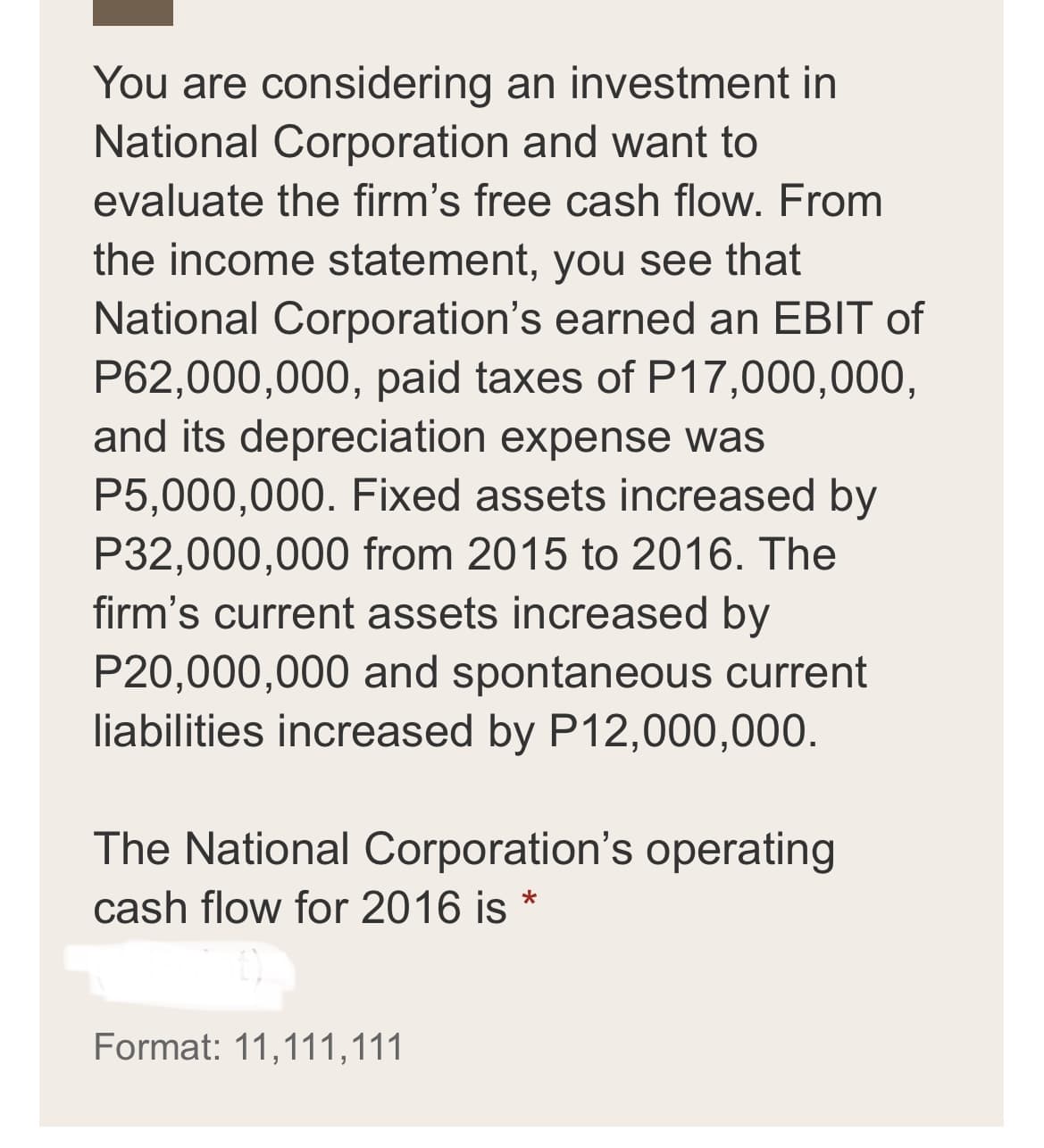

You are considering an investment in National Corporation and want to evaluate the firm's free cash flow. From the income statement, you see that National Corporation's earned an EBIT of P62,000,000, paid taxes of P17,000,000, and its depreciation expense was P5,000,000. Fixed assets increased by P32,000,000 from 2015 to 2016. The firm's current assets increased by P20,000,000 and spontaneous current liabilities increased by P12,000,000. The National Corporation's operating cash flow for 2016 is * Format: 11.111.111

Q: Gia Company had the following bond issue: Date of issue/sale: April 1, 20-A Face value: $200,000…

A: Bonds are a form of liability being incurred by the business. It can be short term or long term,…

Q: The prescribed accounting treatment for stock dividends implicitly assumes that shareholders are…

A: Hi student Since there are multiple questions, we will answer only first question.

Q: Current Attempt in Progress The underlying principle that absorption costing satisfies is the O…

A: Absorption Costing is a management accounting method for accumulating all costs associated with…

Q: USA Trading Corporation and you need to record the following transactions in the General Journal &…

A: Separate entries are passed for sales and cost of sales

Q: The following balance sheet is for X Company: Balance Sheet January 1, 2021 Assets Equities Cash…

A: Solution: Total assets = Total equities We will compute total assets on dec 31, 2021, same will be…

Q: Unconditional transfers of cash or other resources to an entity in a voluntary, nonreciprocal…

A: The correct answer for the above mentioned question is given in the following steps for your…

Q: not-for-profit hospital performs services in the current year at a charge of $1 million. Of this…

A: For not for profit hospital, Net patient service revenue = service charges - charity care services -…

Q: Chart of Accounts Assets Owner's Equity 301 J. David, Capital 302 J. David, Drawing 303 Income and…

A: Journal Entries - Journal Entries are the recording of transactions of the organization. It is…

Q: rdinary shares with P50 par value for a combined cash amount of P11,000,000. The market value of the…

A: Shareholders also invest money in the company and in return they become the owners in proportion to…

Q: Marter Co. filed a bankruptcy petition and liquidated its noncash assets. Marter was paying forty…

A: Mortgage is a form of loan where an asset is produced as a collateral in order to receive the funds…

Q: On January 1, Year 1, the Dole Company purchased an asset that cost $154,000. The asset had an…

A: Income statement (IS) refers to the financial statement which is prepared by companies in…

Q: Africa Traders is a registered VAT vendor and uses the periodic inventory system. Africa Traders…

A: The standard VAT rate of Africa is 15% for trade. Therefore, the value of VAT output to be disclosed…

Q: Rush issued callable bonds on January 1. 2021. Rush's accountant has projected the following…

A: Calculation of annual Stated interest rate on the bonds ::: Carrying Amount at the end…

Q: maximum number of hour operation for the last quarter is 350,000 hours. Determine the best…

A: Profits = selling price - manufacturing cost. Once we determine the profit levels for each product…

Q: Jennifer Company sells many products. Gizmo is one of its popular items. Below is an analysis of the…

A: Inventory valuation is based on the flow of exemption used by the company. There are many methods…

Q: and B formed a partnership on January 1, 2022. A contributed cash of P480,000 and B contributed land…

A: Solution: When any asset is contributed by any partner in partnership, then it is recorded at fair…

Q: Assume the cost of a company’s long-term asset is $20,000, expected salvage value is $1,000, and…

A: The depreciation expense is charged on fixed assets as reduced value of the fixed asset with usage…

Q: Boston Exemcutive, Inc., produces executive limousines and currently manufactures the mini-bar inset…

A: Variable cost is the cost that changes with the change in the output level. Variable cost remains…

Q: In 2022, ABC Company sold inventory costing P150,000 to its 80%-owned subsidiary for P210,000. A…

A: Consolidated Financial statements present assets, liabilities, equities , income , expenses etc of…

Q: On a statement of financial affairs, a company's liabilities should be valued at Select one: a.the…

A: Solution: Liabilities are present obligation of company as a result of past event that requires…

Q: Please prepare a bank reconciliation and journal entries for the month ended April 30th for Bannon…

A: A Journal entry is a primary entry that records the financial transactions initially. The…

Q: 56. The following information is available for Mary Corp. Activity Pool Setups Quality Inspections…

A: The activity rate is calculated as total budgeted cost of particular activity divided by estimated…

Q: A building is acquired on January 1 at a cost of $1,020,000 with an estimated useful life of ten…

A: DDB rate = 2 / 10 years = 20%

Q: onca Co. is looking for financing to expand its laboratory and buys a patent for a new technology…

A: Amount of note payable that should be recorded is = issue of note - down payment

Q: Why would an investigator interview the prime suspect last in the interview proces

A: Fraud investigation is an important area in accounting especially after big fraud scandals like that…

Q: (The following information applies to the questions displayed below.] Lewis and Laurie are married…

A: Lewis and Laurie are married and jointly own home valued = at $265000 Recently paid off the mortgage…

Q: ABC Company produces two products, Nifty and So-So, and uses a costing system in which all overhead…

A: Activity based costing means where the product is valued on the basis of actual direct material ,…

Q: Depreciation is based on the fair value of assets. An impairment loss occurs if the carrying value…

A: GIVEN Depreciation is based on the fair value of assets. An impairment loss occurs if…

Q: Explain why depreciation and interest should not be included as costs in a discounted cash flow…

A: The company makes several investments and an evaluation of investment is necessary. Therefore, the…

Q: ABC Company uses a job-order costing system and a predetermined overhead rate based on machine…

A: Any over or under applied overhead if insignificant is closed to cost of goods sold account. If the…

Q: 3. Discuss the objects of the cut off on the sales and collection cycle.

A: The cash collection cycle is the amount of days it measures the return accounts receivable. The…

Q: 4. Which ONE of the following is NOT an advantage of judicial precedent? A Creates consistency В Can…

A: Option B: Can be hard to understand and apply. As judicial precedent are very complex which is a…

Q: Maria, Leonora and Teresa are partners with adjusted capital balances of P165,000, P150,000 and…

A: The bonus method is used to grant a new partner additional capital in a partnership when the person…

Q: Partners Prada, Paris and Paco have capital balances of P 90,000, P 70,000 and P 40,000 respectively…

A: Solution: When a partner's retire from partnership, partnership business in reconstituted. When Paco…

Q: On April 01, 2022, Chito and Ernie pooled their resources to form a partnership, with the firm…

A: Sometimes, the partners revise their total capital requirements of the partnership firm and for that…

Q: On February 20, 2022, ABC Construction Company entered into a fixed-price contract to construct a…

A: The question is based on the concept of Construction Contracts. Under these contracts revenue is…

Q: Given the information in Exhibit 11.2, calculate the bank's dity sources to liquidity needs. Is…

A: Liquidity sources refer to the mediums of generating money or liquid cash such as cash or cash…

Q: What amount will be recorded in the trade receivables column of the cash receipts journal of Africa…

A: The cash receipts journal records all the transactions related to the receipt of cash irrespective…

Q: Using Excel to Determine Overhead Variances Student Work Area PROBLEM Required: Provide input into…

A: The variance analysis provides a better picture of the cost control of the business operations. It…

Q: How much is the share of B in the gain on sale of the land in the partnership’s financial…

A: Partnership refers to a group of individuals (either persons or corporations) who comes together…

Q: Bizarre Company acquired 6,000 shares with P1 par value at P36 per share. During 2012, the entity…

A: When cost method is used to measure treasury shares. Then treasury shares are to be measured…

Q: On January 1, 2020, Kevin Cosme acquired a P2,000,000, 10% bond for P2,159,708. The ongoing interest…

A:

Q: Question Content Area Based on the following data for the current year, what is the inventory…

A: The inventory turnover ratio can be calculated by dividing the cost of goods sold by the average…

Q: Based on the following data, what is the quick ratio, rounded to one decimal point? Accounts…

A: Quick ratio is defined as the companies ability to meet its short term obligations which is most…

Q: COmBany Mahufactures and sells soccer balls for teams of children in elementary and high school.…

A: Direct Materials Purchase Budget is the pre estimation of the total direct materials to be purchased…

Q: How shall an acquirer in a business combination account for the changes in fair value contingent…

A: The acquirer shall account for changes in the fair value of contingent consideration that are not…

Q: popular compact disc (CD) label at a price of eith 5/3/2021 2:31 PM

A: Payoff Matrix is used in the game theory, where the strategies of a player is listed in a row and…

Q: Problem 2- Prepare a vertical analysis schedule Here is the operating data for Yalis Cleaning, Inc.:…

A: Introduction Vertical analysis is used to evaluate individual financial statement items, it shows…

Q: orrection to m

A: The taxable total income of the individual taxpayer includes the income earned by the respective…

Q: On January 2, 2021, the Statement of Financial Position of Parent and Subsidiary Company prior to…

A: Consolidated Shareholder's Equity- Consolidated Shareholders’ Equity means the sum of Assets of the…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- The Moore Corporation has operating income (EBIT) of 750,000. The companys depreciation expense is 200,000. Moore is 100% equity financed, and it faces a 40% tax rate. What is the companys net income? What is its net cash flow?You have been asked to value Brilliant Enterprises, a publicly traded IT services firm, and have collected the following information: After-tax operating income last year = $100 million Net income last year = $82.5 million Book value of equity at start of this year = $750 million Book value of debt at start of this year = $250 million Capital expenditure last year = $80 million Depreciation last year = $30 million Increase in non-cash working capital last year = $10 million a) Assuming that Brilliant Enterprises will maintain its return on capital and reinvestment rate from last year for the next 3 years, estimate the free cash flow for the company for each of the next 3 years. b) After year 3, Brilliant expects its growth rate to decline to 3% and the return on capital to be 9% in perpetuity. Assuming that its cost of capital is 8%, estimate the terminal value at the end of the third year. c) Assuming that Brilliant has a cost of capital of 10% for the next 3…You are considering an investment in Fields and Struthers, Inc., and want to evaluate the firm's free cash flow. From the income statement, you see that Fields and Struthers earned an EBIT of $70 million, had a tax rate of 21 percent, and its depreciation expense was $7 million. Fields and Struthers's NOPAT gross fixed assets increased by $36 million from 2020 and 2021. The firm's current assets increased by $32 million and spontaneous current liabilities increased by $18 million. Calculate Fields and Struthers's NOPAT operating cash flow for 2021. Calculate Fields and Struthers's NOPAT investment in operating capital for 2021. Calculate Fields and Struthers's NOPAT free cash flow for 2021.

- You are considering an investment in Fields and Struthers, Inc., and want to evaluate the firm’s free cash flow. From the income statement, you see that Fields and Struthers earned an EBIT of $84 million, had a tax rate of 21 percent, and its depreciation expense was $10 million. Fields and Struthers's NOPAT gross fixed assets increased by $50 million from 2020 and 2021. The firm’s current assets increased by $38 million and spontaneous current liabilities increased by $25 million. Calculate Fields and Struthers’s NOPAT operating cash flow for 2021. (Enter your answer in millions of dollars rounded to 2 decimal places.) Calculate Fields and Struthers’s NOPAT investment in operating capital for 2021. (Enter your answer in millions of dollars.) Calculate Fields and Struthers’s NOPAT free cash flow for 2021. (Enter your answer in millions of dollars rounded to 2 decimal places.)The Hastings Sugar Corporation has the following pattern of net income each year, and associated capital expenditure projects. The firm can earn a higher return on the projects than the stockholders could earn if the funds were paid out in the form of dividends. Year Net Income Profitable CapitalExpenditure 1 $ 11 million $ 8 million 2 24 million 11 million 3 9 million 7 million 4 19 million 7 million 5 23 million 8 million The Hastings Corporation has 2 million shares outstanding. (The following questions are separate from each other). If the marginal principle of retained earnings is applied, how much in total cash dividends will be paid over the five years? (Enter your answer in millions.) If the firm simply uses a payout ratio of 40 percent of net income, how much in total cash dividends will be paid? (Enter your answer in millions and round your answer to 1…You are analysing NBM firm and obtained the following information: FCFF reported as R198 million, interest expense is R15 million. If the tax rate is 35% and the net debt of the firm increased by R20 million, what is the approximate market value of the firm if the FCFE grows at 3% and the cost of equity is 14%? R1,950 billion R2,497 billion R2,585 billion R3,098 billion R 1,893 billion

- The Hastings Sugar Corporation has the following pattern of net income each year, and associated capital expenditure projects. The firm can earn a higher return on the projects than the stockholders could earn if the funds were paid out in the form of dividends. Year Net Income Profitable CapitalExpenditure 1 $ 13 million $ 7 million 2 24 million 11 million 3 17 million 6 million 4 18 million 8 million 5 22 million 8 million The Hastings Corporation has 2 million shares outstanding. (The following questions are separate from each other). a. If the marginal principle of retained earnings is applied, how much in total cash dividends will be paid over the five years? (Enter your answer in millions.) b. If the firm simply uses a payout ratio of 50 percent of net income, how much in total cash dividends will be paid? (Enter your answer in millions and round your answer to 1 decimal place.) c. If the firm pays a 10 percent stock…You are working for an imports-exports company. In the current financial year, your company has a net income of $851,000 and plans to use a part of it as retained earnings for a new project which will cost $500,000 next year. The company's stock is currently listed and actively traded on ASX. Required: a) Calculate the amount of net income available for the company to pay dividends to current shareholders if it maintains a capital structure of 46% in debt funding and 54% in equity funding, assuming residual dividend theory applies. b) Your company is going to pay an annual dividend of $5 per share and extra dividend of $2 per share in 4 weeks. The standard process of settlement in ASX is T+2. If tomorrow is the ex-dividend date, when is the record date for dividend payment? calculate the ex-dividend price if today's market price is $43.5, given the dividend tax rate is 13%. c) Your company needs to make a payment of AUD 245,000 to a partner in Tokyo. If the direct…Puddycat Ltd. had the following activity during 2021: Proceeds from the sale of non-current investments: $156,000 Gain on the sale of non-current investments: $16,000 Proceeds from the sale of preferred shares: $182,000 Repayment of long-term debt: $30,000 Increase in income taxes payable: $25,000 What is the cash flow provided by (used in) financing activities? Question 13 options: $212,000 $177,000 $152,000 $140,000

- National Co. make these assumptions for valuation purposes:a. The firm consists of a single asset that will generate pretax net cash flows of P3,000,000 per year forever.b. The income tax rate is 25%.c. After making paying taxes, the firm pays dividends to distribute any remaining cash flows to the equity shareholders each year.d. Equity shareholders have financed the asset entirely with P100,000,000 of equity capital.e. The cost of equity capital is 12%.Compute for the value of the firm to the shareholders using dividend discount model?Assume that XYZ, Inc. is a single asset firm that is expected to generate $5 million in net cash flows per year indefinitely. The firm's tax rate is 35%. After satisfying all mandatory obligations, all remaining FCF is distributed to common stockholders in the form of cash dividends. The appropriate cost of equity capital, to ABC, is 14%. The firm's target capital structure includes a mix of debt and common equity and interest paid on debt amounts of $500,000 and this amount is tax deductable. What is the present value of the common equity to the shareholders of XYX corporation? $20,892,857 $2,925,000 $3,925,000 $4,925,000A firm's net income is $36 million, depreciation is $3 million, its investments in fixed capital totals $13 million, its AFTER-TAX interest totals $4 million and its investment in working capital totals $5 million. The tax rate is 40%. What is its Free Cash Flow to the Firm? a.$27.00 million b. $25.00 million c. $23.40 million d. $25.40 million Give typing answer with explanation and conclusion