GHT Corporation reports the following amounts in its December 31, 20XD income statement: I5950.000 Cost of goods sold $525,000 Net sales Sales discounts 20,000 Advertising expense Salaries expense 221,000 Utilities expense 125,000 32,500 Interest revenue 5,000 Effective income tax rate 20% 22. $ Determine Sales 23. $ Determine gross profit 24. $ Determine operating expenses 25. $ (IBT) Determine Income before income taxes 26. $ Determine Income tax expense 27. $ Determine net income 28. % Calculate gross profit ratio (round to one decimal place)

GHT Corporation reports the following amounts in its December 31, 20XD income statement: I5950.000 Cost of goods sold $525,000 Net sales Sales discounts 20,000 Advertising expense Salaries expense 221,000 Utilities expense 125,000 32,500 Interest revenue 5,000 Effective income tax rate 20% 22. $ Determine Sales 23. $ Determine gross profit 24. $ Determine operating expenses 25. $ (IBT) Determine Income before income taxes 26. $ Determine Income tax expense 27. $ Determine net income 28. % Calculate gross profit ratio (round to one decimal place)

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter14: Financial Statement Analysis

Section: Chapter Questions

Problem 14.26EX: Comprehensive Income Anson Industries, Inc. reported the following information on its 20Y1 income...

Related questions

Question

29

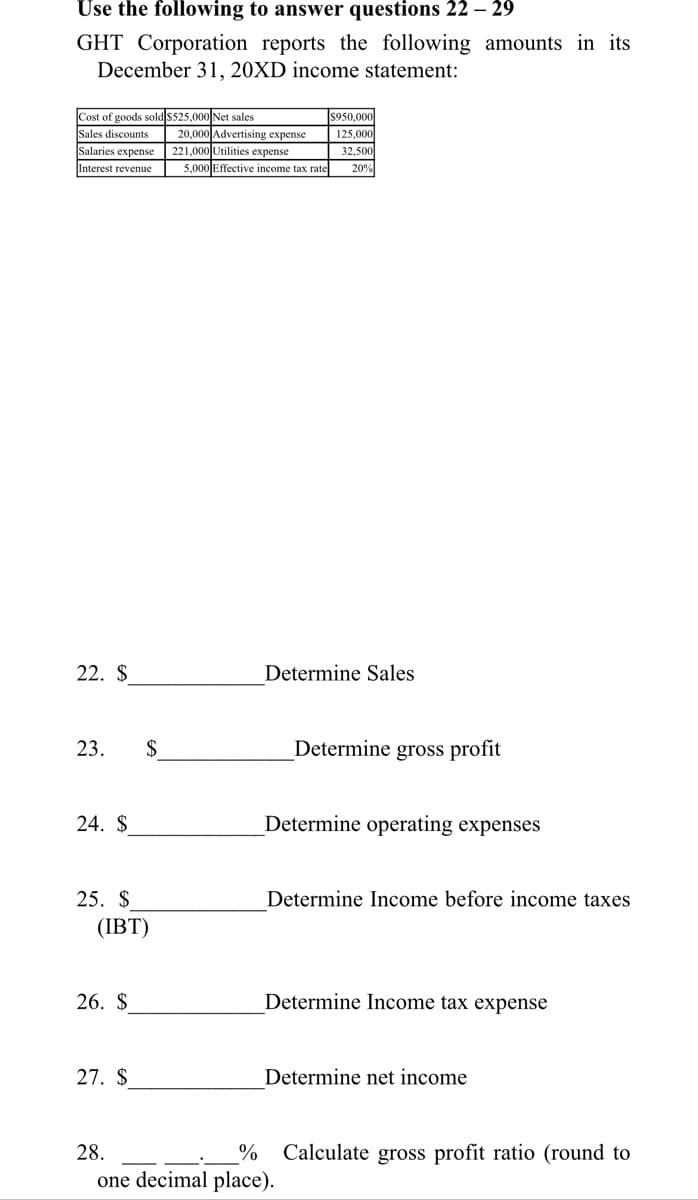

Transcribed Image Text:Use the following to answer questions 22 – 29

GHT Corporation reports the following amounts in its

December 31, 20XD income statement:

Cost of goods sold $525,000 Net sales

Sales discounts

Salaries expense 221,000 Utilities expense

$950,000

125,000

20,000 Advertising expense

32,500

Interest revenue

5,000 Effective income tax rate

20%

22. $

Determine Sales

23.

$

Determine gross profit

24. $

Determine operating expenses

25. $

Determine Income before income taxes

(IBT)

26. $

Determine Income tax expense

27. $

Determine net income

28.

Calculate gross profit ratio (round to

one decimal place).

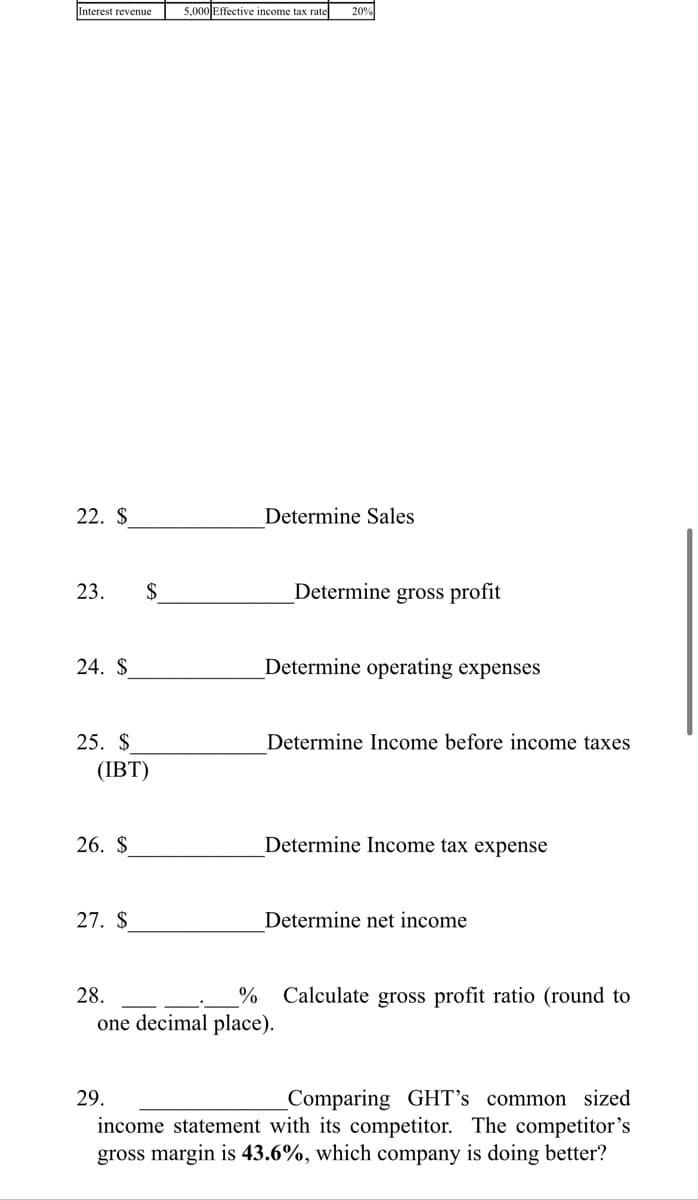

Transcribed Image Text:Interest revenue

5,000 Effective income tax rate

20%

22. $

Determine Sales

23.

$

Determine gross profit

24. $

Determine operating expenses

25. $

Determine Income before income taxes

(IBT)

26. $

Determine Income tax expense

27. $

Determine net income

28.

%

Calculate gross profit ratio (round to

one decimal place).

Comparing GHT's common sized

income statement with its competitor. The competitor's

gross margin is 43.6%, which company is doing better?

29.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning