structions: repare the entries in the Journal

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

22nd Edition

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:James A. Heintz, Robert W. Parry

Chapter9: Payroll Accounting: Employer Taxes And Reports

Section: Chapter Questions

Problem 6SEB

Related questions

Question

100%

Transcribed Image Text:Assignment

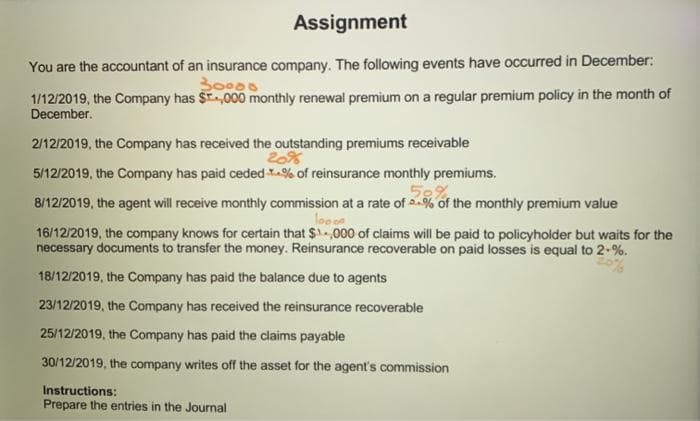

You are the accountant of an insurance company. The following events have occurred in December:

30000

1/12/2019, the Company has $,000 monthly renewal premium on a regular premium policy in the month of

December.

2/12/2019, the Company has received the outstanding premiums receivable

20%

5/12/2019, the Company has paid ceded .% of reinsurance monthly premiums.

8/12/2019, the agent will receive monthly commission at a rate of a% of the monthly premium value

looon

16/12/2019, the company knows for certain that $1,000 of claims will be paid to policyholder but waits for the

necessary documents to transfer the money. Reinsurance recoverable on paid losses is equal to 2-%.

18/12/2019, the Company has paid the balance due to agents

23/12/2019, the Company has received the reinsurance recoverable

25/12/2019, the Company has paid the claims payable

30/12/2019, the company writes off the asset for the agent's commission

Instructions:

Prepare the entries in the Journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,