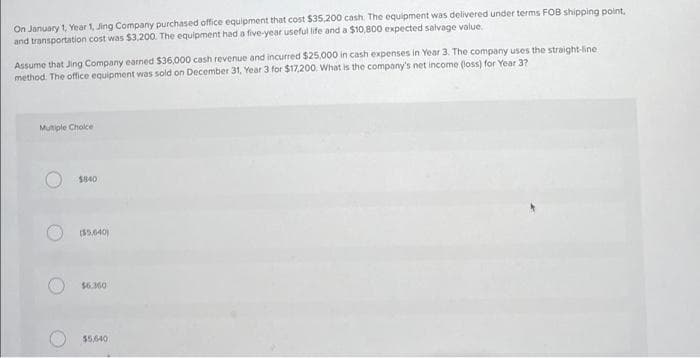

On January 1, Year 1, Jing Company purchased office equipment that cost $35,200 cash. The equipment was delivered under terms FOB shipping point, and transportation cost was $3,200. The equipment had a five-year useful life and a $10,800 expected salvage value. Assume that Jing Company earned $36,000 cash revenue and incurred $25,000 in cash expenses in Year 3. The company uses the straight-line method. The office equipment was sold on December 31, Year 3 for $17,200. What is the company's net income (loss) for Year 3? Munple Cholce $040 ($5.040) $6.360 $5,640

On January 1, Year 1, Jing Company purchased office equipment that cost $35,200 cash. The equipment was delivered under terms FOB shipping point, and transportation cost was $3,200. The equipment had a five-year useful life and a $10,800 expected salvage value. Assume that Jing Company earned $36,000 cash revenue and incurred $25,000 in cash expenses in Year 3. The company uses the straight-line method. The office equipment was sold on December 31, Year 3 for $17,200. What is the company's net income (loss) for Year 3? Munple Cholce $040 ($5.040) $6.360 $5,640

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 5PA: Jada Company had the following transactions during the year: Purchased a machine for $500,000 using...

Related questions

Question

Transcribed Image Text:On January 1, Year 1, Jing Company purchased office equipment that cost $35,200 cash. The equipment was delivered under terms FOB shipping point,

and transportation cost was $3,200. The equipment had a five-year useful life and a $10,800 expected salvage value.

Assume that Jing Company earned $36,000 cash revenue and incurred $25,000 in cash expenses in Year 3. The company uses the straight-line

method. The office equipment was sold on December 31, Year 3 for $17,200. What is the company's net income (loss) for Year 3?

Mutiple Cholce

$840

(55.040)

$6.360

$5,640

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT