Question 28 ( On July 31, 2028, Massive Ltd. had a cash balance of $6,793 in its general ledger. The bank stat the Bank of Auditing on that date showed a balance of $6,578. A comparison of the bank state the Cash account revealed the following: a. Cash receipts for July 31 recorded on the company's books were $3,500, but this amo appear on the bank statement. b. A cheque of $5,100 made by another company was incorrectly deducted to Massive's the Bank of Auditing. c. The bank statement included service charges and debit and credit card processing fe d. Cheques outstanding on June 30 totaled $6,200. Of these, $4,600 worth cleared the cheques written in July cleared the bank in July. d electronic sollestions from customers on account totali

Question 28 ( On July 31, 2028, Massive Ltd. had a cash balance of $6,793 in its general ledger. The bank stat the Bank of Auditing on that date showed a balance of $6,578. A comparison of the bank state the Cash account revealed the following: a. Cash receipts for July 31 recorded on the company's books were $3,500, but this amo appear on the bank statement. b. A cheque of $5,100 made by another company was incorrectly deducted to Massive's the Bank of Auditing. c. The bank statement included service charges and debit and credit card processing fe d. Cheques outstanding on June 30 totaled $6,200. Of these, $4,600 worth cleared the cheques written in July cleared the bank in July. d electronic sollestions from customers on account totali

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter7: Internal Control And Cash

Section: Chapter Questions

Problem 7.3BE

Related questions

Question

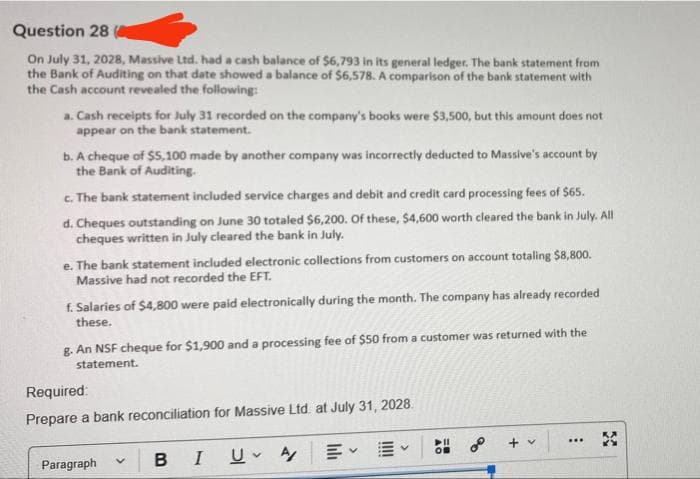

Transcribed Image Text:Question 28

On July 31, 2028, Massive Ltd. had a cash balance of $6,793 in its general ledger. The bank statement from

the Bank of Auditing on that date showed a balance of $6,578. A comparison of the bank statement with

the Cash account revealed the following:

a. Cash receipts for July 31 recorded on the company's books were $3,500, but this amount does not

appear on the bank statement.

b. A cheque of $5,100 made by another company was incorrectly deducted to Massive's account by

the Bank of Auditing.

c. The bank statement included service charges and debit and credit card processing fees of $65.

d. Cheques outstanding on June 30 totaled $6,200. Of these, $4,600 worth cleared the bank in July. All

cheques written in July cleared the bank in July.

e. The bank statement included electronic collections from customers on account totaling $8,800.

Massive had not recorded the EFT.

f. Salaries of $4,800 were paid electronically during the month. The company has already recorded

these.

g. An NSF cheque for $1,900 and a processing fee of $50 from a customer was returned with the

statement.

Required:

Prepare a bank reconciliation for Massive Ltd. at July 31, 2028.

+ v

в I

U- A E

Paragraph

Transcribed Image Text:g. An NSF cheque for $1,900 and a processing fee of $50 from a customer was returned with the

statement.

Required

Prepare a bank reconciliation for Massive Ltd. at July 31, 2028.

Paragraph

B I 쁘 y

...

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning