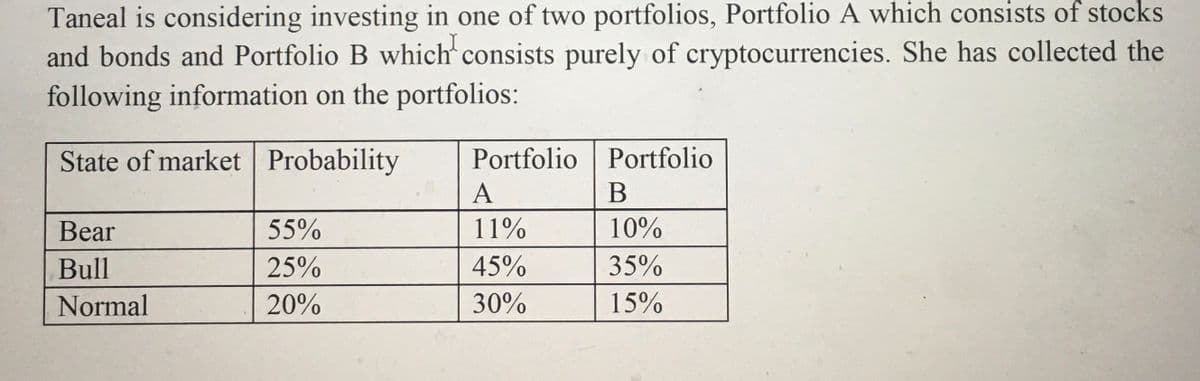

and bonds and Portfolio B which consists purely of cryptoc following information on the portfolios: State of market Probability Bear Bull Normal 55% 25% 20% Portfolio Portfolio A B 11% 10% 45% 35% 30% 15%

Q: Array intends to allocate her savings into various types of financial investments. She has $110,900…

A: The total amount to Invest is $110,900 Given ratio: Stocks : Bonds : Mutual funds =215 : 1311 :91 To…

Q: The Small Business Administration offers business loans at 5.75% interest compounded monthly for 7…

A: Given Monthly payment is $650 rate is 5.75% Term is 7 years

Q: 9. Joe Jones went to his bank to find out how long it will take for $1,000 to amount to $1,350 at 9…

A: Initial amount (P) = $1,000 Accumulated value (AV) = $1,350 Interest rate (r) = 0.09 Period (n) = ?

Q: Freight Terms Determine the amount to be paid in full settlement of each of two invoices, (a) and…

A: The fight term states who is liable to pay for the freight charges. The freight charges are related…

Q: Complete the following, using ordinary interest. (Use Days in a year table.) Note: Do not round…

A: Given, Principal is $1500 Interest rate is 12%

Q: Discuss and explain how using debt ratios applies to your personal finances

A: Personal finance refers to the process in which financial activities are planned and managed like…

Q: What is the share price for year 1 to 3

A: We have to find the share price at the end of each of the first three years. Share price will always…

Q: What is the coupon payment for a bond with a face value of $1000 that currently sells for $1250 if…

A: Coupon payment Coupon payment The interest paid for the bond is known as a coupon payment. The…

Q: The break-even point is that at which: Select one: O A. The level of activity at which the business…

A: Solution:- Break-even point is the point where the total costs of a business are equal to the total…

Q: Covidam Company clinches a contract to supply cleaning services to a nursing home for the next 5…

A: Here, To Find: Part A. Weighted average cost of capital and initial cash flows =? Part B. NPV and…

Q: Robert bought shares of 6% $100 face value at a price of $120. Sam bought shares of 8% $20 face…

A: Data given: Robert: Rate= 6% Face value=$100 Share price = $120. Sam Rate= 8% Face value=$20…

Q: What would be concluded about the South African Mobile Phone sector between 2008 and 2011? A. The…

A: Stock markets show ups and downs and stocks market are quite volatile in nature but overall market…

Q: Thanks to acquisition of a key patent, your company now has exclusive production rights for special…

A: Net present value (NPV) is a financial measure used by companies to assess the profitability of…

Q: Why do i need to divide by 2?

A: Given: The bonds make semiannual coupon payments

Q: e XXX Co. currently has debt with a market value of $300 million outstanding. The debt consists of…

A: Weighted average cost of capital is the weighted cost of debt, weighted cost of preferred stock and…

Q: Calculate the weighted mean from the following sales: $400, $700, $300, $600, $300, $400, $700…

A: Weighted mean:-The weighted mean is a sort of mean that is computed by dividing the weight (or…

Q: As an analyst for a domestic equity–income mutual fund, Robert Ass is evaluating Mosah Water Company…

A: Based on the information provided, we have to estimate the CAPM based required return on equity for…

Q: The treasurer of a firm has an opportunity to purchase a secured 15% mortgage with 5 years remaining…

A: NPV is net present value is the difference between the present value of cash flow and initial…

Q: Consider the following information about the various states of economy and the returns of various…

A: Formula for calculating Mean, Standard deviation and coefficient of variation with probability is as…

Q: Annapurna Trading Ltd. is evaluating two mutually exclusive projects: Project A and Project B. The…

A: As per our guidelines, we are supposed to answer only 3 sub-parts (if there are multiple sub-parts…

Q: Required: 1. Using Excel, calculate the NPV and IRR of each project. Assume Gunnell Incorporated…

A: NPV = - Initial cash outlay + Present value of cash flows IRR is the internal rate of return or the…

Q: You want to buy a $15,000 car. The company offering a 3% interest rate for 60 months (5 years). What…

A: To calculate the monthly payment we will use the below formula Monthly payment = PV/[1-(1+r)-n]/r…

Q: Problem # 3 For an interest rate of 8% per year, compounded every 2 months, determine the nominal…

A: Solution:- Nominal interest rate for the period means the interest rate charged per annum compounded…

Q: Internet Café First Quarter Forecast with Mini Van Loan Downtown Internet Café is planning to buy a…

A: Vehicle loans are very common now days because they help you buy vehicle easily and you pay monthly…

Q: Consider the following information about the various states of the economy and the returns of…

A: Probability T-Bills Philips Pay-up Rubber-Made Market Index 0.2 7% -22% 28% 10% -13% 0.1 7% -2%…

Q: Which of the following investments will have the highest future value atthe end of 10 years? Assume…

A: Type Payment Frequency Time Period End or Beginning Investment C $ 125.00 2 10 Beginning…

Q: 8. A firm has to pay a dividend of $1.20 per share till perpetuity, a zero growth rate of dividends,…

A: Preferred stock is a type of equity. These shares entitle the holders of the preference shares to a…

Q: Suppose that Shopify Inc. (SHOP) is selling for $36.00. Analysts believe that the growth rate for…

A:

Q: John Mesa, CFA, is a portfolio manager in the Trust Department of BigBanc. Mesa has been asked to…

A: Summary of expenses and income: Expenses: 1. Annual after-tax living costs are expected to be…

Q: Anos 0 1 23 4 5 6 Fluxo de Caixa ($) 0 290.000,00 140.000,00 200.000,00 -1.240.000,00 800.000,00…

A: IRR is the rate at which initial invest equal to the present value of all cash flows. Net present…

Q: Consider a European call on Procter and Gamble stock (PG) that expires in one period. The current…

A:

Q: The Gallery offers credit to its customers at a rate of 1.6 percent per month. What is the effective…

A: To calculate the effective annual rate we will use the below formula Effective annual rate =…

Q: a b C d e Sinking Fund Payment Payment Period every 6 months every year every 3 months every month…

A: Sinking fund payment required to attain the given future value can be calculated using following…

Q: Pick the two answers to the following is the Federal Reserve obligated (required) to act as a lender…

A: An organisation that offers loans to banks or other eligible institutions that are experiencing…

Q: What is the tex-equivalent interest rate needed if you purchase a municipal bond wiht a face value…

A: Municipal bonds are bonds issued by state or local governments. They are generally tax exempt.

Q: Bellamee Ltd has bonds outstanding with five years to maturity and are priced at $920.87. If the…

A: Face Value = $1,000 Coupon Rate = 7% Time Period = 5 years Price = $920.87

Q: 3. Dave's Guitar Shop is thinking about building an additional property onto the back of its…

A: Given, The total assets are P5,000,000 Total liabilities are P25,000

Q: What would the future value of $125 be after 8 years at 8.5% compound interest? a. $205.83 b.…

A: To caculate the future value we will use the below formula Future value = P*(1+r)n Where P -…

Q: Calculate the Total Cost, total, depreciation and annual depreceation for the following assets by…

A: Solution:- Depreciation is the wear and tear cost of an asset. It is the cost of using an asset. As…

Q: if we see an increase in default rates, what may that mean for the junk bond market and for…

A: Junk bonds are those bonds that carry a very high risk of default. These bonds are issued by…

Q: Using the cost of new common stock, the firm's WACC is?

A: Given: Weight of long-term debt 50% Weight of preferred stock 15% Weight of common stock equity…

Q: Provide the missing data in the following table: (Round "Turnover" answers to 1 decimal place.)…

A: We will use the concept of financial ratios to solve this equation. Financial ratios is based on the…

Q: Criselda travelled to Kota Kinabalu in Malaysia. At the airport, she saw the following information…

A: Criselda changed 460 SGD to MYR. So Criselda has to sell SGD to get MYR and Currency exchange…

Q: The Dental Clinic, Inc. is contemplating replacing an obsolete word processing system with one of…

A:

Q: Molly Ellen, bookkeeper for Keystone Company, forgot to send in the payroll taxes due on April 15.…

A: Here, Due date 15-April Settlement date 8-November Penalty charged by simple interest 8%…

Q: 8. A portfolio consists of bonds, stocks, commodities and real estates. The portfolio weightings,…

A: Weight Expected return Variance(%) Bonds 50% 8% 10% Stocks 10% 12% 30% Commodities 15% 20%…

Q: Question 2 Jeanius plc is considering an investment of £10 million in a new trouser production…

A: The initial Cash flow requirement is 10 million The required return is 7.5% Total units of…

Q: You are given the following information for Wine and Cork Enterprises (WCE): rRF = 2%; rM = 10%;…

A: Risk free rate is the minimum interest one can receive in the market without taking up any risk.…

Q: You can afford a $1300 per month mortgage payment. You've found a 30 year loan at 8% interest. a)…

A: Monthly payment (P) = $1300 Period = 30 Years Number of monthly paymenst (n) = 30*12 = 360 Interest…

Q: On November 1, 2012, Anderson Corp. sold a $500 million bond issue to finance the purchase of a new…

A: Given The Face value of bond $1000 Coupon rate is 12%

a) Calculate the expected returns for both portfolios

b) Calculate the standard deviation for portfolio A.

Step by step

Solved in 2 steps

Suppose Taneal is considering combining the two portfolios into a single portfolio. If she invests 60% in Portfolio A and 40% in Portfolio B:

i. Determine the return of the new portfolio

ii. If the standard deviation for portfolio B was 19%, comment on the risk of the new portfolio, supported with calculations.

iii. Should Taneal combine these two portfolios? Why?

- Your client, Bo Regard, holds a complete portfolio that consists of a portfolio of risky assets (P) and T-Bills. The information below refers to these assets. E(Rp) 12.00 % Standard Deviation of P 7.20 % T-Bill rate 3.60 % Proportion of Complete Portfolio in P 80 % Proportion of Complete Portfolio in T-Bills 20 % Composition of P: Stock A 40.00 % Stock B 25.00 % Stock C 35.00 % Total 100.00 % What are the proportions of stocks A, B, and C, respectively, in Bo's complete portfolio? A. 40%, 25%, 35% B. 8%, 5%, 7% C. 20%, 12.5%, 17.5% D. 32%, 20%, 28% E. 16%, 10%, 14%Christy is considering investing in the common stock of One Liberty and Heico. The following data are available for these two securities: One Liberty Heico Expected return 0.12 0.16 Standard deviation of returns 0.08 0.20 If she invests 30% of her funds in Heico and 70% in One Liberty, and if the correlation of returns between these securities is +0.65, what is the portfolio's expected return and standard deviation?The following data are available to you as portfolio manager: Security Estimated return (%) Beta A 40 3.0 B 35 2.5 C 30 1.0 D 17.5 1.8 E 20.0 1.5 Market Index 25 2.0 Government Security 17 0 In terms of the security market line, which of the securities listed above are underpriced? Assuming that a portfolio is constructed using equal proportions of the five securities listed above, calculate the expected return and risk of such a portfolio

- Yessy Enterprise Ltd has prepared the following information regarding two investments under consideration. Based on the risk/return profile, which investment should be accepted? Investment A Investment B Probability Return Probability Return 0.15 8% 0.20 1% 0.35 11% 0.30 8% 0.35 19% 0.30 15% 0.15 -2% 0.20 9% Will you change your recommendation (above) if Yessy Enterprise currently holds a portfolio with only five stocks? Why?Rachel is a financial investor who actively buys and sells in the securities market. Now she has a portfolio of all blue chips, including: $13,500 of Share A, $7,600 of Share B, $14,700 of Share C, and $5,500 of Share D. (a) Compute the weights of the assets in Rachel’s portfolio?(b) Find the geometric average return (c)Find the risk free rate of return (d)Find the expected rate of return of the portfolioJJ is a risk-averse investor, she cannot decide whether to invest in stock A or Stock B or in a portfolio that is a combination of both stocks. He has approached the bank and the company has provided her with the following information Probability (%) Expected return (%) Stock A Expected return (%) Stock B 30 13 15 20 14 13 20 15 12 30 16 11 Using these stocks, he has identified two investment portfolio alternatives: Alternative Portfolio 1 100% of A 2 30% of A and 60% of B Calculation the portfolio return and standard deviation for each alternative

- Assume that when investing in the risky portfolio, the investor must choose between just two risky assets: an equity fund and a corporate bond fund. The equity fund has an expected return of 35% and a standard deviation of 28%. The corporate bond fund has an expected return of 15% and a standard deviation of 15%. The equity fund and the corporate bond fund returns have a correlation of 0.30. The treasury bill rate is 6%. Suppose that the investor invests 61.31% of his allocation to the risky portfolio in the equity fund, and therefore 38.69% to the corporate bond fund. Assume that theses weights correspond to those of the optimal risky portfolio". Assume that the investor's risk aversion coefficient (A) equals 7.00. What is the composition of, expected return and standard deviation of the optimal risky portfolio?Jack Ma is attempting to evaluate two possible portfolios – both consisting of the same five assets but held in different proportions. He is particularly interested in using beta to compare the risk of the portfolios and in this regard has gathered the following data. assets assets beta Portfolio A Portfolio B 1 1.30 10% 30% 2 0.70 30% 10% 3 1.25 10% 20% 4 1.10 10% 20% 5 0.90 40% 20% a) Calculate the betas for portfolio A and B. b) Compare the risk of each portfolio to the market as well as to each other C) Which portfolio is more risky and why?Kelly has investments with the following characteristics in her portfolio: Investment in Beta Amount invested Stock Q 1.5 $80,000 Stock R 2.0 $50,000 Stock S 0.85 $70,000 Given the risk free rate of 2% and the market return of 7%, what is the expected rate of return of Kelly’s investment portfolio?

- Elsi is a risk-averse investor. She has invested 60% of her investment in share A and all the remainder in share B. Below are projections for the shares as well as the market. A B Market Expected return (%) 10 30 20 Standard deviation (%) 40 70 30 Correlations A 1 B 0.2 1 Market 0.3 0.68 1 Construct a portfolio for Elsi. The portfolio will consist of shares A and B and have the same level of systematic risk as the market. i)What will be the expected return and standard deviation of returns on the portfolio?As a fund manager in Bull & Bear Securities, you are given the following information regarding your portfolio. Rate of Return if State Occurs {:[" State of "],[" Economy "]:} {:[" Probability of "],[" State of Economy "]:} Stock A Stock B Stock C Boom .72 .06 .11 .17 Bust .28 .19 -.04 .23 Based on the above information, compute the following: i) The expected return in boom economy for all the three stocks. ii) The expected return in bust economy for all the three stocks. iii) The expected return for the portfolio that invest 30 percent each in A and B and 40 percent in C. iv) The standardIn addition to risk free securities, you are currently invested in the Tanglewood Fund, a broad-based fund of stocks and other securities with an expected return of 14% and a volatility of 24%. Currently, the risk-free rate of interest is 3%. Your broker suggests that you add a venture capital fund to your current portfolio. The venture capital fund has an expected return of 20%, a volatility of 79%, and a correlation of 0.2 with the Tanglewood Fund, Assume you follow your broker's advice and put 50% of your money in the venture fund: a. What is the Sharpe ratio of the Tanglewood Fund? b What is the Sharpe ratio of your new portfolio?c. What is the optimal Sharpe ratio you can obtain by investing in the venture fund? (Hint: Use Excel and tourid your answer to three decimal places.)