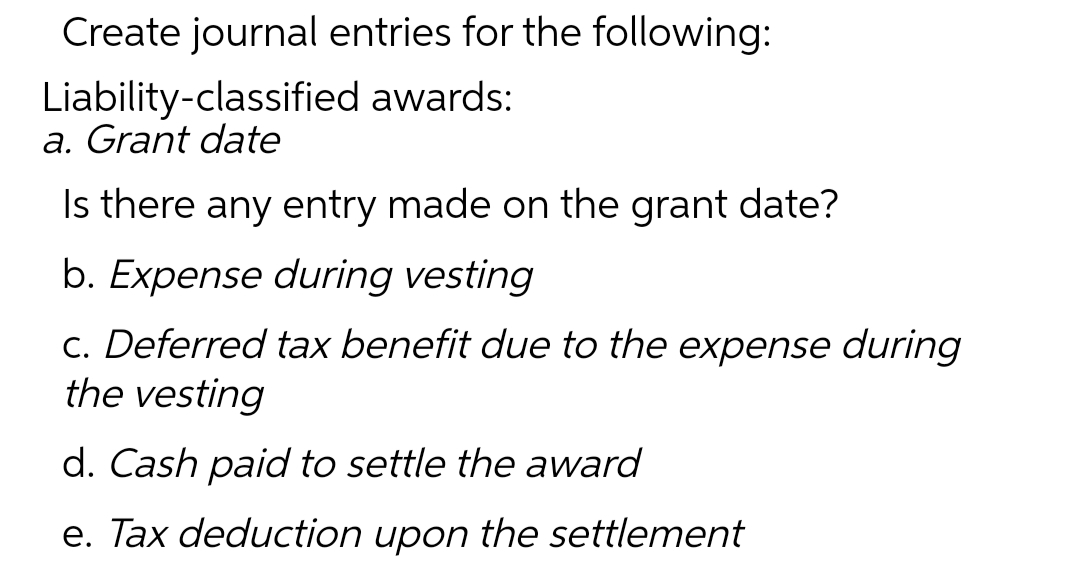

Create journal entries for the following:

Q: Question 26 Residents of which states are most active in seeking to remove the SALT deduction cap?…

A: The SALT cap workaround was enacted in 2021 allowing entities taxed as S corporations or…

Q: Marigold Construction Company began operations on January 1, 2020, During the year, Marigold…

A: The following are calculated to prepare the schedule for gross profit to be recognized:- 1.…

Q: what are total budgeted costs

A: Budgets are the estimates or forecasts to be made for future period. Budgeted costs means forecasted…

Q: The following information applies to Your Company for the current year: Direct labor-hours:…

A: Predetermined overhead rate: Predetermined overhead rate is calculated before the period begins.…

Q: Oxford company has a materials standard of 2.1 pounds per unit of output each pound has a standard…

A: FORMULA: Direct Material quantity variance = (Actual quantity used - Standard quantity…

Q: Which of the following is classified as a general expense? U A) Depreciation costs of showroom O B)…

A: General expenses are different from selling and distribution expenses A) Depreciation costs of…

Q: mark is planning to purchase an Australian Treasury bond with a coupon rate (j2) of 1.04% and face…

A: Treasury bonds are government debt securities issued by the government. These bonds are fixed-rate…

Q: Variance Analysis Problem Avatar, Inc. has prepared the following standard cost sheet for one unit…

A: Variances signifies the variation between the budgeted or estimated costs and the actual costs.

Q: income is $500,000. What should be reported as variable expenses in the contribution margin income…

A: The contribution margin is calculated as difference between sales and variable cost.

Q: PROBLEM 11-21 Return on Investment (ROI) and Residual Income LO11-1, LO11-2 "I know headquarters…

A: The return on investment is a measure to evaluate the performance because it helps in identifying…

Q: Rosie's Company has three products, P1, P2, and P3. The maximum Rosie's can sell is 85,000 units of…

A: Limiting factor is a constraint which limits the production level based on the shortage of the…

Q: accounts to show the flow of costs in the system. Any difference between actual and app should be…

A: The answer has been mentioned below.

Q: Nichols Enterprises has an investment in 27,000 bonds of Elliott Electronics that Nichols accounts…

A: Investment: Investment definition is an item that is purchased or invested in in order to accumulate…

Q: the Table

A: Given as, Exemption Rate $20M 50% $18M 45% $16M 35% $5M 30%

Q: Your friend Harold is trying to decide whether to buy or lease his next vehicle. He has gathered…

A: Net Present Value=(Present Value of Cash Inflows-Present Value of Cash Outflows)

Q: rue or False. All payments by cheque are recorded in the cash payments journal. Any GST/HST paid on…

A: Cash payment journal is a accounting book, which records all type of payments such as payment for…

Q: Elodie is paid her commissions together with her bi-weekly salary of $1,000.00. This pay period her…

A: Calculation of contributionsTherefore, in 2022, the contribution rate is 12.3% of an employee's…

Q: ssued credit memorandum to Dial Corp. for defective merchandise –$315, including 5% GST. Inventory…

A: Sales returns and allowances are a type of sales deduction that represents the selling price of…

Q: The includes all other budgets to present a complete and comprehensive view of the company's…

A: Budgets are the statements prepared to estimate the future revenues and expenses.

Q: A $288,000 bond was redeemed at 98 when the carrying amount of the bond was $280,800. The entry to…

A: Lets understand the basics. For calculating gain/loss on redemption of carrying value of bond, we…

Q: stockholders equity Additional Information for 2022: 1. Land of $820,000 was obtained by issuing a…

A: Cash Flow Statement - Statement of Cash Flow shows the movement of cash in the financial year. It…

Q: QUESTION 1 Elk is a passive investor in three activities that have been profitable in previous…

A: Total suspended loss is $60,000. The suspended loss of $60,000 will be divided between loss making…

Q: Nichols Enterprises has an investment in 27,000 bonds of Elliott Electronics that Nichols accounts…

A: Investment: An investment is a financial asset that is purchased with the expectation of providing…

Q: Explain the term ‘vicarious liability’ and recommend four steps employers can take to meet their…

A: The liabilities mean the state for which someone is personally liable. In simple words, liability is…

Q: Basics of Productivity Measurement Holbrook Company gathered the following data for the past two…

A: Productivity profile involves analysis of the resources in order to produce the required output…

Q: Assume that a foreign company using IFRS is owned by a company using U.S. GAAP. Thus, IFRS balances…

A: The process of recording business transactions in the books of accounts for the first time is…

Q: 3.3 Calculate Ms. N. Zama's net salary for the week. The following information is in respect of…

A:

Q: QUESTION 3 Company X has monthly fixed costs of $150,000 and a unit variable cost of $50. How many…

A: Break even in unit can be calculated by this formula- Fixed cost/(sale price per unit-variable cost…

Q: A major disclosure items for public companies is: lack of internal controls pension…

A:

Q: What is the combined effect on the US dollar value? Please explain.

A: Investment is made by the company or any foreign investor into the business or in the corporation by…

Q: The financial manager of Company X is evaluating Company Y as a possible acquisition. Company Y is…

A: A wealth of a shareholder is the sum total of the earnings per share and the market price of the…

Q: When closing income statement accounts having debit balances, which of the following accounts will…

A: Income statement accounts are temporary in nature and these are to be closed at the end of the year.…

Q: Your Division makes a part that can either be sold to outside customers or transferred internally to…

A: As per the general transfer pricing rule, in the case of sufficient capacity available, the minimum…

Q: Cash $20,000 $60,000 $160,000 $400,000 $60,000 $20,000 $140,000 Accounts Receivable Inventory…

A: Introduction: Working capital: Deduction of current liabilities from current assets derives the…

Q: The market price of a stock is $35.00. An investor has purchased a call option for 100 shares of…

A: Intrinsic Value:- It measures the true value of assets or stock means it is the maximum value of a…

Q: Q/3 The Municipality Directorate has purchased vehicles in ti amount of (120) million Iraqi dinars…

A: As per constant ratio method for calculating depreciation, depreciation is charged on the basis of…

Q: In the month of September, Matiock Industries sold 800 units of product. The average sales price was…

A: The contribution margin is calculated as difference between sales and variable costs.

Q: Determine the amount realized from the sale of non-cash assets. 10.Determine the amount received by…

A: On December 31, 2021, the GAR Partnership of Garry, Aubrey and Rolly is liquidated due to…

Q: Choose the correct answer. How to build customer loyalty? Select one: a. Give at least 30% discount…

A: Solution : - b. Organize loyalty program and reward returned customers with it.

Q: Aldor Corporation opened a new store on January 1, 2014. During 2014, the first year of operations,…

A: Inventory is the raw materials used in production and available for sale. The inventory includes raw…

Q: D. Red, White, and Blue are partners who share profits and losses 20%; 30%; and 50% respectively.…

A: Introduction:- Partnership business means two or more persons form together for making profit and…

Q: Your Company uses a predetermined overhead rate based on machine hours to apply manufacturing…

A: Formula: Predetermined overhead rate = Total estimated manufacturing overhead cost/ Budgeted direct…

Q: Administrative Expenses include:

A: Administrative Expenses are the cost incurred by an organization that is directly not related to the…

Q: Explain the multiplier effect by analysing how a typical consumer would react to this tax cut and…

A: Fiscal multipliers measure the impact of discretionary fiscal policy on output of the economy.They…

Q: Required information [The following information applies to the questions displayed below.] Tyrell…

A:

Q: 1 Jenny Watson started her consulting business, Jenny Consulting, in 2020. During January 2021,…

A: Journal Entries - Journal Entries are the recording of transactions of the organization. It is…

Q: Choose the correct answer. How to build customer loyalty? Select one: a. Give at least 30% discount…

A: Customer loyalty means the ongoing emotional relationship among the company and the customer which…

Q: Profitability

A: Profitability is the prime purpose of every business. Every corporation tries to maximize its…

Q: what is the EUAC corresponding to an overhaul cost of 4000 at year 3 for a machine with 7 years of…

A: Year Overhaul Cost PVF @ 8% Present Value 1 0.926 2 0.857 3 4000 0.794 3176 4…

Q: 6. Selected data for Katan, Inc. at 12/31/21 is as follows: Total assets Total liabilities Net sales…

A: Note: Question 4 mentions references to Questions 1 & 2, but the details of Question 1 &2…

Step by step

Solved in 5 steps

- Which of the following statements are correct? i. A VAT invoice should be pre-numbered and must show the: - Words “Tax Invoice” (shown prominently) ii. A VAT invoice should display the total amount of the consideration and the VAT. iii. A VAT invoice should display the name and address of the registered taxpayer to whom the taxable supply is made. iv. A VAT invoice should display the date of the taxable supply. a. All of the above b. i, ii and iv c. i only d. i, and iiiWhich of the following statements are correct? i. A VAT invoice should be pre-numbered and must show the: - Words “Tax Invoice” (shown prominently) ii. A VAT invoice should display the total amount of the consideration and the VAT. iii. A VAT invoice should display the name and address of the registered taxpayer to whom the taxable supply is made. iv. A VAT invoice should display the date of the taxable supply. a.All of the above b.i, ii and iv c.i, and iii d.i onlyIn the case of grants related to an asset, which of these accounting treatments (balance sheet presentation) is prescribed by IAS 20? (a) Record the grant at a nominal value in the first year and write it off in the subsequent year. (b) Either set up the grant as deferred income or deduct it in arriving at the carrying amount of the asset. (c) Record the grant at fair value in the first year and take it to income in the subsequent year. (d) Take it to the income statement and disclose it as an extraordinary gain.

- In the case of grants related to income, which of these accounting treatments is prescribed by IAS 20? (a) Credit the grant to “general reserve” under shareholders’ equity. (b) Present the grant in the income statement as “other income”’ or as a separate line item, or deduct it from the related expense. (c) Credit the grant to “retained earnings” on the balance sheet. (d) Credit the grant to sales or other revenue from operations in the income statement.Which of the following causes a temporary difference between taxable and pretax accounting income? A. Investment expenses incurred to generate tax-exempt income. B. MACRS used for depreciating equipment. C. The dividends received deduction. D. Life insurance proceeds received due to the death of an executive.Repayment of grant related to income shall be Recognized as component of other comprehensive income Charged to retained earnings Expensed immediately Applied first against the deferred income balance and any excess shall be recognized immediately as an expense

- Which of the following items on the statement of net assets available for benefits would indicate a plan failed nondiscrimination testing? Select one: a. Excess contributions refundable/payable b. Employee contributions receivable c. Adjustment from fair value to contract value d. Adjustment from contract value to fair valueNoncash contributions received by a not-for-profit entity should be recognized on the date received at Select one: a.fair value. b.the amount specified by the donor. c.fair value less an allowance for impairment. d.the future value of the future cash flows as of the end of the asset's estimated useful life.Which of the following is not a procedure in accounting for defined contribution plans? Remeasurements are recorded in other comprehensive income. Contributions shall be recognized as expense in the period it is payable. Any unpaid contribution at the end of the period shall be recognized as accrued expense. Any excess contribution shall be recognized as prepaid expense.

- d. Prepare all journal entries relating to income tax. e. Compute the total income tax expense, identifying separately the current income tax expense and the deferred tax expanseWhich of the following statements is correct? a.The taxpayer has the right to object to a tax assessment anytime after receiving an Assessment Notice. b.The taxpayer must state the grounds of objection in his/her Notice of Objection c.The Tax Commissioner must accept a Return once it is filed on time. d.The Taxpayer has the right to object to an assessment within the timeframe specified on the Assessment Notice.