stimated finished goods inventory balance at the end of July? 13. What is the estimated cost of goods sold and gross margin for July? 14. What is the estimated total selling and administrative expense for July? 15. What is the estimated net operating income for July? Connect EXERCISE 8-1 Schedule of Expected Cash Collections LO8-2 Silver Company makes a product that is very popular as a Mother's Day gift. Thus, peak sales occur in May of each year, as shown in the company's sales budget for the second quarter given below- April May June Total Budgeted sales (all on account) $300,000 $500,000 $200,000 $1,000,000 From past experience, the company has learned that 20% of a month's sales are collected in the month of sale, another 70% are collected in the month following sale, and the remaining 10% are collected in the second month following sale. Bad debts are negligible and can be ignored. February sales totaled $230,000, and March sales totaled $260,000. Required: Using Schedule 1 as your guide, prepare a schedule of expected cash collections from sales, by month and in total, for the second quarter. 1. spont 2. What is the accounts receivable balance on June 30th?

stimated finished goods inventory balance at the end of July? 13. What is the estimated cost of goods sold and gross margin for July? 14. What is the estimated total selling and administrative expense for July? 15. What is the estimated net operating income for July? Connect EXERCISE 8-1 Schedule of Expected Cash Collections LO8-2 Silver Company makes a product that is very popular as a Mother's Day gift. Thus, peak sales occur in May of each year, as shown in the company's sales budget for the second quarter given below- April May June Total Budgeted sales (all on account) $300,000 $500,000 $200,000 $1,000,000 From past experience, the company has learned that 20% of a month's sales are collected in the month of sale, another 70% are collected in the month following sale, and the remaining 10% are collected in the second month following sale. Bad debts are negligible and can be ignored. February sales totaled $230,000, and March sales totaled $260,000. Required: Using Schedule 1 as your guide, prepare a schedule of expected cash collections from sales, by month and in total, for the second quarter. 1. spont 2. What is the accounts receivable balance on June 30th?

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

ChapterMB: Model-building Problems

Section: Chapter Questions

Problem 22M

Related questions

Question

Transcribed Image Text:stimated finished goods inventory balance at the end of July?

13. What is the estimated cost of goods sold and gross margin for July?

14. What is the estimated total selling and administrative expense for July?

15. What is the estimated net operating income for July?

Connect

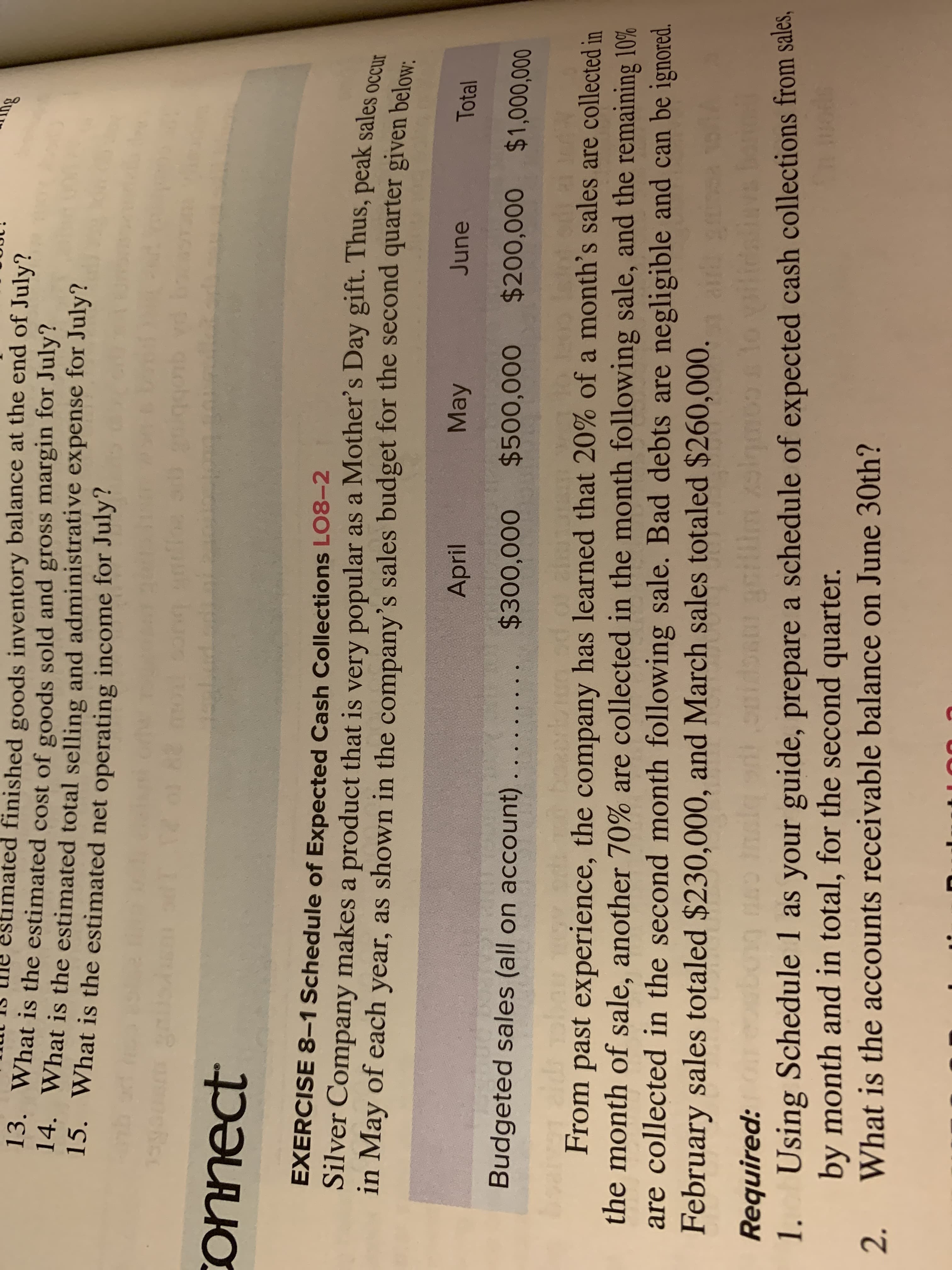

EXERCISE 8-1 Schedule of Expected Cash Collections LO8-2

Silver Company makes a product that is very popular as a Mother's Day gift. Thus, peak sales occur

in May of each year, as shown in the company's sales budget for the second quarter given below-

April

May

June

Total

Budgeted sales (all on account)

$300,000

$500,000 $200,000 $1,000,000

From past experience, the company has learned that 20% of a month's sales are collected in

the month of sale, another 70% are collected in the month following sale, and the remaining 10%

are collected in the second month following sale. Bad debts are negligible and can be ignored.

February sales totaled $230,000, and March sales totaled $260,000.

Required:

Using Schedule 1 as your guide, prepare a schedule of expected cash collections from sales,

by month and in total, for the second quarter.

1.

spont

2.

What is the accounts receivable balance on June 30th?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning