Suppose that 10 years ago you bought a home for $160,000, paying 10% as a down payment, and financing the rest at 7% interest for 30 years. Your down payment was 16,000 and the existing mortage was 144,000. This year (10 years after you first took out the loan), you check your loan balance. Only part of your payments have been going to pay down the loan; the rest has been going towards interest. You see that you still have $123,570 left to pay on your loan. Your house is now valued at $200,000. 1. How much equity do you have in your home (equity is value minus remaining debt)? 2. Since interest rates have dropped, you consider refinancing your mortgage at a lower 6% rate. If you took out a new 30 year mortgage at 6% for your remaining loan balance, what would your new monthly payments be? 3. How much interest will you pay over the life of the new loan?

Suppose that 10 years ago you bought a home for $160,000, paying 10% as a down payment, and financing the rest at 7% interest for 30 years. Your down payment was 16,000 and the existing mortage was 144,000. This year (10 years after you first took out the loan), you check your loan balance. Only part of your payments have been going to pay down the loan; the rest has been going towards interest. You see that you still have $123,570 left to pay on your loan. Your house is now valued at $200,000. 1. How much equity do you have in your home (equity is value minus remaining debt)? 2. Since interest rates have dropped, you consider refinancing your mortgage at a lower 6% rate. If you took out a new 30 year mortgage at 6% for your remaining loan balance, what would your new monthly payments be? 3. How much interest will you pay over the life of the new loan?

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 3PB: Use the tables in Appendix B to answer the following questions. A. If you would like to accumulate...

Related questions

Question

Suppose that 10 years ago you bought a home...

Please answer questions 1-3

thank you

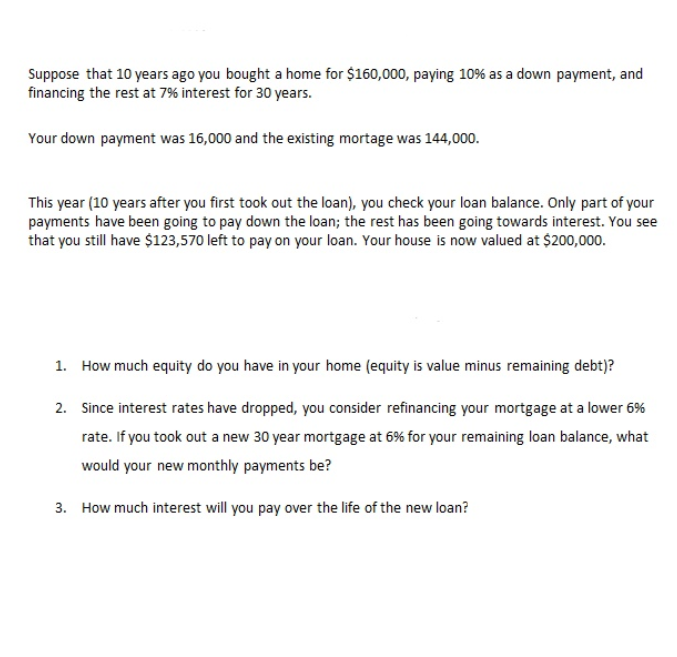

Transcribed Image Text:Suppose that 10 years ago you bought a home for $160,000, paying 10% as a down payment, and

financing the rest at 7% interest for 30 years.

Your down payment was 16,000 and the existing mortage was 144,000.

This year (10 years after you first took out the loan), you check your loan balance. Only part of your

payments have been going to pay down the loan; the rest has been going towards interest. You see

that you still have $123,570 left to pay on your loan. Your house is now valued at $200,000.

1. How much equity do you have in your home (equity is value minus remaining debt)?

2. Since interest rates have dropped, you consider refinancing your mortgage at a lower 6%

rate. If you took out a new 30 year mortgage at 6% for your remaining loan balance, what

would your new monthly payments be?

3. How much interest will you pay over the life of the new loan?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning