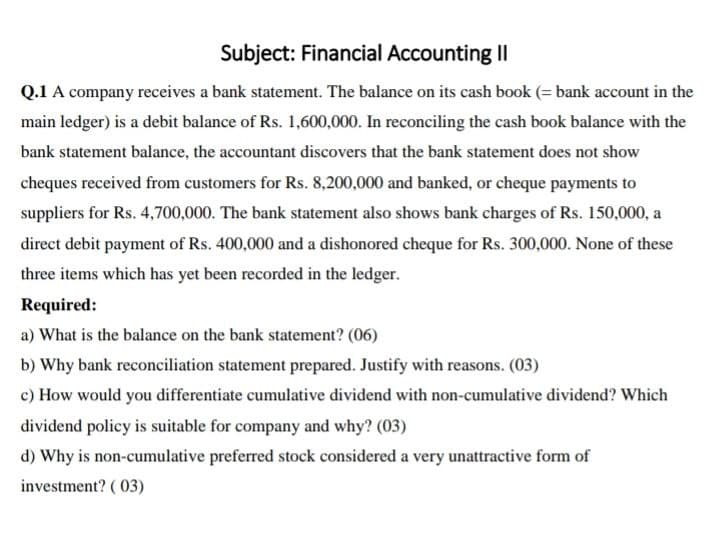

Subject: Financial Accounting II Q.1 A company receives a bank statement. The balance on its cash book (= bank account in the main ledger) is a debit balance of Rs. 1,600,000. In reconciling the cash book balance with the bank statement balance, the accountant discovers that the bank statement does not show cheques received from customers for Rs. 8,200,000 and banked, or cheque payments to suppliers for Rs. 4,700,000. The bank statement also shows bank charges of Rs. 150,000, a direct debit payment of Rs. 400,000 and a dishonored cheque for Rs. 300,000. None of these three items which has yet been recorded in the ledger. Required: a) What is the balance on the bank statement? (06) b) Why bank reconciliation statement prepared. Justify with reasons. (03) c) How would you differentiate cumulative dividend with non-cumulative dividend? Which dividend policy is suitable for company and why? (03) d) Why is non-cumulative preferred stock considered a very unattractive form of investment? ( 03)

Subject: Financial Accounting II Q.1 A company receives a bank statement. The balance on its cash book (= bank account in the main ledger) is a debit balance of Rs. 1,600,000. In reconciling the cash book balance with the bank statement balance, the accountant discovers that the bank statement does not show cheques received from customers for Rs. 8,200,000 and banked, or cheque payments to suppliers for Rs. 4,700,000. The bank statement also shows bank charges of Rs. 150,000, a direct debit payment of Rs. 400,000 and a dishonored cheque for Rs. 300,000. None of these three items which has yet been recorded in the ledger. Required: a) What is the balance on the bank statement? (06) b) Why bank reconciliation statement prepared. Justify with reasons. (03) c) How would you differentiate cumulative dividend with non-cumulative dividend? Which dividend policy is suitable for company and why? (03) d) Why is non-cumulative preferred stock considered a very unattractive form of investment? ( 03)

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter5: Cash Control Systems

Section5.2: Bank Reconciliation

Problem 1OYO

Related questions

Question

I need the answer as soon as possible

Transcribed Image Text:Subject: Financial Accounting II

Q.1 A company receives a bank statement. The balance on its cash book (= bank account in the

main ledger) is a debit balance of Rs. 1,600,000. In reconciling the cash book balance with the

bank statement balance, the accountant discovers that the bank statement does not show

cheques received from customers for Rs. 8,200,000 and banked, or cheque payments to

suppliers for Rs. 4,700,000. The bank statement also shows bank charges of Rs. 150,000, a

direct debit payment of Rs. 400,000 and a dishonored cheque for Rs. 300,000. None of these

three items which has yet been recorded in the ledger.

Required:

a) What is the balance on the bank statement? (06)

b) Why bank reconciliation statement prepared. Justify with reasons. (03)

c) How would you differentiate cumulative dividend with non-cumulative dividend? Which

dividend policy is suitable for company and why? (03)

d) Why is non-cumulative preferred stock considered a very unattractive form of

investment? ( 03)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,