Dark Creek Corporation's CEO is selecting between two mutually exclusive projects. The company is obligated to make a $3,700 payment to bondholders at the end of the year. To minimize agency cost, the firm's bondholders decide to use a bond covenant to stipulate that the bondholders can demand an additional payment if the company chooses to take on the high-volatility project. How much additional payment to bondholders would make stockholders indifferent between the two projects? Cash flows pertaining to the two projects are shown in the table below. Economy Probability 40 Low-Volatility Project Payoff High-Volatility Project Payoff $2,900 Bad $4,000 Good .60 4,800 6,300 O $1366.67 O $1166,67 O $1300.00 O $1233.33

Dark Creek Corporation's CEO is selecting between two mutually exclusive projects. The company is obligated to make a $3,700 payment to bondholders at the end of the year. To minimize agency cost, the firm's bondholders decide to use a bond covenant to stipulate that the bondholders can demand an additional payment if the company chooses to take on the high-volatility project. How much additional payment to bondholders would make stockholders indifferent between the two projects? Cash flows pertaining to the two projects are shown in the table below. Economy Probability 40 Low-Volatility Project Payoff High-Volatility Project Payoff $2,900 Bad $4,000 Good .60 4,800 6,300 O $1366.67 O $1166,67 O $1300.00 O $1233.33

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 1C

Related questions

Question

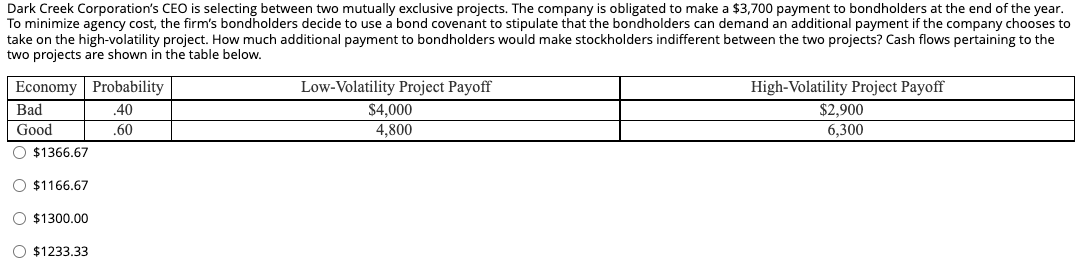

Transcribed Image Text:Dark Creek Corporation's CEO is selecting between two mutually exclusive projects. The company is obligated to make a $3,700 payment to bondholders at the end of the year.

To minimize agency cost, the firm's bondholders decide to use a bond covenant to stipulate that the bondholders can demand an additional payment if the company chooses to

take on the high-volatility project. How much additional payment to bondholders would make stockholders indifferent between the two projects? Cash flows pertaining to the

two projects are shown in the table below.

Economy Probability

Low-Volatility Project Payoff

High-Volatility Project Payoff

$2,900

$4,000

4,800

Bad

40

Good

.60

6,300

O $1366.67

O $1166.67

O $1300.00

O $1233,33

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning