Chapter17: Federal Deficits, Surpluses, And The National Debt

Section: Chapter Questions

Problem 7SQP

Related questions

Question

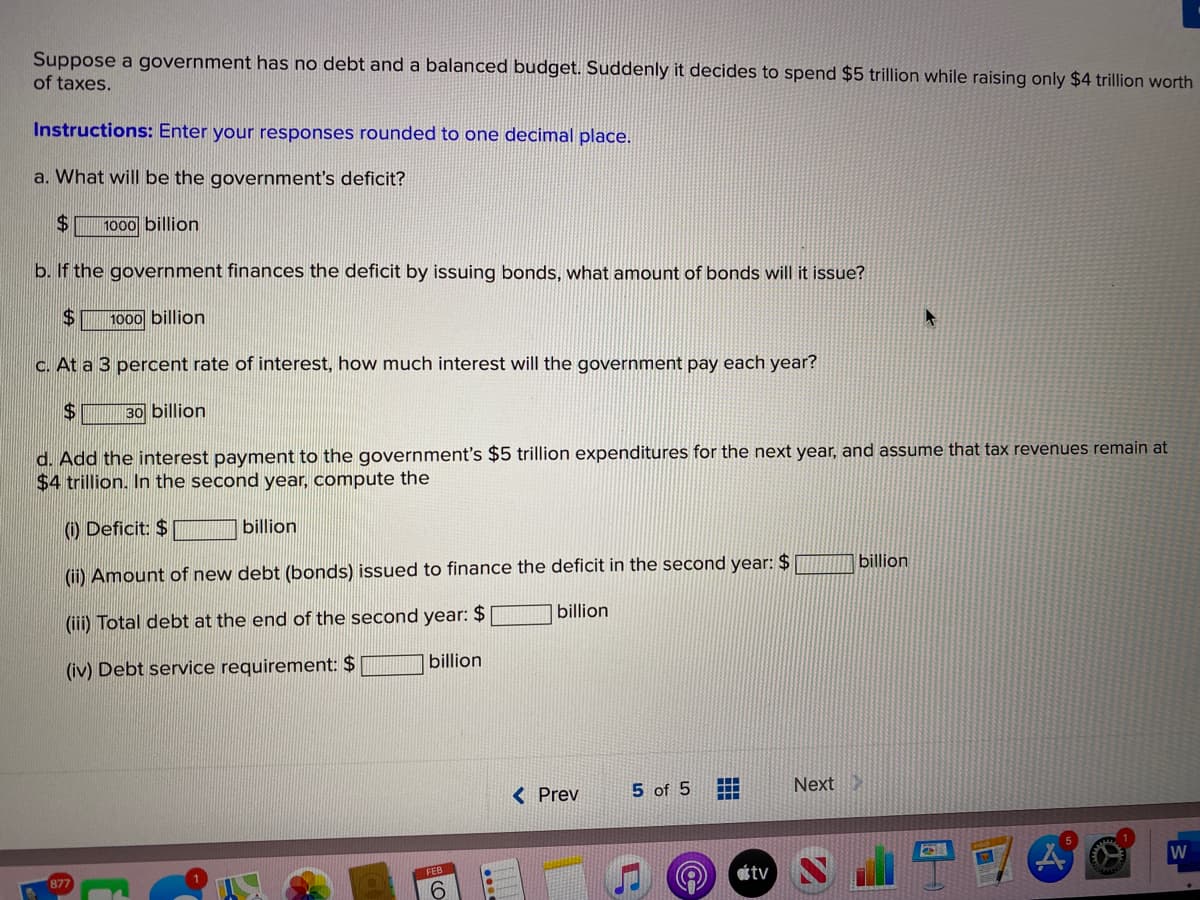

Transcribed Image Text:Suppose a government has no debt and a balanced budget. Suddenly it decides to spend $5 trillion while raising only $4 trillion worth

of taxes.

Instructions: Enter your responses rounded to one decimal place.

a. What will be the government's deficit?

24

1000 billion

b. If the government finances the deficit by issuing bonds, what amount of bonds will it issue?

$4

1000 billion

C. At a 3 percent rate of interest, how much interest will the government pay each year?

$4

30 billion

d. Add the interest payment to the government's $5 trillion expenditures for the next year, and assume that tax revenues remain at

$4 trillion. In the second year, compute the

() Deficit: $

billion

(ii) Amount of new debt (bonds) issued to finance the deficit in the second year: $

billion

(iii) Total debt at the end of the second year: $

billion

(iv) Debt service requirement: $

billion

< Prev

5 of 5

Next

W

tv N

FEB

877

9.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax