Phoenix Company is considering investments in projects C1 and C2. Both require an initial investment of $318,000 and would yield the following annual net cash flows. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Net cash flows Project C1 Project C2 Year 1 $ 42,000 $ 126,000 Year 2 138,000 126,000 Year 3 198,000 126,000 Totals $ 378,000 $ 378,000 a. The company requires a 8% return from its investments. Compute net present values using factors from Table B.1 in Appendix B to determine which projects, if any, should be accepted. b. Using the answer from part a, is the internal rate of return higher or lower than 8% for (i) Project C1 and (ii) Project C2? Hint: It is not necessary to compute IRR to answer this question.

Phoenix Company is considering investments in projects C1 and C2. Both require an initial investment of $318,000 and would yield the following annual net cash flows. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Net cash flows Project C1 Project C2 Year 1 $ 42,000 $ 126,000 Year 2 138,000 126,000 Year 3 198,000 126,000 Totals $ 378,000 $ 378,000 a. The company requires a 8% return from its investments. Compute net present values using factors from Table B.1 in Appendix B to determine which projects, if any, should be accepted. b. Using the answer from part a, is the internal rate of return higher or lower than 8% for (i) Project C1 and (ii) Project C2? Hint: It is not necessary to compute IRR to answer this question.

Chapter11: Capital Budgeting And Risk

Section: Chapter Questions

Problem 9P

Related questions

Question

100%

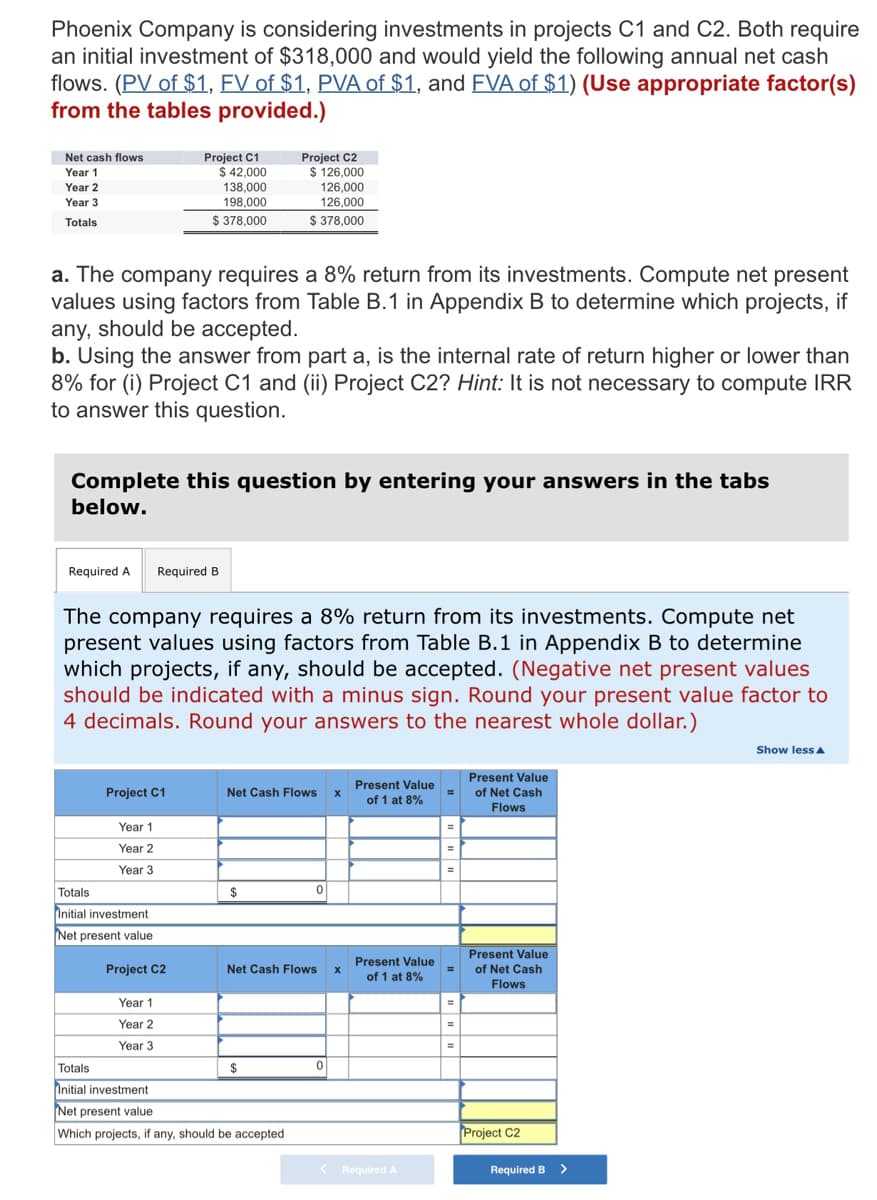

Phoenix Company is considering investments in projects C1 and C2. Both require an initial investment of $318,000 and would yield the following annual net cash flows. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.)

Net cash flows Project C1 Project C2

Year 1 $ 42,000 $ 126,000

Year 2 138,000 126,000

Year 3 198,000 126,000

Totals $ 378,000 $ 378,000

a. The company requires a 8% return from its investments. Compute net present values using factors from Table B.1 in Appendix B to determine which projects, if any, should be accepted.

b. Using the answer from part a, is the internal rate of return higher or lower than 8% for (i) Project C1 and (ii) Project C2? Hint: It is not necessary to compute IRR to answer this question.

Transcribed Image Text:Phoenix Company is considering investments in projects C1 and C2. Both require

an initial investment of $318,000 and would yield the following annual net cash

flows. (PV of $1, EV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s)

from the tables provided.)

Net cash flows

Project C1

$ 42,000

138,000

198,000

$ 378,000

Project C2

$ 126,000

Year 1

Year 2

126,000

126,000

$ 378,000

Year 3

Totals

a. The company requires a 8% return from its investments. Compute net present

values using factors from Table B.1 in Appendix B to determine which projects, if

any, should be accepted.

b. Using the answer from part a, is the internal rate of return higher or lower than

8% for (i) Project C1 and (ii) Project C2? Hint: It is not necessary to compute IRR

to answer this question.

Complete this question by entering your answers in the tabs

below.

Required A

Required B

The company requires a 8% return from its investments. Compute net

present values using factors from Table B.1 in Appendix B to determine

which projects, if any, should be accepted. (Negative net present values

should be indicated with a minus sign. Round your present value factor to

4 decimals. Round your answers to the nearest whole dollar.)

Show lessa

Present Value

Present Value

Project C1

Net Cash Flows x

of Net Cash

%3D

of 1 at 8%

Flows

Year 1

Year 2

%3D

Year 3

%3D

Totals

Initial investment

$

Net present value

Present Value

%3D

Present Value

of Net Cash

Project C2

Net Cash Flows

of 1 at 8%

Flows

Year 1

Year 2

Year 3

%3D

Totals

24

Initial investment

Net present value

Which projects, if any, should be accepted

Project C2

< Required A

Required B

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning