Required: 1. Explain the relevance of the Partnership Act and the Partnership Deed 2. Prepare the following a. Statement of Profit and Loss and Appropriation Account b. The Partners Current Account c. The Statement of Financial Position

Required: 1. Explain the relevance of the Partnership Act and the Partnership Deed 2. Prepare the following a. Statement of Profit and Loss and Appropriation Account b. The Partners Current Account c. The Statement of Financial Position

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter7: Fixed Assets, Natural Resources, And Intangible Assets

Section: Chapter Questions

Problem 7.1.1P

Related questions

Question

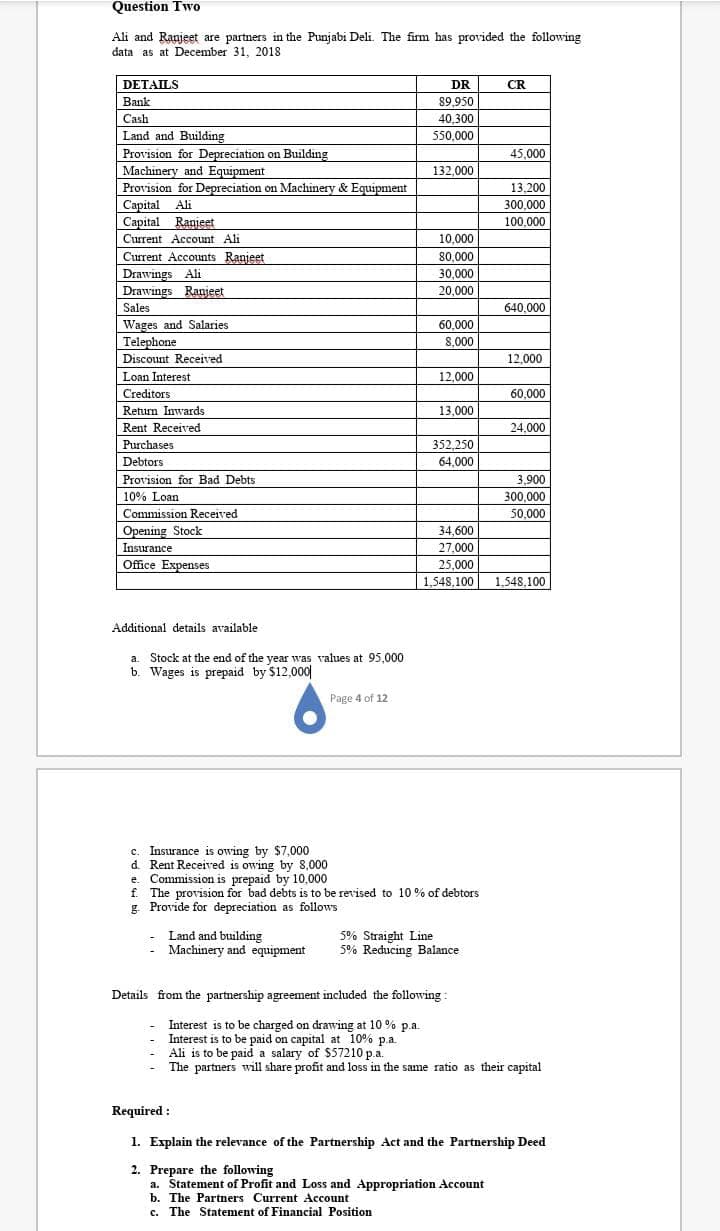

Transcribed Image Text:Question Two

Ali and Ranjeet are partners in the Punjabi Deli. The firm has provided the following

data as at December 31, 2018

DETAILS

Bank

Cash

Land and Building

Provision for Depreciation on Building

Machinery and Equipment

Provision for Depreciation on Machinery & Equipment

Capital Ali

Capital Ranjeet

Current Account Ali

Current Accounts Ranjeet

Drawings Ali

Drawings Ranjeet

Sales

Wages and Salaries

Telephone

Discount Received

Loan Interest

Creditors

Return Inwards

Rent Received

Purchases

Debtors

Provision for Bad Debts

10% Loan

Commission Received

Opening Stock

Insurance

Office Expenses

Additional details available

a Stock at the end of the year was values at 95,000

b. Wages is prepaid by $12,000

c. Insurance is owing by $7,000

d. Rent Received is owing by 8,000

Page 4 of 12

Land and building

Machinery and equipment

DR

89,950

40.300

550.000

132,000

10,000

80,000

30,000

20,000

60,000

8,000

12,000

13,000

352,250

64,000

e. Commission is prepaid by 10,000

f The provision for bad debts is to be revised to 10% of debtors

g. Provide for depreciation as follows

CR

5% Straight Line

5% Reducing Balance.

45,000

13,200

300,000

100.000

640.000

12.000

60,000

24,000

34,600

27,000

25,000

1,548,100 1,548,100

3.900

300.000

50,000

Details from the partnership agreement included the following:

Interest is to be charged on drawing at 10% p.a.

Interest is to be paid on capital at 10% p.a.

Ali is to be paid a salary of $57210 p.a.

The partners will share profit and loss in the same ratio as their capital

Required:

1. Explain the relevance of the Partnership Act and the Partnership Deed

2. Prepare the following

a. Statement of Profit and Loss and Appropriation Account

b. The Partners Current Account

c. The Statement of Financial Position.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage