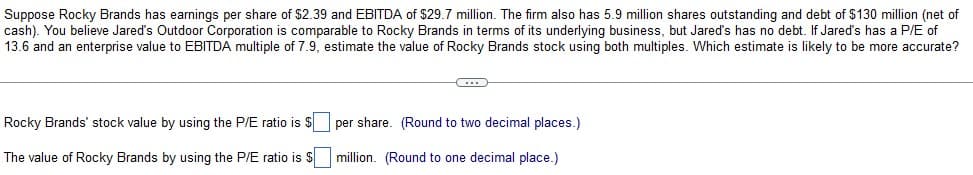

Suppose Rocky Brands has earnings per share of $2.39 and EBITDA of $29.7 million. The firm also has 5.9 million shares outstanding and debt of $130 million (net of cash). You believe Jared's Outdoor Corporation is comparable to Rocky Brands in terms of its underlying business, but Jared's has no debt. If Jared's has a P/E of 13.6 and an enterprise value to EBITDA multiple of 7.9, estimate the value of Rocky Brands stock using both multiples. Which estimate is likely to be more accurate? Rocky Brands' stock value by using the P/E ratio is $ The value of Rocky Brands by using the P/E ratio is $ per share. (Round to two decimal places.) million. (Round to one decimal place.)

Suppose Rocky Brands has earnings per share of $2.39 and EBITDA of $29.7 million. The firm also has 5.9 million shares outstanding and debt of $130 million (net of cash). You believe Jared's Outdoor Corporation is comparable to Rocky Brands in terms of its underlying business, but Jared's has no debt. If Jared's has a P/E of 13.6 and an enterprise value to EBITDA multiple of 7.9, estimate the value of Rocky Brands stock using both multiples. Which estimate is likely to be more accurate? Rocky Brands' stock value by using the P/E ratio is $ The value of Rocky Brands by using the P/E ratio is $ per share. (Round to two decimal places.) million. (Round to one decimal place.)

Chapter14: Distributions To Shareholders: Dividends And Repurchases

Section: Chapter Questions

Problem 12P

Related questions

Question

Transcribed Image Text:Suppose Rocky Brands has earnings per share of $2.39 and EBITDA of $29.7 million. The firm also has 5.9 million shares outstanding and debt of $130 million (net of

cash). You believe Jared's Outdoor Corporation is comparable to Rocky Brands in terms of its underlying business, but Jared's has no debt. If Jared's has a P/E of

13.6 and an enterprise value to EBITDA multiple of 7.9, estimate the value of Rocky Brands stock using both multiples. Which estimate is likely to be more accurate?

Rocky Brands' stock value by using the P/E ratio is $

The value of Rocky Brands by using the P/E ratio is $

per share. (Round to two decimal places.)

million. (Round to one decimal place.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College