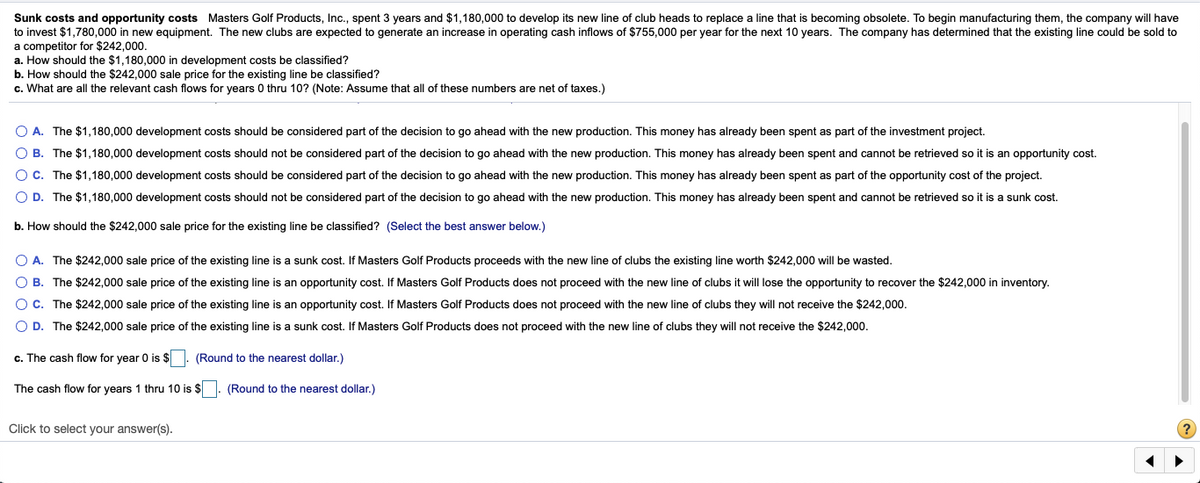

Sunk costs and opportunity costs Masters Golf Products, Inc., spent 3 years and $1,180,000 to develop its new line of club heads to replace a line that is becoming obsolete. To begin manufacturing them, the company will have to invest $1,780,000 in new equipment. The new clubs are expected to generate an increase in operating cash inflows of $755,000 per year for the next 10 years. The company has determined that the existing line could be sold to a competitor for $242,000. a. How should the $1,180,000 in development costs be classified? b. How should the $242,000 sale price for the existing line be classified? c. What are all the relevant cash flows for years 0 thru 10? (Note: Assume that all of these numbers are net of taxes.)

Sunk costs and opportunity costs Masters Golf Products, Inc., spent 3 years and $1,180,000 to develop its new line of club heads to replace a line that is becoming obsolete. To begin manufacturing them, the company will have to invest $1,780,000 in new equipment. The new clubs are expected to generate an increase in operating cash inflows of $755,000 per year for the next 10 years. The company has determined that the existing line could be sold to a competitor for $242,000. a. How should the $1,180,000 in development costs be classified? b. How should the $242,000 sale price for the existing line be classified? c. What are all the relevant cash flows for years 0 thru 10? (Note: Assume that all of these numbers are net of taxes.)

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter12: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 11P: REPLACEMENT ANALYSIS St. Johns River Shipyards is considering the replacement of an 8-year-old...

Related questions

Question

I need A-C answered

Transcribed Image Text:Sunk costs and opportunity costs Masters Golf Products, Inc., spent 3 years and $1,180,000 to develop its new line of club heads to replace

to invest $1,780,000 in new equipment. The new clubs are expected to generate an increase in operating cash inflows of $755,000 per year for the next 10 years. The company has determined that the existing line could be sold to

a competitor for $242,000.

a. How should the $1,180,000 in development costs be classified?

line that is becoming obsolete. To begin manufacturing them, the company will have

b. How should the $242,000 sale price for the existing line be classified?

c. What are all the relevant cash flows for years 0 thru 10? (Note: Assume that all of these numbers are net of taxes.)

O A. The $1,180,000 development costs should be considered part of the decision to go ahead with the new production. This money has already been spent as part of the investment project.

O B. The $1,180,000 development costs should not be considered part of the decision to go ahead with the new production. This money has already been spent and cannot be retrieved so it is an opportunity cost.

O C. The $1,180,000 development costs should be considered part of the decision to go ahead with the new production. This money has already been spent as part of the opportunity cost of the project.

O D. The $1,180,000 development costs should not be considered part of the decision to go ahead with the new production. This money has already been spent and cannot be retrieved so it is a sunk cost.

b. How should the $242,000 sale price for the existing line be classified? (Select the best answer below.)

O A. The $242,000 sale price of the existing line is a sunk cost. If Masters Golf Products proceeds with the new line of clubs the existing line worth $242,000 will be wasted.

O B. The $242,000 sale price of the existing line is an opportunity cost. If Masters Golf Products does not proceed with the new line of clubs it will lose the opportunity to recover the $242,000 in inventory.

O C. The $242,000 sale price of the existing line is an opportunity cost. If Masters Golf Products does not proceed with the new line of clubs they will not receive the $242,000.

O D. The $242,000 sale price of the existing line is a sunk cost. If Masters Golf Products does not proceed with the new line of clubs they will not receive the $242,000.

c. The cash flow for year 0 is $

(Round to the nearest dollar.)

The cash flow for years 1 thru 10 is $. (Round to the nearest dollar.)

Click to select your answer(s).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning