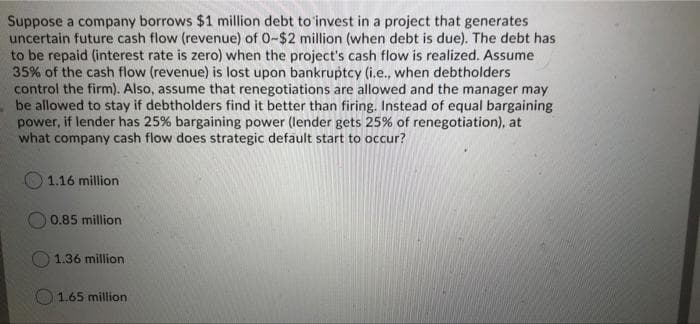

Suppose a company borrows $1 million debt to 'invest in a project that generates uncertain future cash flow (revenue) of 0-$2 million (when debt is due). The debt has to be repaid (interest rate is zero) when the project's cash flow is realized. Assume 35% of the cash flow (revenue) is lost upon bankruptcy (i.e., when debtholders control the firm). Also, assume that renegotiations are allowed and the manager may be allowed to stay if debtholders find it better than firing. Instead of equal bargaining power, if lender has 25% bargaining power (lender gets 25% of renegotiation), at what company cash flow does strategic default start to occur? O 1.16 million O 0.85 million 1.36 million O 1.65 million

Suppose a company borrows $1 million debt to 'invest in a project that generates uncertain future cash flow (revenue) of 0-$2 million (when debt is due). The debt has to be repaid (interest rate is zero) when the project's cash flow is realized. Assume 35% of the cash flow (revenue) is lost upon bankruptcy (i.e., when debtholders control the firm). Also, assume that renegotiations are allowed and the manager may be allowed to stay if debtholders find it better than firing. Instead of equal bargaining power, if lender has 25% bargaining power (lender gets 25% of renegotiation), at what company cash flow does strategic default start to occur? O 1.16 million O 0.85 million 1.36 million O 1.65 million

Chapter16: Working Capital Policy And Short-term Financing

Section: Chapter Questions

Problem 5P

Related questions

Question

Transcribed Image Text:Suppose a company borrows $1 million debt to'invest in a project that generates

uncertain future cash flow (revenue) of 0-$2 million (when debt is due). The debt has

to be repaid (interest rate is zero) when the project's cash flow is realized. Assume

35% of the cash flow (revenue) is lost upon bankruptcy (i.e., when debtholders

control the firm). Also, assume that renegotiations are allowed and the manager may

be allowed to stay if debtholders find it better than firing. Instead of equal bargaining

power, if lender has 25% bargaining power (lender gets 25% of renegotiation), at

what company cash flow does strategic default start to occur?

1.16 million

O 0.85 million

1.36 million

O1.65 million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT