Subject: Law on Partnership and Corporations True or False.

Chapter20: Corporations And Partnerships

Section: Chapter Questions

Problem 19DQ

Related questions

Question

Subject: Law on

True or False.

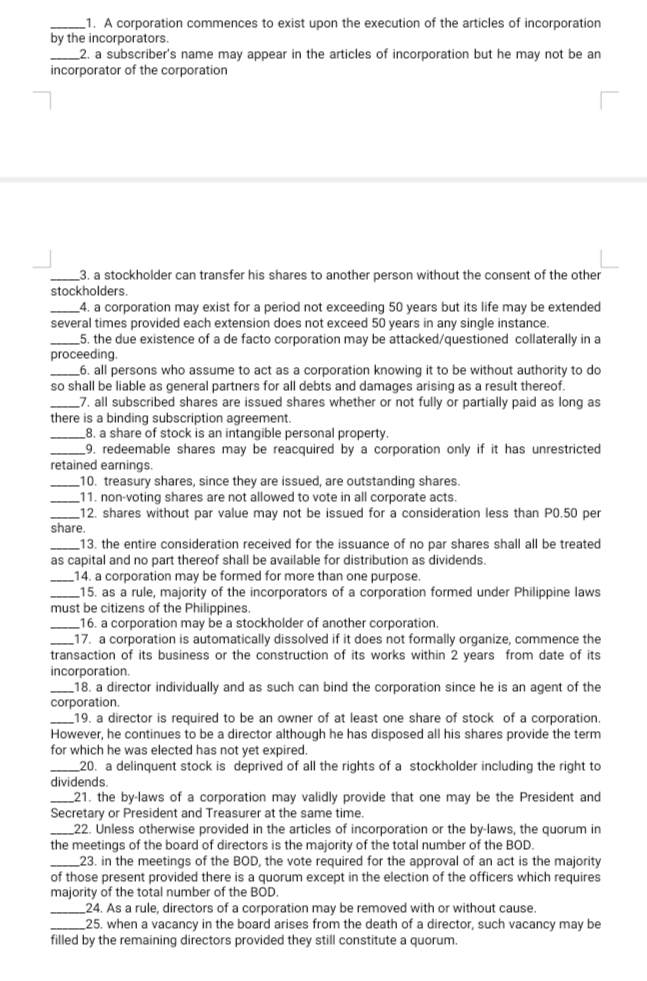

Transcribed Image Text:_1. A corporation commences to exist upon the execution of the articles of incorporation

by the incorporators.

_2. a subscriber's name may appear in the articles of incorporation but he may not be an

incorporator of the corporation

3. a stockholder can transfer his shares to another person without the consent of the other

stockholders.

4. a corporation may exist for a period not exceeding 50 years but its life may be extended

several times provided each extension does not exceed 50 years in any single instance.

_5. the due existence of a de facto corporation may be attacked/questioned collaterally in a

proceeding.

_6. all persons who assume to act as a corporation knowing it to be without authority to do

so shall be liable as general partners for all debts and damages arising as a result thereof.

7. all subscribed shares are issued shares whether or not fully or partially paid as long as

there is a binding subscription agreement.

8. a share of stock is an intangible personal property.

_9. redeemable shares may be reacquired by a corporation only if it has unrestricted

retained earnings.

10. treasury shares, since they are issued, are outstanding shares.

_11. non-voting shares are not allowed to vote in all corporate acts.

_12. shares without par value may not be issued for a consideration less than P0.50 per

share.

_13. the entire consideration received for the issuance of no par shares shall all be treated

as capital and no part thereof shall be available for distribution as dividends.

14. a corporation may be formed for more than one purpose.

_15. as a rule, majority of the incorporators of a corporation formed under Philippine laws

must be citizens of the Philippines.

corporation may be a stockholder of another corporation.

17. a

a corporation is automatically dissolved if it does not formally organize, commence the

transaction of its business or the construction of its works within 2 years from date of its

incorporation.

18. a director individually and as such can bind the corporation since he is an agent of the

corporation.

19. a director is required to be an owner of at least one share of stock of a corporation.

However.

for which he was elected has not yet expired.

_20. a delinquent stock is deprived of all the rights of a stockholder including the right to

dividends

he

continues to be a director although he has disposed all his shares provide the term

_21. the by-laws of a corporation may validly provide that one may be the President and

Secretary or President and Treasurer at the same time.

_22. Unless otherwise provided in the articles of incorporation or the by-laws, the quorum in

the

s of the board of directors is the majority of the total number of the BOD.

meetings

_23. in the meetings of the BOD, the vote required for the approval of an act is the majority

of those present provided there is a quorum except in the election of the officers which requires

majority of the total number of the BOD.

24. As a rule, directors of a corporation may be removed with or without cause.

_25. when a vacancy in the board arises from the death of a director, such vacancy may be

filled by the remaining directors provided they still constitute a quorum.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT