Stewart Recording Studio, owned by Ron Stewart, showed the following bank reconciliation at March 31: Stewart Recording Studio Bank Reconciliation March 31, 2020 Bank statement balance $ 22,200 Book balance $ 31,085 Add: Deposit of March 31 in transit 10,045 $ 32,245 Deduct: Outstanding cheques: #14 $ 843 #22 317 1,160 Adjusted bank balance $ 31,085 Adjusted book balance $ 31,085 Cash Acct. No. 101 Date Explanation PR Debit Credit Balance 2020 March 31 Balance 31,085 April 30 CR17 71,762 102,847 30 CD13 92,000 10,847 A list of deposits made and cheques written during April, taken from the Cash Receipts Journal and Cash Disbursements Journal, is shown below: Deposits Made April 7 $ 693 13 4,620 18 5,926 23 13,961 27 1,758 30 44,804 Total April Cash Receipts $ 71,762 Cheques Written No. 23 $ 5,223 24 3,164 25 944 26 313 27 4,271 28 4,900 29 19,818 30 41,440 31 416 32 11,511 Total April Cash Disbursements $ 92,000 The following bank statement is available for April: Bank Statement To: Stewart Recording Studio April 30, 2020 Bank of Canada Cheques/Charges Deposits/Credits Balance 22,200 #31 04/03 416 04/03 10,045 31,829 #28 04/07 9,400 04/07 693 23,122 #26 04/13 313 04/13 4,620 27,429 NSF 04/18 14,337 04/18 5,926 19,018 #24 04/23 3,164 04/23 13,961 29,815 #23 04/27 5,223 04/27 1,758 26,350 #29 04/30 19,818 04/30 121,000 127,532 PMT 04/30 16,052 111,480 INT 04/30 498 110,982 SC 04/30 177 110,805 NSF = Not Sufficient Funds SC = Service Charge PMT = Payment of Principal on the loan INT = Interest on Bank Loan In reviewing cheques returned by the bank, the bookkeeper discovered that cheque #28, for delivery expense, was recorded in the Cash Disbursements Journal correctly as $4,900. The NSF cheque for $14,337 was that of customer Oprah Winney, deposited in March. On the bank statement, the payment for $16,052 is regarding a note payable. There is also a deposit of $121,000 dated April 30. It is an investment made by the owner into the business (the bank transferred the funds electronically from the owner’s personal account to his business account, which is why it was not recorded in the Cash Receipts Journal). 1. Record to reinstate customer account (April 30) 2. Record the April Bank service charges (April 30) 3. Record the April Interest expense (April 30) Image attached for reference

Stewart Recording Studio, owned by Ron Stewart, showed the following bank reconciliation at March 31: Stewart Recording Studio Bank Reconciliation March 31, 2020 Bank statement balance $ 22,200 Book balance $ 31,085 Add: Deposit of March 31 in transit 10,045 $ 32,245 Deduct: Outstanding cheques: #14 $ 843 #22 317 1,160 Adjusted bank balance $ 31,085 Adjusted book balance $ 31,085 Cash Acct. No. 101 Date Explanation PR Debit Credit Balance 2020 March 31 Balance 31,085 April 30 CR17 71,762 102,847 30 CD13 92,000 10,847 A list of deposits made and cheques written during April, taken from the Cash Receipts Journal and Cash Disbursements Journal, is shown below: Deposits Made April 7 $ 693 13 4,620 18 5,926 23 13,961 27 1,758 30 44,804 Total April Cash Receipts $ 71,762 Cheques Written No. 23 $ 5,223 24 3,164 25 944 26 313 27 4,271 28 4,900 29 19,818 30 41,440 31 416 32 11,511 Total April Cash Disbursements $ 92,000 The following bank statement is available for April: Bank Statement To: Stewart Recording Studio April 30, 2020 Bank of Canada Cheques/Charges Deposits/Credits Balance 22,200 #31 04/03 416 04/03 10,045 31,829 #28 04/07 9,400 04/07 693 23,122 #26 04/13 313 04/13 4,620 27,429 NSF 04/18 14,337 04/18 5,926 19,018 #24 04/23 3,164 04/23 13,961 29,815 #23 04/27 5,223 04/27 1,758 26,350 #29 04/30 19,818 04/30 121,000 127,532 PMT 04/30 16,052 111,480 INT 04/30 498 110,982 SC 04/30 177 110,805 NSF = Not Sufficient Funds SC = Service Charge PMT = Payment of Principal on the loan INT = Interest on Bank Loan In reviewing cheques returned by the bank, the bookkeeper discovered that cheque #28, for delivery expense, was recorded in the Cash Disbursements Journal correctly as $4,900. The NSF cheque for $14,337 was that of customer Oprah Winney, deposited in March. On the bank statement, the payment for $16,052 is regarding a note payable. There is also a deposit of $121,000 dated April 30. It is an investment made by the owner into the business (the bank transferred the funds electronically from the owner’s personal account to his business account, which is why it was not recorded in the Cash Receipts Journal). 1. Record to reinstate customer account (April 30) 2. Record the April Bank service charges (April 30) 3. Record the April Interest expense (April 30) Image attached for reference

