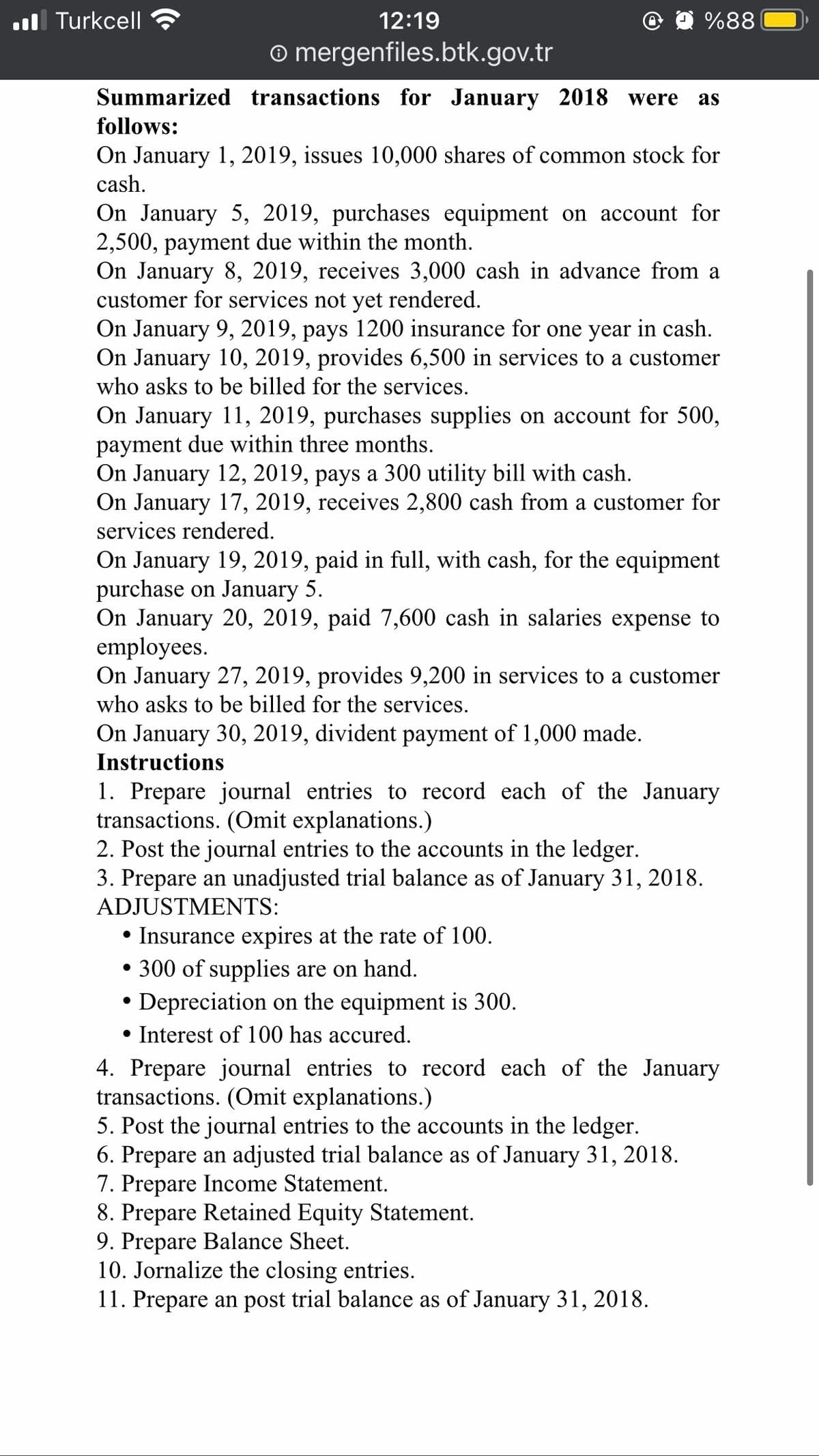

Summarized transactions for January 2018 were as follows: On January 1, 2019, issues 10,000 shares of common stock for cash. On January 5, 2019, purchases equipment on account for 2,500, payment due within the month. On January 8, 2019, receives 3,000 cash in advance from a customer for services not yet rendered.

Summarized transactions for January 2018 were as follows: On January 1, 2019, issues 10,000 shares of common stock for cash. On January 5, 2019, purchases equipment on account for 2,500, payment due within the month. On January 8, 2019, receives 3,000 cash in advance from a customer for services not yet rendered.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 22E

Related questions

Question

Transcribed Image Text:l Turkcell

12:19

%88

o mergenfiles.btk.gov.tr

Summarized transactions for January 2018 were

as

follows:

On January 1, 2019, issues 10,000 shares of common stock for

cash.

On January 5, 2019, purchases equipment on account for

2,500, payment due within the month.

On January 8, 2019, receives 3,000 cash in advance from a

customer for services not yet rendered.

On January 9, 2019, pays 1200 insurance for one year in cash.

On January 10, 2019, provides 6,500 in services to a customer

who asks to be billed for the services.

On January 11, 2019, purchases supplies on account for 500,

payment due within three months.

On January 12, 2019, pays a 300 utility bill with cash.

On January 17, 2019, receives 2,800 cash from a customer for

services rendered.

On January 19, 2019, paid in full, with cash, for the equipment

purchase on January 5.

On January 20, 2019, paid 7,600 cash in salaries expense to

employees.

On January 27, 2019, provides 9,200 in services to a customer

who asks to be billed for the services.

On January 30, 2019, divident payment of 1,000 made.

Instructions

1. Prepare journal entries to record each of the January

transactions. (Omit explanations.)

2. Post the journal entries to the accounts in the ledger.

3. Prepare an unadjusted trial balance as of January 31, 2018.

ADJUSTMENTS:

• Insurance expires at the rate of 100.

• 300 of supplies are on hand.

Depreciation on the equipment is 300.

• Interest of 100 has accured.

4. Prepare journal entries to record each of the January

transactions. (Omit explanations.)

5. Post the journal entries to the accounts in the ledger.

6. Prepare an adjusted trial balance as of January 31, 2018.

7. Prepare Income Statement.

8. Prepare Retained Equity Statement.

9. Prepare Balance Sheet.

10. Jornalize the closing entries.

11. Prepare an post trial balance as of January 31, 2018.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning