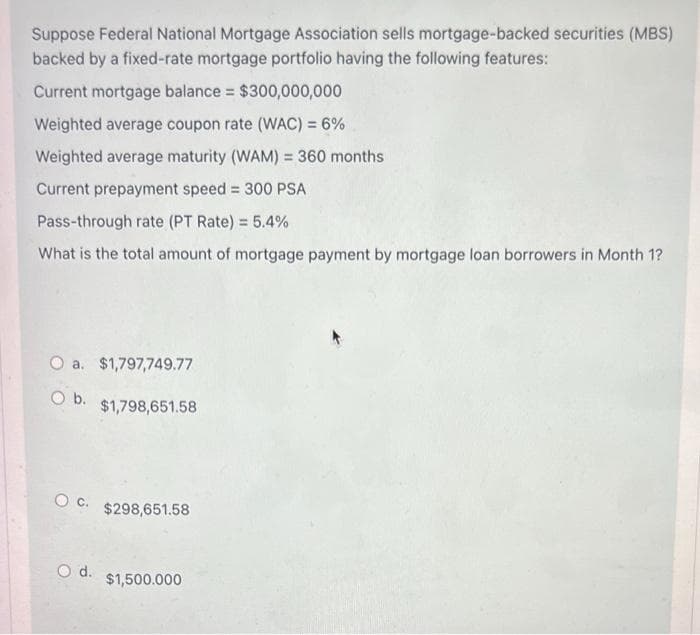

Suppose Federal National Mortgage Association sells mortgage-backed securities (MBS) backed by a fixed-rate mortgage portfolio having the following features: Current mortgage balance = $300,000,000 Weighted average coupon rate (WAC) = 6% Weighted average maturity (WAM) = 360 months Current prepayment speed = 300 PSA Pass-through rate (PT Rate) = 5.4% What is the total amount of mortgage payment by mortgage loan borrowers in Month 1?

Q: Which of the following presumption is correct about the reliability of audit evidence

A: Reliability of audit evidence :- Evidence from sources outside an entity is more reliable than…

Q: You think MBB stock has potential for an upward move in price. You have no position whatsoever in…

A: Current stock price is RM 12 View:- Bullish on MBB stock Two Possible Bullish option strategies that…

Q: Calculate the accrued interest (in $) and the total proceeds (in $) of the bond sale. (Round your…

A: Accrued interest is one of the features of accrual accounting which follows revenue recognition and…

Q: One of the mutually exclusive alternatives below must be selected Base your recommendation on…

A: Incremental Analysis: When two mutually exclusive projects have equal lives, incremental analysis…

Q: n all-equity firm currently has 1,000,000 shares of stock outstanding and is considering…

A: The earning per share is important factor for shareholders and if the EPS is increasing than it is…

Q: The following data pertains to Xena Corp. Xena Corp. Total Assets $23,610 Interest-Bearing Debt…

A: Cost of debt capital = Average borrowing rate for debt ×[1- Tax rate]

Q: The quick ratio is 1.7 while the current ratio is 2.5. The current liabilities amount to PHP5,000.…

A: Here, Quick Ratio is 1.7 Current Ratio is 2.5 Current Liabilities is PHP5,000 Cost of Good Sold is…

Q: compounded monthly to have that amount when it is due? What is the interest rate per period? | M…

A: Present Value: It represents the present worth of the future amount and is estimated by discounting…

Q: 3. Timmy borrows $10,000 and agree to make annual payments for five years (beginning one year after…

A: Borrowed amount = $10,000 Interest rate = 0.07 First payment = $1,000 Second payment = $2,000 Third…

Q: what it the firm’s cash conversion cycle?

A: Cash Conversion Cycle: It is a metric used in finance that indicates the time it takes for a firm…

Q: tive rate is 10% tive rate is 8% tive rate is 12%

A: Present value of financial liability i.e loan is the present value of future actual cashoutflows…

Q: How much money should be set aside today to provide an income of PHP 11,200 a month for 4 years if…

A: Monthly payment (C) = PHP 11,200 Number of payments (n) = 48 (4 Years * 12) Monthly interest rate…

Q: Cost of Equity with and without Flotation Jarett & Sons’s common stock currently trades at $30.00 a…

A: Cost of Equity without floatation cost: Given, Next Year's Dividend = 1 Share Price = 30 Growth = 4%…

Q: bank discount and proceeds for these notes. Assume that the notes were discounted on June 10 at a…

A: Notes are issued by the banks on discount and the customer have to pay the face value on the…

Q: What are the recommended options strategies when you expect the market has extreme (high)…

A: We have four basic option strategies: buy call, buy put, write call, and write put, because there…

Q: What amount of money invested today at 15% interest can provide the following scholarships: ₱30,000…

A: Interest rate = 15% Annual cash flow in first 6 years = P30,000 Annual cash flow in next 6 years =…

Q: Royal Arts Company has invested 18000 as the initial investment into a new project. the following…

A: Initial cost = 18000 Years 1 cash flow = 11000 Years 2 cash flow = 8000 Years 3 cash flow = 2000…

Q: What are the strengths and weaknesses for establishing base pay in international contexts for home…

A: In the home country based approach the pay compensation is based on the payment levels of the home…

Q: 30. Systematic versus Unsystematic Risk Consider on Stocks I and II: State of Probability of State…

A: Market risk premium is 7% Risk free rate is 4% To Find: Beta Standard deviation

Q: Apple Inc.’s 2021 Consolidated Financial Statements (FYE 9/25/21) reveal a $11,085,000,000 cash…

A: Before investing in new projects or assets, profitability of the project is evaluated by using…

Q: 1. Distinguish between the conventional and contemporary scope of public finance in your own words…

A: The study of government receipts and payments is referred to as public finance. The term 'finance'…

Q: What is the difference between a credit card and a debit card? O A credit card is loaned money, plus…

A: Debit card or debit card are the facilities given by the banks to their customers so that they can…

Q: A new baking machine costing $10,000 is purchased. Using a declining balance rate of 15 percent,…

A: Depreciation is the systematic allocation of cost of the asset over the useful life of asset. It…

Q: Exclusions from gross income, except: O Interest on the price of land covered by the Presidential…

A: As per Bureau of Internal Revenue(BIR) of republic of Philippines, certain items have been specified…

Q: Consider the exchange rate between U.S. Dollar and New Zealand Dollar: USD/NZD. If the exchange rate…

A: The price of a country's currency in reference to the currency of another country. When countries…

Q: Find the compound interest earned if PhP 31,496 is deposited in a bank at 2.6% compounded monthly…

A: Solved using Financial Calculator PV = -31,496 N = 26 I/Y = 2.6/12 = 0.2167 CPT FV = 33,319.17

Q: Amy will need PHP 1.75M on July 4, 2015. To prepare for this, she places equal deposits at the end…

A: Future value required on July 4 2015 (FV) = PHP 1,750,000 Interest rate (r) = 8% Number of annual…

Q: The management of Quest Media Inc. is considering two capital investment projects. The estimated net…

A: Standard Disclaimers“Since you have posted a question with multiple subparts, we will solve the…

Q: The company's WACC is 8.5%. What is the IRR of the better project? (Hint: The better project may or…

A: Internal Rate of Return: IRR makes the project's net present value equal to zero. Thus, the present…

Q: Given cash of 3 million; accounts payable of 5 million, gross profit of 30 million, sales of 20…

A: Current ratio = Current assets/Current liabilities

Q: . The value of a Bitcoin by the end of 2021 was 60.573€, the inflation in Europe is 6%. The…

A: Rate of exchange change according to inflation and interest rate in the market.

Q: alculate the present value o mediate of 100 per quarter ng a nominalinterest ra mpounded monthly.

A: Present value is the value today of annuity that will be equivalent today to future cash flow from…

Q: Fabric Outlet has 17,500 shares of stock outstanding with a par value of $1 per share. The current…

A: By splitting the stock, the market value per share will reduced because number of shares will…

Q: calculate the value of the Treasury note:

A: Bond: It represents a debt instrument issued to raise capital for the business. The issuer pays…

Q: i. Determine the outstanding balance on your current loan for the remaining 240 payments. ii. If…

A: Mortgage amortization refers to a schedule which is prepared to shows the periodic loan payments,…

Q: shares of Stock B that sell for 2. Portfolio Expected Return You own a portfolio that has $3,140…

A: Expected Return: The expected return is the minimum required rate of return which an investor…

Q: Assume the mean and standard deviation of sample returns are 8% and 10% respectively. Assuming…

A: Sample returns are 8% Standard deviation is 10% Returns are normally distributed To Find:…

Q: The sum of P4200 will be withdrawn from a fund at 3-month intervals, the first withdrawal to be made…

A: Solved using Financial Calculator PV = -48,000 FV = 6000 PMT = 4200 I/Y = 7 CPT N = 22.2304…

Q: Scenario 2: Bremily Firewood Company is expanding their operations. The company has an expansion…

A: NPV means PV of net benefits arises from the project during the project life. It is computed by…

Q: A company purchases a new asset for $400,000. It has a useful life of 8 years with a $80,000 salvage…

A: Explanation : Net Present value ( NPV) is that technique under capital budgeting which help for…

Q: The following bond list is from the business section of a financial newspaper on January 1, 2016.…

A: Given, The Coupon rate of bond 4.13% Term is 5 years The bond pays semi annual coupons

Q: Melvin Indecision has difficulty deciding whether to put his savings in Mystic Bank or Four Rivers…

A: Given,In this question, we are going to solve the payment made by melvin in terms of the…

Q: Lupo, Inc., has an average collection period of 52 days. Its average daily investment in receivables…

A: a) Given, Average collection period = 52 days Average collection period = 365/ Receivables turnover…

Q: Your textbook presents portfolio management in the context of projects. The author of Ch. 1 states…

A: The project portfolio management is a system of evaluating different projects and based on that,…

Q: Required: 1. Compute the net present value of Project A. (Enter negative values with a minus sign.…

A: Net present value (NPV) of an alternative/project refers to the variance between the initial…

Q: An officer of the state lottery commission has sampled lottery ticket purchasers over a 1-week…

A: Income from a project is the difference between the revenues received from the project and the costs…

Q: Assume that the reserve ratio is 23 percent and banks in the system are loaning out all their excess…

A: The banking system is made up all financial institutions that provide loans, accept deposits, and…

Q: Clark and Lana take a 30-year home mortgage of $127,000 at 7.9%, compounded monthly. They make their…

A: “Hi There, thanks for posting the question. But as per Q&A guidelines, we must answer the first…

Q: Company Data Fancy Flatware Standard Silverware Shiny Silver Shares outstanding 5 million 10 million…

A: Debt to total assets ratio can be defined as the ratio which gauges the total debt in relation to…

Q: Company A had a profit of $2 million last year. This company expects the profit to increase by 6%…

A: Given, Information regarding the company A is given to us. Profit=$2 million Rate of increase in…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

- Given that a seasoned 360-month agency mortgage pass-through security has currently a weighted average maturity (WAM) of 357 months. It has $400M outstanding balance, a 7.5% pass-through coupon rate, and 8.125% weighted average coupon (WAC). Assuming 125% PSA and a first month mortgage payment of $2,975,868, what is the expected prepayment for the first month? Group of answer choices $267,535 $267,470 $334,473 $334,647 None of the aboveSuppose GHI Bank has a portfolio of 8-year fixed rate mortgages with total principal amount of $50 million and interest rate is 9%. Interest is paid semi-annually and principal is scheduled to be repaid at maturity. GHI Bank finances its loan portfolio with six-month certificate of deposits (CDs) at an interest rate equal to six-month LIBOR plus 50 basis points. Question: Suppose GHI Bank enter into a 8-year fixed-floating interest rate swap is available with a notional amount of $50 million in which GHI Bank pays a fixed 8% every six months and received 6-month LIBOR. Explain how can the bank use this swap to hedge its interest rate exposure.Third Mortgage Investors makes money by purchasing mortgage backed securities (MBS), stripping them into interest only (IO) and principal only (PO) components, and selling the components for more than it paid for the original security. Suppose the company purchases a $100,000 Face value MBS carrying a coupon of 9 percent and a maturity of 30 years. Assume for the purpose of the following analysis, the MBS will make payments on an “ANNUAL BASIS.” 1) What is the annual payment on the MBS

- Suppose you purchase a T-bills that is 125 days from maturity for $9,765. The T-bills has a face value of $10,000.a. Calculate the T-bills’s quoted discount rate. b. Calculate the T-bills’s annualized rate.c. Who are the major issuers of and investors in money market securities?The MZ Mortgage Company is issuing a CMO with three tranches. The A tranche will consist of $40.5 million with a coupon of 8.25 percent. The B tranche will be issued with a coupon of 9.0 percent and a principal of $22.5 million. The Z tranche will carry a coupon of 10.0 percent with a principal of $45 million. The mortgages backing the security issue were originated at a fixed rate of 10 percent with a maturity of 10 years (annual payments). The issue will be overcollateralized by $4.5 million, and the issuer will receive all net cash flows after priority payments are made to each class of securities. Priority payments will be made to the class A tranche and will include the promised coupon, all amortization from the mortgage pool, and interest that will be accrued to the Z class until the principal of $40.5 million due to the A tranche is repaid. The B class securities will receive interest-only payments until the A-class is repaid and then will receive priority payments of…A CMO has been issued with 3 tranches and a residual. At origination: - Tranche A investors own $25 million of principal with a coupon rate of 3.50%. - Tranche B investors own $35 million of principal with a coupon rate of 3.70%. - Tranche Z investors own $8 million of principal with a coupon rate of 4.50%. The residual carries $1 million and receives all residual payments. Mortgages backing the security issued are fully amortizing fixed rate with mortgage rate of 4.50% with 30 year maturities and monthly payments. Assume no servicing/guarantee fee and no prepayments. What is the mortgage pool's starting balance at origination? Round your answers to cents (e.g. if your answer is $56000.0444, write 56000.04).

- A commercial bank invests in a loan with a current market value of $600,000 and a maturity of 3 years. The bank partially funds the loan by issuing a zero coupon bond with a maturity (principal) value of $450,000 and a duration of 3 years. The current market rate is 7% and interest rates are expected to increase by 1%. Which of the following statements is true? (a) The current equity value of the position is $150,000 and if interest rates increase the equity value will increase. (b) The current equity value of the position is $232,666 and if interest rates increase the equity value will increase. (c) The current equity value of the position is $232,666 and if interest rates increase the equity value will decrease. (d) The current equity value of the position is $150,000 and if interest rates increase the equity value will remain the same. (e) None of the given answers. The current equity value of the position is $232,666 and if interest rates increase the equity value will remain the…A mortgage pass-through security (PT) has a par value of $100,000, a 4% coupon paid monthly, and is based on 30 year mortgages. The current market rate for similar bonds is 3.5%, and prepayments currently equal $100 per month. Assume rates immediately rise to 4.5%, and prepayments drop to $40 as a result. The PT will now be paid off in month 310. What is the price of the PT today? Group of answer choices: $98,323.2214 $184,274.6844 $94,737.4877 $102,365.1248Third Mortgage Investors makes money by purchasing mortgage backed securities (MBS), stripping them into interest only (IO) and principal only (PO) components, and selling the components for more than it paid for the original security. Suppose the company purchases a $100,000 Face value MBS carrying a coupon of 9 percent and a maturity of 30 years. Assume for the purpose of the following analysis, the MBS will make payments on an “ANNUAL BASIS.” What is the remaining principal balance on the MBS if it survives 1-year? 3-years? 5 years? 8 years?

- Consider an FI with the following off-balance-sheet items: A two-year loan commitment with a face value of $120 million, a standby letter of credit with a face value of $20 million and trade-related letters of credit with a face value of $70 million. All counterparties have a credit rating of BBB. Assuming a required capital ratio of 8%, what is the capital amount the FI needs to hold against these exposures? ANSWER MUST BE 7.52 millionThird Mortgage Investors makes money by purchasing mortgage backed securities (MBS), stripping them into interest only (IO) and principal only (PO) components, and selling the components for more than it paid for the original security. Suppose the company purchases a $100,000 Face value MBS carrying a coupon of 9 percent and a maturity of 30 years. Assume for the purpose of the following analysis, the MBS will make payments on an “ANNUAL BASIS.” Years Survived Yield (%) 1 6.00 3 7.00 5 8.00 8 9.00 What is the total cash flow received by the purchasers of the IO strip, and the PO strip if the MBS survives 1 year? 3 years? 30 years?A bank has issued a six-month, $1.0 million negotiable CD with a 0.53 percent quoted annual interest rate (iCD, sp). a. Calculate the bond equivalent yield and the EAR on the CD. b. How much will the negotiable CD holder receive at maturity? c. Immediately after the CD is issued, the secondary market price on the $1 million CD falls to $998,900. Calculate the new secondary market quoted yield, the bond equivalent yield, and the EAR on the $1.0 million face value CD. Required A: Bond Equivalent Yield ___ EAR____ (Use 365 days in a year. Do not round intermediate calculations. Round your answers to 3 decimal places.) Required B: CD Holder will receive at maturity_____(Do not round intermediate calculations. Round your answer to nearest whole number.) Required C: Bond Equivalent Yield____ Secondary Market Quoted Yield______ EAR_____ (Use 365 days in a year. Do not round intermediate calculations. Round your answers to 4 decimal places.