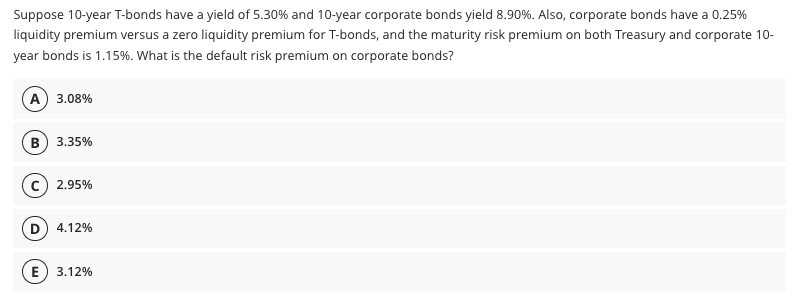

Suppose 10-year T-bonds have a yield of 5.30% and 10-year corporate bonds yield 8.90%. Also, corporate bonds have a 0.25% liquidity premium versus a zero liquidity premium for T-bonds, and the maturity risk premium on both Treasury and corporate 10- year bonds is 1.15%. What is the default risk premium on corporate bonds? А) 3.08% в) 3.35% c) 2.95% D 4.12% E) 3.12%

Suppose 10-year T-bonds have a yield of 5.30% and 10-year corporate bonds yield 8.90%. Also, corporate bonds have a 0.25% liquidity premium versus a zero liquidity premium for T-bonds, and the maturity risk premium on both Treasury and corporate 10- year bonds is 1.15%. What is the default risk premium on corporate bonds? А) 3.08% в) 3.35% c) 2.95% D 4.12% E) 3.12%

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter4: Bond Valuation

Section: Chapter Questions

Problem 5P: Default Risk Premium A Treasury bond that matures in 10 years has a yield of 6%. A 10-year corporate...

Related questions

Question

Transcribed Image Text:Suppose 10-year T-bonds have a yield of 5.30% and 10-year corporate bonds yield 8.90%. Also, corporate bonds have a 0.25%

liquidity premium versus a zero liquidity premium for T-bonds, and the maturity risk premium on both Treasury and corporate 10-

year bonds is 1.15%. What is the default risk premium on corporate bonds?

A) 3.08%

B) 3.35%

2.95%

D) 4.12%

E) 3.12%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College