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Stewart Recording Studio, owned by Ron Stewart, showed the following bank reconciliation at March 31:

| Stewart Recording Studio | |||||||||

| Bank Reconciliation | |||||||||

| March 31, 2020 | |||||||||

| Bank statement balance | $ | 22,200 | Book balance | $ | 31,085 | ||||

| Add: | |||||||||

| Deposit of March 31 in transit | 10,045 | ||||||||

| $ | 32,245 | ||||||||

| Deduct: | |||||||||

| Outstanding cheques: | |||||||||

| #14 | $ | 843 | |||||||

| #22 | 317 | 1,160 | |||||||

| Adjusted bank balance | $ | 31,085 | Adjusted book balance | $ | 31,085 | ||||

| Cash | Acct. No. 101 | ||||||||

| Date | Explanation | PR | Debit | Credit | Balance | ||||

| 2020 | |||||||||

| March | 31 | Balance | 31,085 | ||||||

| April | 30 | CR17 | 71,762 | 102,847 | |||||

| 30 | CD13 | 92,000 | 10,847 | ||||||

A list of deposits made and cheques written during April, taken from the Cash Receipts Journal and Cash Disbursements Journal, is shown below:

| Deposits Made | |||||

| April | 7 | $ | 693 | ||

| 13 | 4,620 | ||||

| 18 | 5,926 | ||||

| 23 | 13,961 | ||||

| 27 | 1,758 | ||||

| 30 | 44,804 | ||||

| Total April Cash Receipts | $ | 71,762 | |||

| Cheques Written | |||||

| No. | 23 | $ | 5,223 | ||

| 24 | 3,164 | ||||

| 25 | 944 | ||||

| 26 | 313 | ||||

| 27 | 4,271 | ||||

| 28 | 4,900 | ||||

| 29 | 19,818 | ||||

| 30 | 41,440 | ||||

| 31 | 416 | ||||

| 32 | 11,511 | ||||

| Total April Cash Disbursements | $ | 92,000 | |||

The following bank statement is available for April:

| Bank Statement | |||||||||||

| To: Stewart Recording Studio | April 30, 2020 Bank of Canada |

||||||||||

| Cheques/Charges | Deposits/Credits | Balance | |||||||||

| 22,200 | |||||||||||

| #31 | 04/03 | 416 | 04/03 | 10,045 | 31,829 | ||||||

| #28 | 04/07 | 9,400 | 04/07 | 693 | 23,122 | ||||||

| #26 | 04/13 | 313 | 04/13 | 4,620 | 27,429 | ||||||

| NSF | 04/18 | 14,337 | 04/18 | 5,926 | 19,018 | ||||||

| #24 | 04/23 | 3,164 | 04/23 | 13,961 | 29,815 | ||||||

| #23 | 04/27 | 5,223 | 04/27 | 1,758 | 26,350 | ||||||

| #29 | 04/30 | 19,818 | 04/30 | 121,000 | 127,532 | ||||||

| PMT | 04/30 | 16,052 | 111,480 | ||||||||

| INT | 04/30 | 498 | 110,982 | ||||||||

| SC | 04/30 | 177 | 110,805 | ||||||||

| NSF = Not Sufficient Funds |

SC = Service Charge |

PMT = Payment of Principal on the loan |

INT = Interest on Bank Loan |

||||||||

- In reviewing cheques returned by the bank, the bookkeeper discovered that cheque #28, for delivery expense, was recorded in the Cash Disbursements Journal correctly as $4,900.

- The NSF cheque for $14,337 was that of customer Oprah Winney, deposited in March.

- On the bank statement, the payment for $16,052 is regarding a note payable.

- There is also a deposit of $121,000 dated April 30. It is an investment made by the owner into the business (the bank transferred the funds electronically from the owner’s personal account to his business account, which is why it was not recorded in the Cash Receipts Journal).

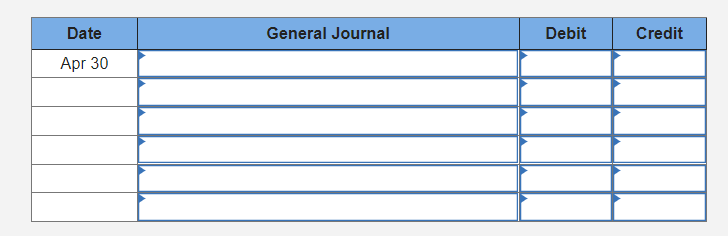

1. Record to reinstate customer account (April 30)

2. Record the April Bank service charges (April 30)

3. Record the April Interest expense (April 30)

Image attached for reference

Transcribed Image Text:Date

General Journal

Debit

Credit

Apr 30

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education