 and a basis of $30,000 in Y1 for a 50% ownership percentage. During Y1 and Y2, Animal Corp. reported income totaling $50,000 and made distributions tataling $100,000 (proportionally to each shareholder). In Y3 Animal Corp. reportea an ordinary business loss of $20,000. What was Stevle D's deductible Y3 loss attributable to Animal Corp.? $0 deducoble loss Tr$10,000 deductible loss D$5.000 de.los elu loss $7.500 deductible loss

Stevje D. contributed property to Anlmal Corp, an S-Corporation, with a FMV of $50,000 and a basis of $30,000 in Y1 for a 50% ownership percentage. During Y1 and Y2, Animal Corp. reported income totaling $50,000 and made distributions tataling $100,000 (proportionally to each shareholder). In Y3 Animal Corp. reportea an ordinary business loss of $20,000. What was Stevle D's deductible Y3 loss attributable to Animal Corp.? $0 deducoble loss Tr$10,000 deductible loss D$5.000 de.los elu loss $7.500 deductible loss

Chapter11: The Corporate Income Tax

Section: Chapter Questions

Problem 6MCQ

Related questions

Question

Transcribed Image Text:Stevje D. cantributed property to Anlmal Corp, an S-Corporation, with a FMV of

$50,000 and a basis of $30,000 in Y1 for a 50% ownership percentage. During Y1

and Y2, Animal Corp. reported income totaling $50,000 and made distributions

tataling $100,000 (proportionally to each shareholder). In Y3 Animal Corp. reported

an ordinary business loss of $20,000. What was Stevle D's deductible Y3 loss

attributable to Animal Corp.?

$0 deducoible loss

Tr $10,000 deductible loss

$5.000de los elu loss

$7.500 deductible loss

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you