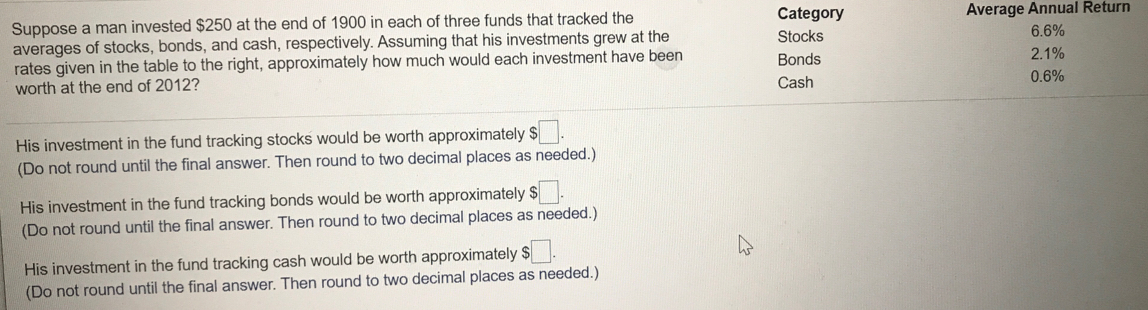

Suppose a man invested $250 at the end of 1900 in each of three funds that tracked the averages of stocks, bonds, and cash, respectively. Assuming that his investments grew at the rates given in the table to the right, approximately how much would each investment have been worth at the end of 2012? Category Average Annual Return Stocks 6.6% Bonds 2.1% Cash 0.6% His investment in the fund tracking stocks would be worth approximately $ (Do not round until the final answer. Then round to two decimal places as needed.) His investment in the fund tracking bonds would be worth approximately $ (Do not round until the final answer. Then round to two decimal places as needed.) His investment in the fund tracking cash would be worth approximately $ (Do not round until the final answer. Then round to two decimal places as needed.)

Suppose a man invested $250 at the end of 1900 in each of three funds that tracked the averages of stocks, bonds, and cash, respectively. Assuming that his investments grew at the rates given in the table to the right, approximately how much would each investment have been worth at the end of 2012? Category Average Annual Return Stocks 6.6% Bonds 2.1% Cash 0.6% His investment in the fund tracking stocks would be worth approximately $ (Do not round until the final answer. Then round to two decimal places as needed.) His investment in the fund tracking bonds would be worth approximately $ (Do not round until the final answer. Then round to two decimal places as needed.) His investment in the fund tracking cash would be worth approximately $ (Do not round until the final answer. Then round to two decimal places as needed.)

PFIN (with PFIN Online, 1 term (6 months) Printed Access Card) (New, Engaging Titles from 4LTR Press)

6th Edition

ISBN:9781337117005

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter13: Investing In Mutual Funds, Etfs, And Real Estate

Section: Chapter Questions

Problem 7FPE

Related questions

Question

100%

Transcribed Image Text:Suppose a man invested $250 at the end of 1900 in each of three funds that tracked the

averages of stocks, bonds, and cash, respectively. Assuming that his investments grew at the

rates given in the table to the right, approximately how much would each investment have been

worth at the end of 2012?

Category

Average Annual Return

Stocks

6.6%

Bonds

2.1%

Cash

0.6%

His investment in the fund tracking stocks would be worth approximately $

(Do not round until the final answer. Then round to two decimal places as needed.)

His investment in the fund tracking bonds would be worth approximately $

(Do not round until the final answer. Then round to two decimal places as needed.)

His investment in the fund tracking cash would be worth approximately $

(Do not round until the final answer. Then round to two decimal places as needed.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT