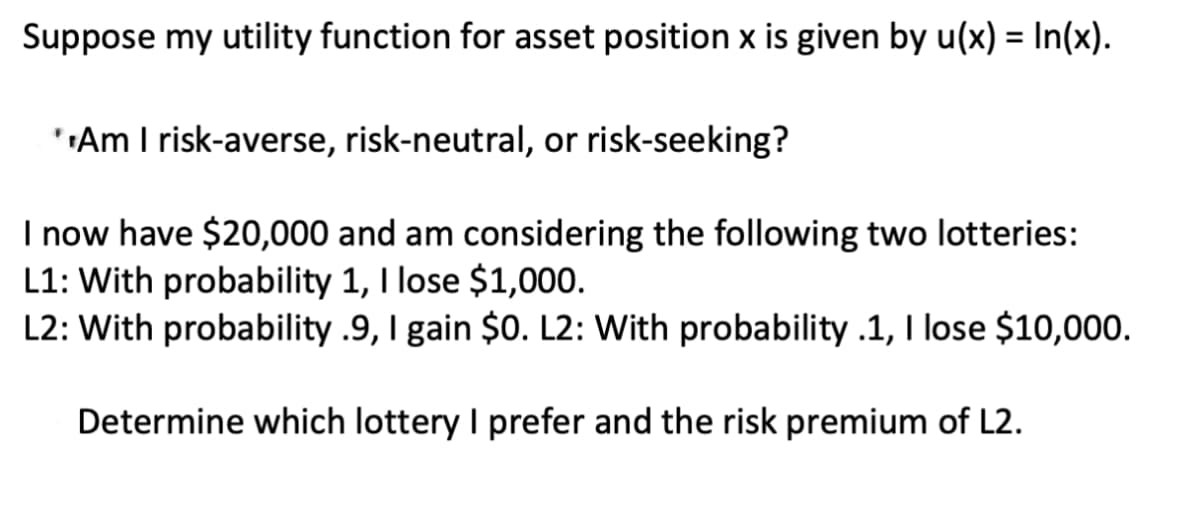

Suppose my utility function for asset position x is given by u(x) = In(x). **Am I risk-averse, risk-neutral, or risk-seeking? I now have $20,000 and am considering the following two lotteries: L1: With probability 1, I lose $1,000. L2: With probability .9, I gain $0. L2: With probability .1, I lose $10,000. Determine which lottery I prefer and the risk premium of L2.

Q: The following table shows the profile, by the math section of the SAT Reasoning Test, of admitted…

A: From the table, the total number of applicants is 70139. The number of applicants neither had math…

Q: 5.) How many different 4-letter radio station call letters are possible if: (a) The first letter…

A: It is given that 4-letter radio station call letters.

Q: (d) Use the known information on the estimate the true average age of the trees. Construct the 95%…

A: Tree No Diameter (x) Age (y) 1 12 125 2 11.4 119 3 7.9 83 4 9 85 5 10.5 99 6 7.9 117…

Q: Giving a test to a group of students, the grades and gender are summarized below. If one student was…

A: here suppose, A : student was female. B : student earned B here we need to find P(A or B) As…

Q: A particular fruit's weights are normally distributed, with a mean of 342 grams and a standard…

A: given data normal distribution μ = 342σ = 9n = 15P(337<x¯<339) = ?

Q: A certain transmission system has 2 transmission modes. In Mode 1, the transmitted signal X is…

A: Hello! As you have posted more than 3 sub parts, we are answering the first 3 sub-parts. In case…

Q: For the two events E, F, let P(F) = 0.240, P(E I F') = 0.303, and P(E I F) = 0.375. Find: (i) P(E ∩…

A: Given,P(F)=0.240P(E|F')=0.303P(E|F)=0.375

Q: In a bolt manufacturing factory, there are four machines A,B,C and D, manufacturing 15%, 20%, 30%…

A: Let F= defective…

Q: To evaluate the effectiveness review sessions, a professor gave a pre-test before the review, and a…

A: 1. Suppose μd̄ is the difference of the population mean of post-test (x2) and pre-test (x1) scores.

Q: Problem 4 Let X₁,...,Xn be independent random variables with values in (1,...,x) and probability…

A:

Q: To calculate the margin of error of a sample estimate, you must know all but which one of the…

A: Followings are the Explanation of the question Formula for the Margin of Error ME=Zc*σn…

Q: special deck of 20 cards has 5 that are red, 5 yellow, 5 green, and 5 blue. The five cards of each…

A: It is given that a special deck of 20 cards has 5 that are red, 5 yellow, 5 green, and 5 blue.

Q: Q7. Suppose that someone makes an average of one spelling mistake per email they send. What is the…

A: Given: An average of one spelling mistake is made per email.

Q: P(Student was male) P(Student was female) P(Student was male and got an "A") = = te your

A: It is given that Total students = 66 Male students = 26 Female students = 40 Student was male and…

Q: A number cube Is rolled three times. An outcome is represented by a string of the sort OEE (meaning…

A:

Q: Check FULL HD 4 X (b) Subtract. 43°F Cloudy 0 0 not X 00000 P(not x) = 0 1-P (not X) = P(x) = 0 (c)…

A: It is given that X be the event that the wheel stops on a white slice and not X be the event that…

Q: Step 1. Hypotheses Set-Up: Ho: Select an answer ✓ = Ha: Select an answer ? V Step 2. The…

A: It is given that the population standard deviation of TV watching times for teenagers is different…

Q: A manufacturing firm finds that 70% of its new hires turn out to be good workers, and 30% become…

A: Method: Using the probability tree diagram

Q: Show that if S= == [": x(t) dt 10 then E(s) (1 -10 (10-|T) R. (T) dr

A: Given that s=∫010XtdtEs2=∫-101010-τRxτdτ

Q: lass. For a 4-period class, students should spend an average of 12 hours studying for the on…

A: given data bell shaped distribution μ = 13 hoursσ = 3 hours99.7% ofstudents have study hours…

Q: 2.) A couple has narrowed down the choice of a name for their new baby to 4 first names and 5 middle…

A: Given A couple has narrowed down the choice of a name for their new baby to 4 first names and 5…

Q: A large portfolio of policies is such that a proportion of p, 0<p<1 incurred claims during the last…

A: Solution: Let X be the number of policies with claim. From the given information, n=25 and p=0.1.

Q: . The mean life of a battery is 50 hours with a standard deviation of 6 hours. The manufacturer…

A: Given Mean =50 hours standard deviations=6 hours

Q: How about for b) b) What is the probability that a defective part is produced at this factory?

A: From the given information, the probability of products producing by first machine is 0.35. The…

Q: Recall that a poker hand consists of 5 cards from a standard deck of 52. In Exercises 15-18, find…

A: The probability of an event is the ratio of the number of cases favorable to that event to the total…

Q: a. For this study, we should use Select an answer b. The null and alternative hypotheses would be:…

A: Followings are the explanation of the question Use the one sample Z proportion test The following…

Q: Sales delay is the elapsed time between the manufacture of a product and its sale. According an…

A: Given information: μ=2.06σ2=0.03 Determine the mean and standard deviation of the given distribution…

Q: 10. Let (X, Y) have the joint p.d.f. given by: {1 1, if yl <x, 0<x< 1 otherwise Show that the…

A:

Q: Texas Instruments produces computer chips in production runs of 1 million at a time. It has found…

A: Hello! As you have posted more than 3 sub parts, we are answering the first 3 sub-parts. In case…

Q: i) Use an appropriate method to show that W = is a pivotal quantity. ii) Construct a 90% upper…

A: A quantity is said to be pivotal quantity if it's distribution is free from parameter of interest.

Q: 3. A group of people were asked if they had run a red light in the last year. 150 responded “yes”,…

A: Given,no.of people had run ared light in the last year=150no.of people responded "no" =185Total…

Q: How did u get the 18?

A: Probability = favorable/total Total balls = 8 Numbered from 1 to 8

Q: A rondom Variable x takes value X; with Probability Pi with i=1N labelling all possibilities. The…

A:

Q: You want to obtain a sample to estimate a population proportion. Based on previous evidence, you…

A: We have given that when true population percentage is p = 90% = 0.90 Significance level (α) = 1 -…

Q: Compute the probability of 7 successes in a random sample of size n = 15 obtained from a population…

A: given data N=40X=20p=xn =2040 =0.50n=15x= no of successp=0.50q=1-0.50=0.50p(X=x)=nCx * px *qn-x…

Q: H.W3: A fair dice is thrown; find the amount of information gained if you are told that no. 4 will…

A: Given problem Given that A fair dice is thrown. We have to find the amount of information…

Q: Let A. B, C be three events in the sample space S. Write down the expression for the event that at…

A: It is given that A, B and C are three events in the sample space S.

Q: There are two spinners containing only white and purple slices Spinner A has 12 white slices and 3…

A: Here we have given that spinner A has 12 white and 3 purple slices And B has 5 white and 15…

Q: and the Cumbillabice diambition function of hubo randomly chosen points of the con F(x) = 2 lifbe AO…

A: We have to find the cumulative distribution function of the distance of two randomly choosen points…

Q: The table below shows the number of survey subjects who have received and not received a speeding…

A: Speeding Ticket No Speeding Ticket Total Red Car 199 162 361 Not Red Car 123 151 274 Total…

Q: 55 use microwave ovens; 66 use electric ranges; 56 use gas ranges; 18 use microwave ovens and…

A:

Q: Suppose best buy offers an extended warranty for $25 on an electronic device whose value is $250.…

A: Given Probability of claim for warranty=5% Refund on warranty claim=$250

Q: Let X be a random variable with distribution Ber(p) and let n be a natural number. Find the…

A: It is given that X follows Ber(p), then X can take values 0 and 1 with probabilities (1 - p) and P…

Q: Find the CDF of the distance of two randomly chosen points of the [0,11] interval. F(x) = if x11.

A: Solution - Given that, Find the CDF of the distance of two randomly chosen of the [0,11] interval

Q: A green marble is drawn. What is the probability that it came from Jar 2?

A: Let us define some events A : Jar 1 is selected. B : Jar 2 is selected C : Jar 3 is selected. E :…

Q: pianist plans to play 4 pieces at a recital from her repertoire of 26 pieces. How many different…

A: given data, A pianist plans to play 4 pieces at a recital from her repertoire of 26 pieceswe have to…

Q: ii. Create a 99% confidence interval for the proportion of all wheat bread rolls produced from Ideal…

A: (ii)

Q: i) Find the sampling distribution of the statistic W = X₁ + 2X₂ − X3 + X₁ + X5. ii) What is the…

A:

Q: The probability density function of a continuous random variable X is given by y=4−2x from x=1…

A: A continuous function f(x) is the probability density function of the continuous random variable X…

Q: This year, there are ten freshmen, seven sophomores, ten juniors, and eight seniors are eligible to…

A: Followings are the Explanation of the question Number of ways to select k items from n, nCk= n!/(k!…

Step by step

Solved in 3 steps with 3 images

- Suppose that you would like to create composite indexes from three stocks: stk1, stk2, stk3. Their stock prices (Pt) and total shares outstanding (Qt) from day 0 to day 1 are shown as follows: stk3 splits two-for-one in day 1. P0 Q0 P1 Q1 stk1 40 250 50 250 stk2 50 100 50 100 stk3 60 150 50 300 Which answer is the closest value to the rate of return on a price-weighted index of the three stocks? A. 20% B. 25% C. 30% D. 35%Suppose that a life insurance company insures 1 million 50-year-old people in a given year. (Assume a death rate of 5 per 1000 people.) The cost of the premium is $200 per year, and the death benefit is $50,000 What is the expected profit or loss for the insurance company?Suppose that spot and futures prices of the underlying asset when hedge is initiated are $3.10 and $2.50 respectively, and when hedge is closed out are $2.90 and $2.80 respectively. 1. What is the meaning of above numbers? 2. What is the basis risk when hedge is initiated? 3. What is the basis risk when hedge is closed out? 4. Is it a perfect hedge? 5. What will be the effective price received (paid) for the hedging asset? (S₂ + F₁-F₂

- A corporate bond that pays 4% per annum semi-annually has a yield of 3% p.a. withcontinuous compounding and a remaining life of 1.5 years (immediate after couponpayment). The yield on a similar risk-free bond is 2% p.a. with continuous compounding. The risk-free rates are 1% p.a. with continuous compounding for all maturities.Assume that the unconditional probability of default per every six months is a constantand that defaults can happen at the end of every six months (immediate before couponpayment). The recovery rate is 40%. Estimate the unconditional probability of defaultusing the “more exact calculation”.The government is attempting to determine whetherimmigrants should be tested for a contagious disease. Let’sassume that the decision will be made on a financial basis.Assume that each immigrant who is allowed into the countryand has the disease costs the United States $100,000, andeach immigrant who enters and does not have the diseasewill contribute $10,000 to the national economy. Assumethat 10% of all potential immigrants have the disease. Thegovernment may admit all immigrants, admit no immigrants,or test immigrants for the disease before determiningwhether they should be admitted. It costs $100 to test aperson for the disease; the test result is either positive ornegative. If the test result is positive, the person definitelyhas the disease. However, 20% of all people who do havethe disease test negative. A person who does not have thedisease always tests negative. The government’s goal is tomaximize (per potential immigrant) expected benefits minusexpected costs. Use a decision…A forward contract exists for a unit of two-year government securities with delivery to take place three years from now. Suppose the price of these securities three years from now is uniformly distributed from a low $800 to a high of $1,400. The one-year expected riskless rate of interest is 5 percent for all periods under consideration. If investors are risk neutral, what should be the current forward price? Suppose now that investors are risk averse and that the forward price is $1,200. What do you know about the relationship between the market value of two-year government securities and overall consumption? Continue to assume (as in (ii)) that the current forward price (at time 0) is $1,200. One year from now (at time 1) the forward price for the same item and same delivery date is $1,000. Determine the time 1 value (to the buyer) of the contract that was agreed upon at time 0.

- Suppose that 2% of the employed lose their job each month. Further suppose that 25% of the unemployed find a job each month. a. What is the average duration of employment in this labor market? b. Do you think this is a reasonable figure given estimates of the natural rate? Why or why not? c. If you wanted to reduce the steady-state level of unemployment, what type of policies might you pursue and why?Suppose that a consumer cannot vary hours of work as he or she chooses. In particular, he or she must choose between working q hours and not working at all, where q > 0. Suppose that dividend income is zero, and that the consumer pays a tax T if he or she works, and receives a benefit b when not working, interpreted as an unemployment insurance payment. a. If the wage rate increases, how does this affect the consumer’s hours of work? What does this have to say about what we would observe about the behavior of actual consumers when wages change? Explained also with the graph b. Suppose that the unemployment insurance benefit increases. How will this affect hours of work? Explain the implications of this for unemployment insurance programs. Explained also with the graphAn online cosmetic seller intends to send parcel on Cash On delivery in an attempt to increase her business. One out of every 10 parcels are returned, and the seller loses Rs. 350 (paid for delivery). But if the parcel is received, she gets a flat profit of Rs. 1000. Should she go for this new strategy? What is her expected net gain on each parcel?

- An investor has decided to commit no more than $80,000 to the purchase of the common stocks of two companies, Company A and Company B. He has also estimated that there is a chance of at most a 1% capital loss on his investment in Company A and a chance of at most a 4% loss on his investment in Company B, and he has decided that these losses should not exceed $2000. On the other hand, he expects to make a(n) 15% profit from his investment in Company A and a(n) 18% profit from his investment in Company B. Determine how much he should invest in the stock of each company (x dollars in Company A and y dollars in Company B) in order to maximize his investment returns. What are the (x,y) values? What is the optimal profit?An investor has decided to commit no more than $80,000 to the purchase of the common stocks of two companies, Company A and Company B. He has also estimated that there is a chance of at most a 1% capital loss on his investment in Company A and a chance of at most a 4% loss on his investment in Company B, and he has decided that these losses should not exceed $2000. On the other hand, he expects to make a(n) 15% profit from his investment in Company A and a(n) 18% profit from his investment in Company B. Determine how much he should invest in the stock of each company (x dollars in Company A and y dollars in Company B) in order to maximize his investment returns.(x, y)= What is the optimal profit?$Mike, a lumber wholesaler, is considering the purchase of a (railroad) car- load of varied dimensional lumber. He calculates that the probabilities of reselling the load for $10,000, $9000, and for $8000 are 0.22, 0.33, and 0.45 respectively. In order to ensure an expected profit of $3000, how much can Mike pay for the load