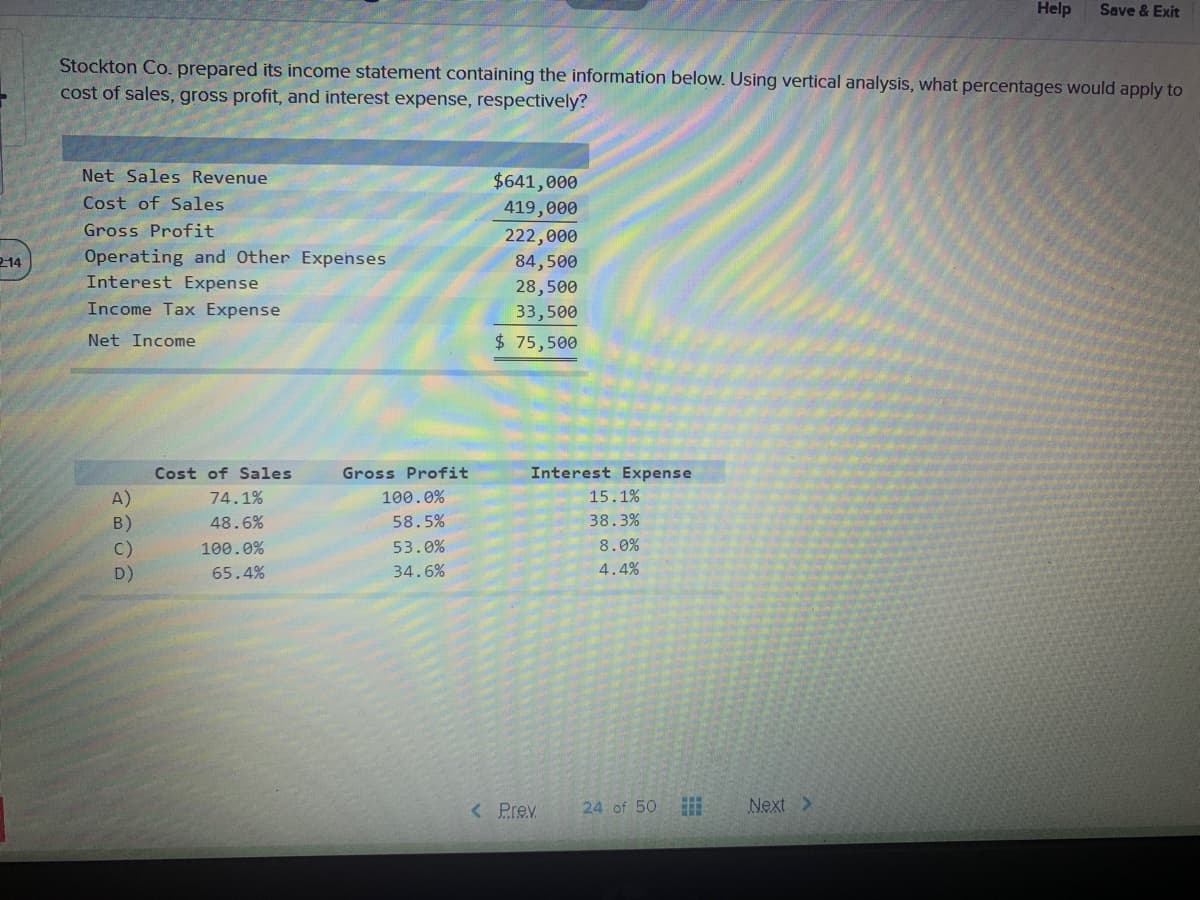

Stockton Co. prepared its income statement containing the information below. Using vertical analysis, what percentages would apply to cost of sales, gross profit, and interest expense, respectively? Net Sales Revenue $641,000 Cost of Sales 419,000 Gross Profit 222,000 Operating and Other Expenses 84,500 Interest Expense 28,500 33,500 Income Tax Expense Net Income $ 75,500 Cost of Sales Gross Profit Interest Expense 15.1% A) B) c) D) 74.1% 100.0% 48.6% 58.5% 38.3% 100.0% 53.0% 8.0% 65.4% 34.6% 4.4%

Stockton Co. prepared its income statement containing the information below. Using vertical analysis, what percentages would apply to cost of sales, gross profit, and interest expense, respectively? Net Sales Revenue $641,000 Cost of Sales 419,000 Gross Profit 222,000 Operating and Other Expenses 84,500 Interest Expense 28,500 33,500 Income Tax Expense Net Income $ 75,500 Cost of Sales Gross Profit Interest Expense 15.1% A) B) c) D) 74.1% 100.0% 48.6% 58.5% 38.3% 100.0% 53.0% 8.0% 65.4% 34.6% 4.4%

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 38E: Sundahl Companys income statements for the past 2 years are as follows: Refer to the information for...

Related questions

Question

Transcribed Image Text:Help

Save & Exit

Stockton Co. prepared its income statement containing the information below. Using vertical analysis, what percentages would apply to

cost of sales, gross profit, and interest expense, respectively?

Net Sales Revenue

$641,000

Cost of Sales

419,000

Gross Profit

222,000

Operating and Other Expenses

Interest Expense

214

84,500

28,500

Income Tax Expense

33,500

Net Income

$ 75,500

Cost of Sales

Gross Profit

Interest Expense

A)

B)

74.1%

100.0%

15.1%

48.6%

58.5%

38.3%

100.0%

53.0%

8.0%

D)

65.4%

34.6%

4.4%

<Prev

24 of 50

Next >

Transcribed Image Text:Multiple Choice

Option A

Option B

Option C

Option D

< Prev.

24 of 50

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning