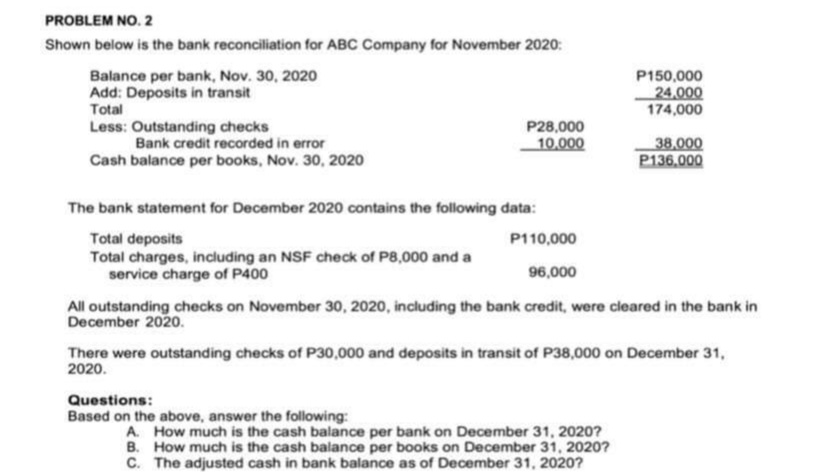

PROBLEM NO. 2 Shown below is the bank reconciliation for ABC Company for November 2020: Balance per bank, Nov. 30, 2020 Add: Deposits in transit Total P150,000 24,000 174,000 Less: Outstanding checks P28,000 10.000 Bank credit recorded in error 38,000 P136,000 Cash balance per books, Nov. 30, 2020 The bank statement for December 2020 contains the following data: P110,000 Total deposits Total charges, including an NSF check of P8,000 and a service charge of P400 96,000 All outstanding checks on November 30, 2020, including the bank credit, were cleared in the bank in December 2020.

PROBLEM NO. 2 Shown below is the bank reconciliation for ABC Company for November 2020: Balance per bank, Nov. 30, 2020 Add: Deposits in transit Total P150,000 24,000 174,000 Less: Outstanding checks P28,000 10.000 Bank credit recorded in error 38,000 P136,000 Cash balance per books, Nov. 30, 2020 The bank statement for December 2020 contains the following data: P110,000 Total deposits Total charges, including an NSF check of P8,000 and a service charge of P400 96,000 All outstanding checks on November 30, 2020, including the bank credit, were cleared in the bank in December 2020.

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter7: Internal Control And Cash

Section: Chapter Questions

Problem 7.3BE

Related questions

Question

100%

Transcribed Image Text:PROBLEM NO. 2

Shown below is the bank reconciliation for ABC Company for November 2020:

Balance per bank, Nov. 30, 2020

Add: Deposits in transit

Total

Less: Outstanding checks

P150,000

24,000

174,000

P28,000

10.000

Bank credit recorded in error

38,000

P136,000

Cash balance per books, Nov. 30, 2020

The bank statement for December 2020 contains the following data:

P110,000

Total deposits

Total charges, including an NSF check of P8,000 and a

service charge of P400

96,000

All outstanding checks on November 30, 2020, including the bank credit, were cleared in the bank in

December 2020.

There were outstanding checks of P30,000 and deposits in transit of P38,000 on December 31,

2020.

Questions:

Based on the above, answer the following:

A. How much is the cash balance per bank on December 31, 2020?

B. How much is the cash balance per books on December 31, 2020?

C. The adjusted cash in bank balance as of December 31, 2020?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning