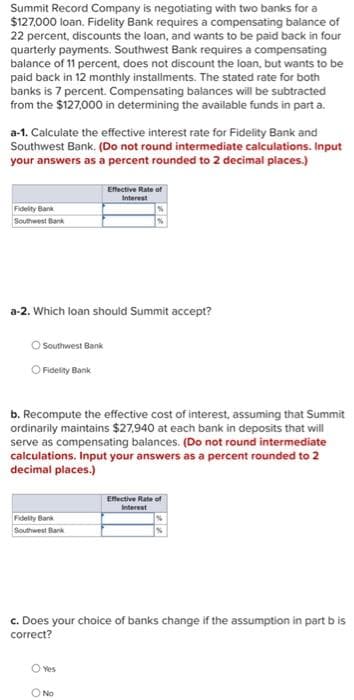

Summit Record Company is negotiating with two banks for a $127,000 loan. Fidelity Bank requires a compensating balance of 22 percent, discounts the loan, and wants to be paid back in four quarterly payments. Southwest Bank requires a compensating balance of 11 percent, does not discount the loan, but wants to be paid back in 12 monthly installments. The stated rate for both banks is 7 percent. Compensating balances will be subtracted from the $127,000 in determining the available funds in part a a-1. Calculate the effective interest rate for Fidelity Bank and Southwest Bank. (Do not round intermediate calculations. Input your answers as a percent rounded to 2 decimal places.) Effective Rate of Interest Fidelity Bank Southwest Bank a-2. Which loan should Summit accept? O Southwest Bank O Fidelity Bank b. Recompute the effective cost of interest, assuming that Summit ordinarily maintains $27,940 at each bank in deposits that will serve as compensating balances. (Do not round intermediate calculations. Input your answers as a percent rounded to 2 decimal places.) Effective Rate of Interest Fidelity Bank Southwest Bank

Summit Record Company is negotiating with two banks for a $127,000 loan. Fidelity Bank requires a compensating balance of 22 percent, discounts the loan, and wants to be paid back in four quarterly payments. Southwest Bank requires a compensating balance of 11 percent, does not discount the loan, but wants to be paid back in 12 monthly installments. The stated rate for both banks is 7 percent. Compensating balances will be subtracted from the $127,000 in determining the available funds in part a a-1. Calculate the effective interest rate for Fidelity Bank and Southwest Bank. (Do not round intermediate calculations. Input your answers as a percent rounded to 2 decimal places.) Effective Rate of Interest Fidelity Bank Southwest Bank a-2. Which loan should Summit accept? O Southwest Bank O Fidelity Bank b. Recompute the effective cost of interest, assuming that Summit ordinarily maintains $27,940 at each bank in deposits that will serve as compensating balances. (Do not round intermediate calculations. Input your answers as a percent rounded to 2 decimal places.) Effective Rate of Interest Fidelity Bank Southwest Bank

Chapter16: Working Capital Policy And Short-term Financing

Section: Chapter Questions

Problem 30P

Related questions

Question

13

Transcribed Image Text:Summit Record Company is negotiating with two banks for a

$127,000 loan. Fidelity Bank requires a compensating balance of

22 percent, discounts the loan, and wants to be paid back in four

quarterly payments. Southwest Bank requires a compensating

balance of 11 percent, does not discount the loan, but wants to be

paid back in 12 monthly installments. The stated rate for both

banks is 7 percent. Compensating balances will be subtracted

from the $127,000 in determining the available funds in part a.

a-1. Calculate the effective interest rate for Fidelity Bank and

Southwest Bank. (Do not round intermediate calculations. Input

your answers as a percent rounded to 2 decimal places.)

Effective Rate of

Interest

Fidelity Bank

Southwest Bank

a-2. Which loan should Summit accept?

O Southwest Bank

O Fidelity Bank

b. Recompute the effective cost of interest, assuming that Summit

ordinarily maintains $27,940 at each bank in deposits that will

serve as compensating balances. (Do not round intermediate

calculations. Input your answers as a percent rounded to 2

decimal places.)

Effective Rate of

Fidelity Bank

Southwest Bank

c. Does your choice of banks change if the assumption in part bis

correct?

O Yes

O No

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Given:

VIEWa: Calculation of Effective Interest Rate of Fidelity Bank:

VIEWCalculation of Effective Interest Rate of Southwest Bank:

VIEWb.Calculation of Effective Interest Rate of Fidelity Bank if Compensating Balance deposited in Bank:

VIEWCalculation of Effective Interest Rate of Southwest Bank if Compensating Balance deposited in Bank:

VIEWAnswers:

VIEWTrending now

This is a popular solution!

Step by step

Solved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College