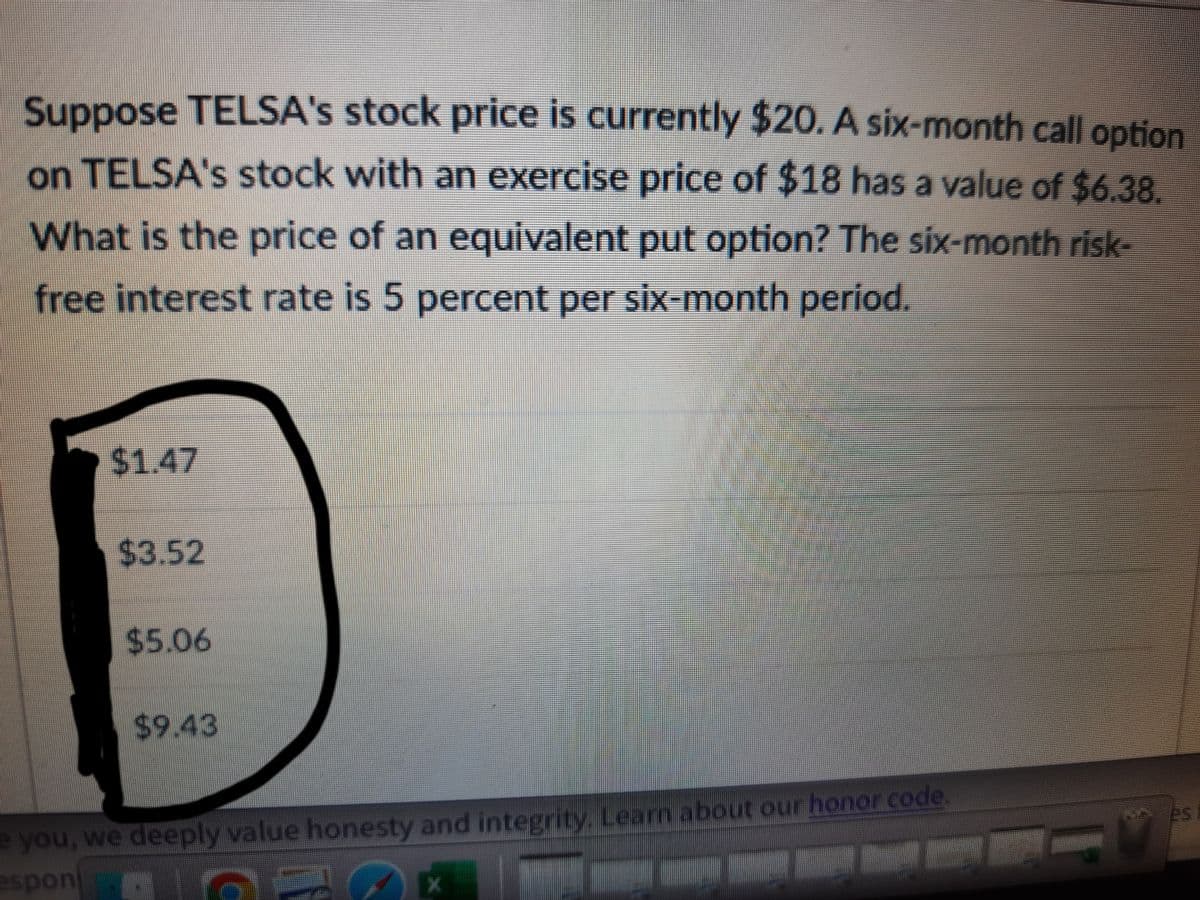

Suppose TELSA's stock price is currently $20. A six-month call option on TELSA's stock with an exercise price of $18 has a value of $6.38. What is the price of an equivalent put option? The six-month risk- free interest rate is 5 percent per six-month period.

Q: Stock A has an expected return of 12% and a standard deviation of 35%. Stock B has an expected…

A: Expected return on portfolio is the weighted average return on stocks in the portfolio and can be…

Q: Although most financial statements forecasting models are structurally similar, they have to be…

A: Financial statements forecasting models are made in spreadsheets in which all relevant cells are…

Q: Matt and Alex are married and filed jointly. Their combined wages were $83,300. They received $1650…

A: Data given: Combined wages = $83,300 Interest income = $ 1650 Child tax credit = $2000 Contribution…

Q: tement. True False

A: Cash flow statement is statement of cash at any time of the company it shows how much cash is coming…

Q: Zero coupon bonds: a. All of the listed items are correct b. Are close to worthless since the…

A: Zero coupon bonds, as the name indicates, have zero coupons. In other words they do not pay any…

Q: The following financial information was provided by Anya Company: Net Income 8,255,000.00…

A: Given, Net income is 8,255,000 Tax rate is 35%

Q: is the modified duration? (Do not

A: Modified duration refers to the formula which is used to measure the change in the amount of…

Q: Suppose that the interest rate on Treasury bills is 6%, and every sale of bills costs P60. You pay…

A: Economic Order Quantity: The economic order quantity is the ordering level at which the storage…

Q: 4) Jones purchased a perpetuity today for 7000. He will receive the first annual payment of 200 five…

A: Price of perpetuity = Present value of perpetuity = 7000 First payment after 5 years = 200 Every…

Q: If the chance that a risk will occur cannot be reasonably predicted or the possible financial loss…

A: An uninsurable risk is one that presents an unknown or unacceptable risk of loss for an insurance…

Q: 1. Given a price-earnings ratio of 12, EPS of P2.18, and payout ratio of 75%, compute for the…

A: Dividend yield refers to a ratio which shows the relationship between the annual dividend and…

Q: 23. n a single period common sized statement, the base amount is net sales in the Statement of…

A: Solution:- Common sized statement is a statement where each item is shown as percentage of a common…

Q: Q25. Because of the importance of cash, the statement of cash flows has become the third primary…

A: Financial statements are the company’s performance report which is prepared at the end of the period…

Q: You deposit $300 each month into an account earning 3% interest compounded monthly. a) How much will…

A: Monthly deposit (P) = $300 Interest rate = 3% Monthly interest rate (r) = 3%/12 = 0.25% Period = 15…

Q: Required information [The following information applies to the questions displayed below.] A…

A: Solution:- Return on investment means the percentage of net income to the average assets. So, Return…

Q: Modified True or False T means Correct and F means Wrong Scenario: A $150,000 loan is to be…

A: Given, Meaning of amortization, Its a time in which the debt is lowered & paid off by the…

Q: Compare the moving VWAP and Moving Average in terms of their similarity and dissimilarity.

A: Volume weighted average price = price × volume ÷ total volume. It is analysis based tool helps to…

Q: Explain with examples how to measure exchange rate risk for long positions and short positions Notes…

A: Forex (Forex or FX) is the trading of one currency against another. For example, you can exchange US…

Q: Five years ago, a piece of equipment was purchased at a cost of $170,000, with a salvage value of…

A: The existing equipment is 5 years old and remaining life of such equipment is 10 years more. The new…

Q: Required: 1. Compute Project Y's annual net cash flows. Annual amounts Income Cash Flow Sales of new…

A: Net annual cash flow refers to the amount of cash flow earned by the company during a period. Net…

Q: 51. Statement 1. The Primary markets are huge and relevant, while secondary markets are smaller and…

A: Primary market- is the market where companies issue and sell their shares to the public for the…

Q: mmon stocK has (-free rate is 4 percent an market risk prem 7 регcent. EQUIRED Calculate the…

A: Price of common equity can be present value of dividends and present value of terminal value of…

Q: . You are convinced that a stock's price will move by at least 15% over the next three months. You…

A: The protective put option strategy is used when the investor is bearish about the stock market; the…

Q: 5. The exam is not an open 1. Discuss the major categories of financial services available to users.

A: “Since you have asked multiple questions, we will solve the one question for you. If you want any…

Q: Given the following three mutually exclusive alternatives, Alternative A •.. B C Initial Cost $50…

A: Let initial cost = C Annual benefits = A n = 5 years i = 10%

Q: Volkswagen Key Financial Ratios 2016-12 2017-12 2018-12 2019-12 2020-12 TTM Efficiency 101.55 107.25…

A: Efficiency refers to Optimal utilization of available resources (Material, Labor, Machine time,…

Q: Keith is saving in a bank in order to purchase a new house in six years. She anticipates that the…

A: Future value refers to the value that an amount would assume at a future time period after…

Q: $100,000 State of Massachsetts bond, 3.5% coupon (paid annually), due 5/11/2032 is quoted at a yield…

A: Bonds pay the annual interest rate on the bonds and annual income would be coupon payment on bond.

Q: Suppose you want to have $400,000 for retirement in 20 years. Your account earns 5.1% interest. How…

A: Future value required (FV) = $400,000 Interest rate = 5.1% Monthly interest rate (r) = 5.1%/12 =…

Q: A $300,000 issue of eleven-year bonds redeemable at par offers 6.19%…

A: Bond valuation involves five components – coupon rate, yield, present value, future value and time…

Q: tax rate is 40%.How much would BG Company's earnings after taxes be under this financing plan? O…

A: Net income (earnings after tax) refers to the amount of profit earned by the company from selling…

Q: Muthu purchases a shop and mortgages it for RM100,000. The mortgage requires repayment in equal…

A: Loan amortization is a kind of annuity. That is fixed sum of money is repaid at equal intervals. If…

Q: CRIA iV, N) Today you purchase a previously owned Tesla Model 3 for $40,000. You take out a 0.25%…

A: Loans are paid by the equal monthly installments and these have payment of loan amount and also…

Q: Music producer, will receive royalties over a period of 3 years for the theme song she made for a TV…

A: In order to calculate the present value of all future royalties at the given interest rate, the…

Q: Which of the following situations are likely to reduce agency conflicts between stockholders and…

A: Agency conflicts arise due to the conflict between shareholders and managers with respect to the…

Q: refers to the stockpiles of forex, gold, and bonds in the US Treasury.

A: A backed currency is one that is backed or supported by a commodity, such as silver or gold. The…

Q: Which of the following will shorten the cash cycle? Select one: A. An increase in the raw materials…

A: The answer is option D. An increase in the trade payables days

Q: The firm's average accounts receivable balance is P2.5 million, and they are financed by a bank loan…

A: In finance the lockbox system is a service that many banks provide. It is related to receipt of…

Q: 1. What are the techniques used in evaluating investments? List them and explain

A: Capital budgeting is a process used by the companies to use its limited resources to get the best…

Q: An investment of 105,815.40 can be made in a project that will produce a uniform annual revenue of…

A: Since you have asked a multiple subpart question, we will answer the first three subparts for you.…

Q: Bry borrowed a certain amount from ABC lending corp. In their contract, Kem must pay PHP 150,000 in…

A: Payment amount after 3 years = PHP 150,000 Simple interest rate = 0.075 Period = 3 Years Loan amount…

Q: has a 10 percent return on total assets of sh.1000,000 and a net profit margin of 5 percent. What…

A: Net profit margin is the net income on sales and return on assets is net income on the assets and…

Q: You find a bond with 27 years until maturity that has a coupon rate of 9.0 percent and a yield to…

A: Given, The face value of bond is $1000 Coupon rate is 9% term is 27 years

Q: Question 24 Using the formula for YTM (yield to maturity) in the lecture, what is the rate of return…

A: YTM using formula = (Coupon + (Face value - price)/(No. of years to maturity))/((Face…

Q: Iculate the Company's depreciation and amortization expe

A: The production volume of a corporation is determined by calculating NOPAT on operating income.By…

Q: 20. Ron and Sandy have purchased their first house. They borrowed $174, 000 for 30 years at an…

A: Solution:- Total monthly payment will be the total payment made towards the monthly mortgage…

Q: Big Sky Mining Company must install $1.5 million of new machinery in its Nevada mine. It can obtain…

A: Answer - Part 1 - NPV LEASE ANALYSIS 0 1 2 3 4 Cost of Owning After-tax loan…

Q: Suppose Lion Cage Multinational floated 5000 bonds on January 1, 2020 with a par value of 1500 at…

A: Bond valuation involves five components – coupon rate, yield, present value, future value and time…

Q: Cassie Company manufactures a line of deluxe office fixtures. The annual demand for its miniature…

A: Answer - Working Note- The production in each run = 5,000/4 = 1250 This average inventory =…

Q: Engineering Economy Compute the accumulated depreciation in 8 years of an equipment with FC of ₱1…

A: The acronym SOYD method stands for the sum of years digits method. As per this method, the…

Step by step

Solved in 2 steps with 3 images

- Put–Call Parity The current price of a stock is $33, and the annual risk-free rate is 6%. A call option with a strike price of $32 and with 1 year until expiration has a current value of $6.56. What is the value of a put option written on the stock with the same exercise price and expiration date as the call option?Binomial Model The current price of a stock is 20. In 1 year, the price will be either 26 or 16. The annual risk-free rate is 5%. Find the price of a call option on the stock that has a strike price of 21 and that expires in 1 year. (Hint: Use daily compounding.)You purchase 36 call options on Greshak Corp. to increase returns on your equity portfolio. The three month calls specify the strike price is $48.00 and require a premium of $3.25. If Greshak's stock is trading at $52.00 at the time the options expire, what are your options worth? What was your net profit (in dollars and as an annualized percentage)? What would your profit in dollars and as an annualized percentage had been if the stock instead sold for $51.00/share at expiration? How about $50.00/share?

- Assume you own a call option on IBM stock with a strike price of $40. The option will expire in exactly six months time. If the stock is trading at $35 in six months, what will be the payoff of the call? Options for above is { $0.00 , $10,00 , $15.00 , $75.00 , $95.00 } Assume that you have shorted the call option described above, if the stock is trading at $55 in six months, what will you owe?Options for above is { $0.00 , $10.00 , $15.00 , $75.00 , $95.00 }If the stock is trading at $50 in six months, what will be the payoff of the call?Options for above is { $0.00 , $10.00 , $15.00 , $75.00 , $95.00 }Astock currently trades at $100. In one month its price will either be $125, $100, or $75. 1 sell you a call option on this stock, struck at $95, for $11. | hedge my exposure by purchasing A shares, borrowing 1004 - 11 in order to fund the purchase. The simple rate of interest is 12%. (2) What will my profit/loss be in one month? {b) Is it possible for me to completely hedge my exposure? Explain.You own a call option on Intuit stock with a strike price of $40. The option will expire in exactly three months’ time. If the stock is trading at $55 in three months, what will be the payoff of the call? Note: practice drawing the payoff diagram. Assume that you have shorted the call option in Question 2. If the stock is trading at $55 in three months, what will you owe? Note: practice drawing the payoff diagram. (ONLY ANSWER THIS QUESTION)

- You shorted a call option on Intuit stock with a strike price of $38. When you sold (wrote) the option, you received $3. The option will expire in exactly three months' time. a. If the stock is trading at $49 in three months, what will your payoff be? What will your profit be? b. If the stock is trading at $35 in three months, what will your payoff be? What will your profit be? c. Draw a payoff diagram showing the payoff at expiration as a function of the stock price at expiration. d. Redo c, but instead of showing payoffs, show profits. Question content area bottom Part 1 a. The payoff of the short is $ short is $ enter your response here. enter your response here, and the profit of the. Please step by step answer.A.K. Scott’s stock is selling for $37 a share. A 3-month call on this stock with a strike price of $38 is priced at $2. Risk-free assets are currently returning 0.28 percent per month. a) What should be the price of a 3-month put option on this stock with a strike price of $38? b) Which of the two options is currently in the money and does that accord with your conclusions about their relative prices?The current price of a non-dividend-paying stock is $25. Over the next six months it is expected to rise to $30 or fall to $21. An investor buys put options with a strike price of $27. What is the value of each option? The risk-free interest rate is 5% per annum with continuous compounding. Answer to 3dps. Group of answer choices 1.578 2.840 3.018 0.935