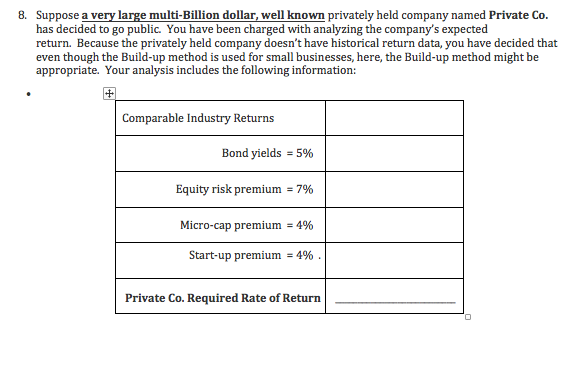

Suppose a very large multi-Billion dollar, well known privately held company named Private Co. has decided to go public. You have been charged with analyzing the company's expected return. Because the privately held company doesn't have historical return data, you have decided that even though the Build-up method is used for small businesses, here, the Build-up method might be appropriate. Your analysis includes the following information: 8. Comparable Industry Returns Bond yields 5% Equity risk premium = 7% Micro-cap premium = 4% Start-up premium = 4% Private Co. Required Rate of Return

Suppose a very large multi-Billion dollar, well known privately held company named Private Co. has decided to go public. You have been charged with analyzing the company's expected return. Because the privately held company doesn't have historical return data, you have decided that even though the Build-up method is used for small businesses, here, the Build-up method might be appropriate. Your analysis includes the following information: 8. Comparable Industry Returns Bond yields 5% Equity risk premium = 7% Micro-cap premium = 4% Start-up premium = 4% Private Co. Required Rate of Return

Chapter3: Evaluation Of Financial Performance

Section: Chapter Questions

Problem 12QTD

Related questions

Question

Transcribed Image Text:Suppose a very large multi-Billion dollar, well known privately held company named Private Co.

has decided to go public. You have been charged with analyzing the company's expected

return. Because the privately held company doesn't have historical return data, you have decided that

even though the Build-up method is used for small businesses, here, the Build-up method might be

appropriate. Your analysis includes the following information:

8.

Comparable Industry Returns

Bond yields 5%

Equity risk premium = 7%

Micro-cap premium = 4%

Start-up premium = 4%

Private Co. Required Rate of Return

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning